📈 The altcoins in the wings: Signs of a smashing comeback multiply

Welcome to the Daily Tribune for Saturday, April 19, 2025 ☕️

Hello Cointribe! 🚀

Today, we are Saturday, April 19, 2025, and like every day from Tuesday to Saturday, we summarize the latest 24 hours' news that you shouldn't miss!

But first…

✍️ Cartoon of the day:

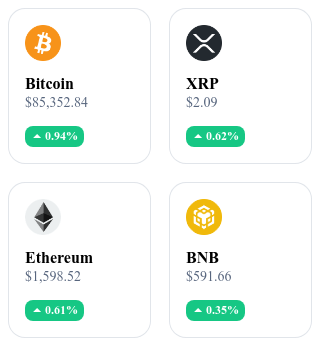

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

📉 Ethereum faces layer 2 saturation despite blobs

Planned improvements by Ethereum, including increased blobs per block, are not enough to support transaction growth on layer 2 solutions. A tenfold multiplication of transactions could lead to prohibitive fees for users.

🚀 Altcoins poised to return to the forefront in Q2 2025

According to Sygnum Bank, the second quarter of 2025 could mark the return of altcoins, thanks to a more favorable regulatory climate and increased user adoption.

⚙️ Solana proposes a dynamic inflation adjustment

The SIMD 0228 proposal from Solana plans to adjust the inflation of SOL based on the percentage of tokens staked, to maintain a balance between economic incentive and network security.

📊 Coinbase reaches $100 billion in Bitcoin futures volume

Despite tariff turbulences, Coinbase International reports a volume of $100 billion in Bitcoin futures contracts in one week, illustrating the growing interest in crypto derivatives products.

Crypto of the day: JasmyCoin (JASMY)

JasmyCoin is a project led by the Japanese company Jasmy Corporation, founded by former Sony executives. It aims to give users full ownership of their personal data in the era of the Internet of Things (IoT). Relying on blockchain infrastructure combined with decentralized storage solutions like IPFS, Jasmy offers individuals control, security, and monetization of their data. This approach seeks to provide an alternative to the tech giants that today centralize the collection and exploitation of personal information, creating a truly free data market.

The token JASMY, based on the ERC-20 standard, is used as a means of exchange within the Jasmy ecosystem. It facilitates transaction fee payments, access to data protection services, and participation in strategic decisions through protocol governance.

Recent performance:

Current price: 0.0171 $ USD

24-hour variation: +5.5 %

Market capitalization: approximately 818 million dollars

Rank on CoinMarketCap: #70

Bitcoin and gold: a historical correlation under certain conditions

While gold recently hit a historic high of $3,357 per ounce, investors are questioning the possibility of a similar rise in Bitcoin. Past cycle analysis reveals a correlation between these two assets, though this relationship is influenced by various economic and psychological factors.

A correlation with a time lag

Historically, Bitcoin has often followed gold’s upward movements with a lag of 100 to 150 days. For instance, in 2017, a 30% increase in gold preceded Bitcoin soaring to $19,120. Similarly, in 2020, gold reached $2,075 before Bitcoin climbed to $69,000. This pattern suggests that Bitcoin could react to gold’s movements, but with some delay.

Key contextual factors

The correlation between Bitcoin and gold is not systematic. In 2022, despite stable gold performance, Bitcoin experienced a significant decline, influenced by factors such as interest rate hikes and specific crypto market events. Thus, although Bitcoin is sometimes regarded as a digital version of gold, its trajectory depends on multiple economic variables and investor confidence.

The relationship between Bitcoin and gold is complex and context-dependent. While correlation patterns have been observed in the past, they do not guarantee future repetitions. Investors should remain cautious and consider all influencing factors before making investment decisions.🔗 Read the full analysis