The co-founder of Ledger David Balland released after a dramatic kidnapping!

Welcome to the Daily Tribune of Friday, January 24, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, we are on Friday, January 24, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't have missed!

But first…

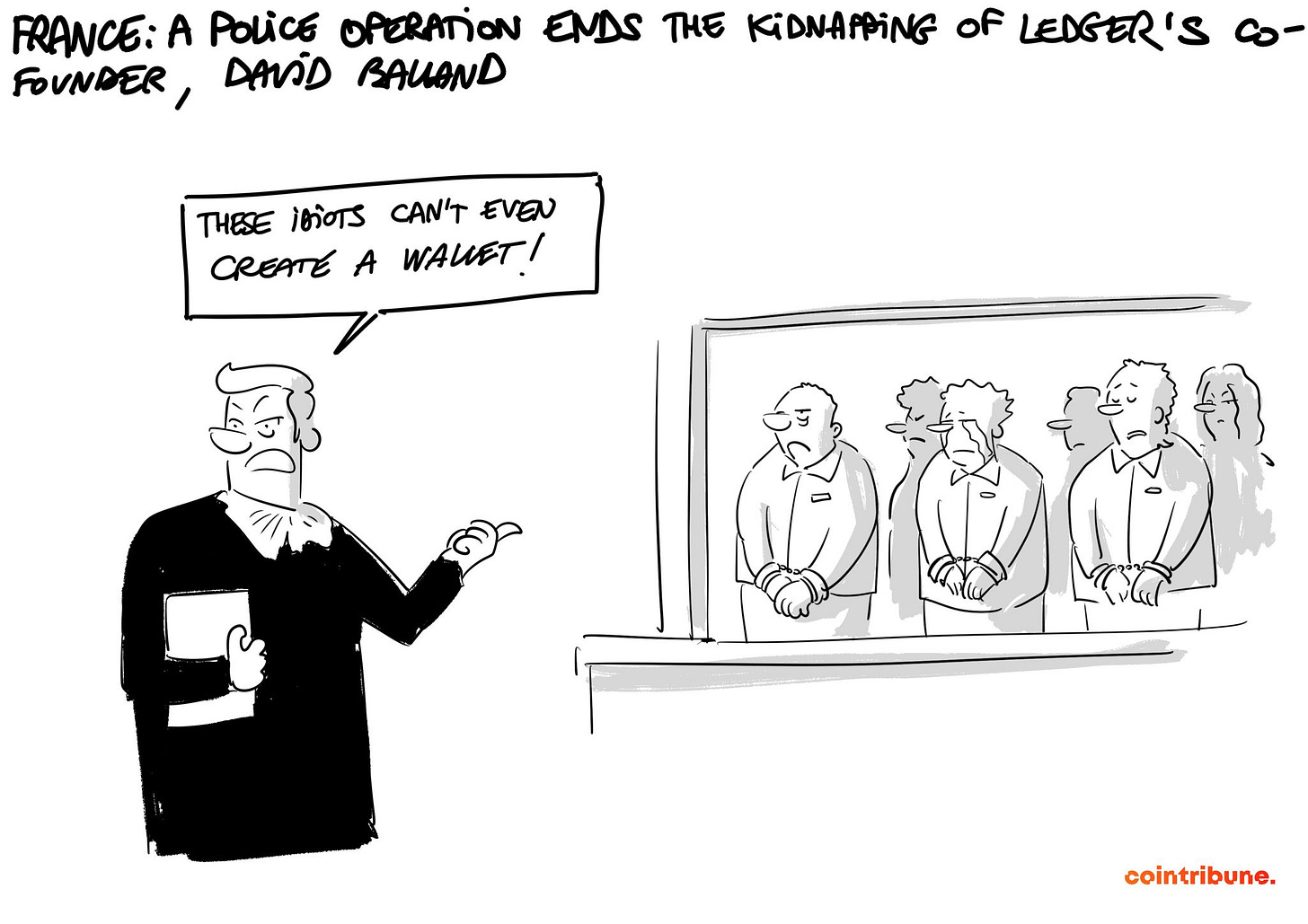

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🎯 Release of the co-founder of Ledger after a kidnapping

David Balland, co-founder of the French company Ledger, was released after a kidnapping that occurred on January 21, 2025. The kidnappers, who demanded a ransom in cryptocurrencies, moved their victim several times before an intervention by the national police ended the incident on the night of January 22. Balland received medical care after his release, although the extent of his trauma remains unknown.

This incident highlights the increased risks for personalities in the crypto sector, often targeted due to their digital assets, and raises concerns about the physical security of sector leaders, beyond the digital protection devices provided by companies like Ledger.

🤑 94% of Trump and Melania tokens concentrated in 40 wallets

A recent analysis revealed that 94% of $TRUMP and $MELANIA tokens are held by only 40 wallets. This situation raises doubts about the fairness and accessibility of the tokens, as the majority of individual investors own only a fraction of these assets. Data shows that a single wallet holds 90% of the MELANIA tokens, reinforcing concerns about a potential "rug pull" in this memecoin.

Despite massive adoption of tokens (with 790,000 wallets for $TRUMP and 343,000 for $MELANIA), this concentration of wealth fuels volatility and reduces the confidence of small investors.

📈 XRP and Solana to debut in futures contracts on the CME starting February

The Chicago Mercantile Exchange (CME) will introduce futures contracts for cryptocurrencies XRP and Solana (SOL) starting February 2025, marking a key step for the crypto market. These contracts, available in standard and micro versions, will offer flexibility to investors. Each standard contract will represent 500 SOL or 50,000 XRP, while the micros will require 25 SOL or 2,500 XRP, all denominated in US dollars to ensure stability and trust. This initiative reflects a growing demand for crypto derivatives products, fueled by a political climate perceived as more favorable.

Companies like ProShares and WisdomTree have already filed requests for ETFs focused on these assets, highlighting their growing potential. These contracts open new investment opportunities, allowing speculation on the price movements of SOL and XRP.

⚡ Bitcoin divides opinions at the World Economic Forum

At the World Economic Forum in Davos in 2025, the proposal to create a strategic reserve of bitcoin for the United States, supported by Donald Trump, sparked intense debates. Brian Armstrong, CEO of Coinbase, argued for BTC to become a modern equivalent of gold, and figures like Michael Saylor and Cynthia Lummis defended this idea.

Lesetja Kganyago, governor of the South African Reserve Bank, criticized this vision, preferring to explore central bank digital currencies (CBDCs) and other strategic assets. The debate highlighted the divergences between those who see bitcoin as an emerging economic standard and those who consider it too volatile to play a national reserve role.

The crypto of the day: NEXO (NEXO)

NEXO, based on the Ethereum ecosystem, innovates by offering a crypto lending platform that allows users to lend or borrow digital assets such as Bitcoin and stablecoins. The added value lies in its ease of use and its unique model of competitive interest rates.

The native token, NEXO, serves as the cornerstone of this ecosystem. It offers significant benefits to holders, including reduced interest rates on loans, attractive returns on deposits, and free crypto withdrawals. Distributed through a mixed model of private and public sales, NEXO can be used to optimize fees, access rewards, and receive instant cashback.

Recent Performance

Current Price: €1.35

24h Change: +9.8%

Market Capitalization: €1.47 billion

Rank on CoinMarketCap: #91

Bitcoin at $700,000: The bold vision of BlackRock's CEO

Larry Fink, CEO of BlackRock, made waves at the World Economic Forum in Davos by announcing the possibility that Bitcoin could reach $700,000. This prediction is based on the growing institutional adoption of this cryptocurrency, where even modest allocations (2% to 5%) of institutional portfolios could be enough to propel Bitcoin to unprecedented heights.

In light of global monetary devaluation and persistent inflation, Fink views Bitcoin as a credible international haven for investors looking to safeguard their assets against economic and political instability.

As companies like MicroStrategy have already begun to integrate Bitcoin into their financial strategies, this trend could disrupt the global financial ecosystem. However, challenges remain, notably Bitcoin's volatility and regulatory uncertainties that hinder massive adoption by institutions.

Fink's prediction highlights a possible tipping point for the global financial system, where cryptos could redefine the balance of power between traditional and digital assets.

If such a scenario were to materialize, the implications would be significant for investors, but also for governments and regulators.