🔥 The Bank of France and the AMF tackle cryptos

Welcome to the Daily Tribune of Thursday, November 14, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, November 14, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

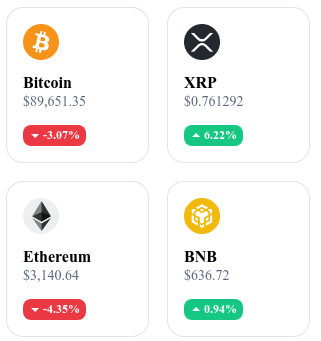

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🔥 Solana surprises by surpassing Ethereum on key metrics

Solana (SOL) has reached an impressive peak of 214 dollars, a record since 2021, marking a growth of 2,500% since its post-FTX low. This rise is fueled by a renewed confidence from investors and increased activity on its network. In October 2024, Solana surpassed Ethereum in terms of real economic value, reaching 111% of that of Ethereum, supported by the rise of memecoins and decentralized applications on its platform.

Its total value locked (TVL) has also surged, attracting large-scale projects like Helium and Render, thus diversifying the ecosystem. The technological upgrade "Firedancer," scheduled for 2025, could further solidify this position, positioning Solana as a serious rival to Ethereum.

🇫🇷 France urges Europe for regulation of cryptos by Esma

As bitcoin nears 100,000 dollars, the AMF and the Bank of France are calling for centralized European regulation of cryptocurrencies to protect investors against the increasing market risks. François Villeroy de Galhau and Marie-Anne Barbat-Layani, heads of the two institutions, propose that Esma (European Securities and Markets Authority) take charge of supervision, instead of national regulators. This measure aims to standardize regulation, reduce money laundering risks, and ensure enhanced legal protection for users.

Although the MiCA regulation is in place, French authorities believe it is insufficient without a strict common application. However, some European countries prefer to maintain their independence on this sensitive topic.

🚀 Peanut the Squirrel ($PNUT) reaches a billion market cap with a meteoric rise

Peanut the Squirrel ($PNUT), a cryptocurrency based on Solana, recently crossed the symbolic threshold of 1 billion dollars in market capitalization, marking a jump of 266.17% in just a few days. Driven by its recent listing on Binance, this crypto is attracting the attention of investors, reaching an "extreme greed" level with an index of 84, reflecting collective euphoria.

Currently priced at 1.68$, $PNUT has recorded 50% of "green" days over the recent months, but its volatility remains a factor to monitor.

🚀 Elon Musk heads the DOGE agency: Dogecoin in full boom

Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead a new federal agency, the Department of Government Efficiency (DOGE), dedicated to modernizing and streamlining American institutions. With a colossal budget of 6.5 trillion dollars, this agency aims to reduce bureaucracy and optimize public spending by 2026. Musk, true to his provocative style, promised total transparency by publishing all of the agency's actions online, including a ranking of the "stupidest expenses."

The news has electrified the crypto market, particularly Dogecoin, Musk's favorite, which surged by 112% this week, reaching a peak of 0.43$. This movement reflects the growing influence of political decisions on the crypto ecosystem, with an increasingly blurred line between technological innovation and governance.

Crypto of the day: Peanut the Squirrel (PNUT)

Peanut the Squirrel (PNUT) is based on the Solana blockchain, benefiting from the speed and low transaction costs of this infrastructure. This cryptocurrency adopts a memecoin model to attract users while integrating technical aspects aimed at increasing community engagement. It stands out by an initial distribution on major exchange platforms and liquidity pools, which allows for high accessibility and liquidity from the start.

Holders of $PNUT benefit from the token's volatility for speculation or trading, and some platforms offer them rewards for staking. Furthermore, $PNUT is usable for transactions on Solana, making it a versatile token within its ecosystem.

Recent Performances:

Current price: 1.94€

Increase over 1 day: +13.7%

Market capitalization: 1,938,887,895€

Rank on CoinGecko: 62

Technical analysis of the day: XRP (XRP)

After a prolonged consolidation period between 0.75$ and 0.43$, XRP shows signs of recovery with a notable rebound to 0.66$ after touching a key support at 0.38$. The breach above the resistance at 0.57$ and reaching the annual VWAP suggests reinforced bullish momentum. The medium-term trend, now officially bullish according to Dow theory, is supported by a positive crossover of the 50 and 200-day moving averages, even though they do not yet display a clearly upward slope. Buyer interest remains predominant, reinforced by the price increase and the positive momentum of technical oscillators.

In terms of forecasts, holding the price above 0.50$ could lead to a new test of the resistance at 0.75$. If this threshold is surpassed, XRP could target 0.85$, even 0.93$, and potentially reach the symbolic level of 1$. Conversely, a pullback below 0.50$ would indicate a possible correction, with support to monitor around 0.43$ and 0.40$. Although the current technical indicators favor a bullish outlook, caution remains essential due to key resistances still at play.

🔗 Read the full analysis here.