🚨 The Bitcoin storm is coming: Should you sell…?

Welcome to the Daily for Thursday, October 23, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, October 23, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the top news from the last 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

💸 Aave announces major annual buyback plan funded by DeFi revenue

Aave has unveiled an annual token buyback program financed through revenues generated by its DeFi operations. The plan allocates part of protocol fees to support the AAVE price and strengthen governance by redistributing tokens to long-term holders.

👉 Read the full article

⚛️ Google’s quantum computer threatens modern encryption

Researchers at Google Quantum AI have presented a quantum computer capable of executing 256 stable logical qubits — a breakthrough that challenges the security of conventional cryptographic systems. This milestone reignites the debate on post-quantum cryptography, now a top priority for institutions and blockchain projects.

👉 Read the full article

🪙 Gold plunges $2.1 trillion in one day: should we worry?

The gold market lost $2.1 trillion in capitalization in a single session, marking its steepest correction since 2020. The drop is attributed to a stronger dollar, rising U.S. bond yields, and temporary institutional fund withdrawals.

👉 Read the full article

💵 The meteoric rise of stablecoins alarms Wall Street

Stablecoin volumes have hit an all-time high of $165 trillion, sparking concern among regulators and major U.S. banks. Analysts fear that such rapid expansion could disrupt bond market liquidity and accelerate financial disintermediation.

👉 Read the full article

Crypto of the Day: Kaspa (KAS)

Innovation and Added Value 🧠

Kaspa is a next-generation proof-of-work (PoW) blockchain designed to deliver speed, scalability, and security without compromising decentralization.

Unlike traditional blockchains (such as Bitcoin), Kaspa relies on an innovative architecture called BlockDAG (Directed Acyclic Graph), which allows multiple blocks to be validated simultaneously. This system removes the typical bottlenecks of linear blockchains, enabling near-instant transactions with confirmations in just seconds.

Kaspa aims to modernize Bitcoin’s vision by combining PoW robustness with scalability comparable to next-gen blockchains. The project is open source, fully community-driven, and launched without pre-mining or presale — reinforcing its technical legitimacy and ideological alignment with the founding principles of Web3.

The Token 💰

KAS is the native cryptocurrency of the Kaspa network. It primarily rewards miners who validate blocks and secure the network.

Its issuance mechanism follows a continuous decay model rather than the traditional halving, ensuring a gradual reduction in monetary creation over time.

The token is also used to pay transaction fees and encourage circulation within the ecosystem. With no ICO, pre-mining, or venture capital, KAS stands out as a rare asset in the industry — a purely community-driven project built for sustainability and economic neutrality.

Real-Time Performance 📊

💵 Current price: 0.169 USD

📈 24h change: +3.27 %

💰 Market cap: 4 000 000 000 USD

🏅 Rank on CoinMarketCap: #24

🪙 Circulating supply: 23 400 000 000 KAS

📊 24h trading volume: 50 700 000 USD

Bitcoin on the Edge: Is a Drop Below $100,000 Inevitable?

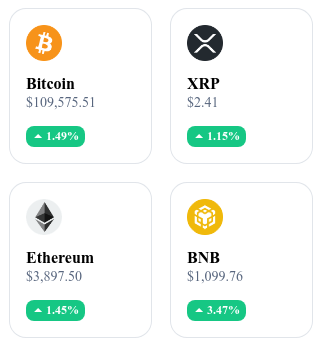

The Bitcoin market is going through a turbulent phase. As the leading cryptocurrency trades around $109,000, some analysts fear it could fall below the symbolic $100,000 threshold. This possibility fuels both concern and speculation… but it might also represent a strategic buying opportunity. Why is this drop happening, and what does it mean?

A downward trend fueled by indicators and geopolitics

Since its recent peak at $126,000, Bitcoin’s price has dropped by nearly 14%. While such corrections are typical in crypto market cycles, several technical factors have amplified the warning signs. First, the On-Balance Volume (OBV) indicator has fallen to its lowest level since April, signaling waning buyer momentum and a weakening price support zone.

At the same time, the derivatives market has seen a wave of liquidations. In just 24 hours, more than $186 million were wiped out—$155 million from long positions. These forced sales accelerate price declines mechanically.

These technical pressures are compounded by a tense macroeconomic environment. Geoffrey Kendrick, senior analyst at Standard Chartered, links the potential drop to the U.S.–China trade war and reduced market liquidity. In other words, less capital is flowing into risk assets like Bitcoin. According to Kendrick, a drop below $100,000 by the weekend is plausible.

Buying signals for experienced investors?

While a move below $100,000 worries some, it hasn’t triggered full-blown panic. On the contrary, several major players view it as a temporary dip and a buying opportunity. Kendrick himself describes it as a “buy window,” suggesting strategic investors could accumulate at more attractive levels.

This view is shared by major institutions. MicroStrategy, led by Michael Saylor, recently added 168 BTC at an average price of $112,051 per coin, bringing its total holdings to 640,418 BTC—worth about $69 billion.

Behind this move lies a strong conviction: Bitcoin is viewed as a store of value comparable to gold, a hedge against fiat devaluation, and a long-term bet on institutional adoption through ETFs and banking integration.

For MicroStrategy, a brief dip below $100,000 doesn’t undermine Bitcoin’s long-term trajectory. That’s why Standard Chartered still maintains a bullish target of $200,000 by the end of 2025—a scenario where a temporary drop precedes a powerful rebound driven by strengthening fundamentals.

👉 Read the full article