🌟 The crazy memecoins, 👑 Bitcoin revolutionizes ETFs

Welcome to the Daily Tribune on Friday, May 17, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, May 17, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

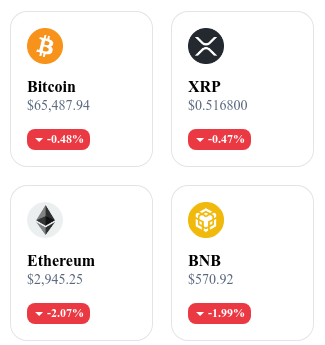

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🌟 Memecoins revolutionize the crypto ecosystem

Since April 1, 2024, over a million new crypto tokens have been created, marking an unprecedented enthusiasm for memecoins. Ethereum has seen the creation of 372,642 new tokens, while Solana has welcomed over 643,000 new tokens, including 466,914 memecoins. This proliferation showcases the creativity and speculative potential of these humorous and speculative tokens. Especially, Solana has become the stronghold of memecoin developers, confirming the dominant trend of 2024. Read full article

👑 Bitcoin: The new king of ETFs

Millennium Management made a dramatic entry into the Bitcoin ETF market by investing $2 billion, becoming the undisputed leader in the sector. This investment fund has diversified its placements among several major players such as BlackRock, Fidelity, Grayscale, ARK, and Bitwise, demonstrating a long-term strategic vision. This massive influx of capital confirms the increasing integration of Bitcoin into institutional portfolios. Other big names in finance, such as Elliott Capital and Apollo, are following this trend, bringing total investments in Bitcoin ETFs to $12.1 billion. Read full article

🔍 The decisive test of Mastercard and Standard Chartered

Mastercard and Standard Chartered have successfully conducted the first live test of their Multi-Token Network (MTN) on the regulated framework of the Hong Kong Monetary Authority's Fintech Supervisory Sandbox. This test involved the tokenization of carbon credits, using the technology of "atomic swaps" to ensure simultaneous and irreversible exchanges between a tokenized deposit and a carbon credit. This development highlights the blockchain's ability to transform financial transactions by making them more secure and transparent. This collaboration illustrates how these pioneering financial institutions are shaping the future of digital finance. Read full article

🇸🇻 One Bitcoin per day: The visionary bet of El Salvador

El Salvador continues its bold strategy of daily Bitcoin purchases, at a rate of one BTC per day, in order to build long-term reserves. This initiative, launched in November 2022, aims to capitalize on the cryptocurrency's future potential despite the IMF's reservations. Currently, El Salvador holds 5,748 BTC, worth over $360 million, with a profit of $57 million. The Bitcoins are stored in cold wallets within the national territory. President Nayib Bukele's ambitious bet reflects unwavering confidence in Bitcoin to stimulate the country's economic growth. Read full article

Crypto of the day: Chainlink (LINK)

Chainlink (LINK) is an innovative blockchain that connects smart contracts to real-world data through a network of decentralized oracles. This innovation provides added value by ensuring the reliability and security of the data used by smart contracts.

The native crypto, LINK, is mainly used to pay for the services of node operators who provide this data and to secure contracts through staking. Distributed via an ICO in 2017, LINK offers benefits such as rewards for staking and participating in the network. Holders can use LINK to access services on the Chainlink network and participate in its governance.

Recent Performances

Current price: €14.33

1-day decrease: 12.35%

Market capitalization: €9,202,574,444

Rank on CoinMarketCap: 15

Bitcoin booms: Why is Ethereum lagging behind?

The crypto market has had a bullish week, but Ethereum is struggling to keep up with Bitcoin's frenetic pace. Although the total market capitalization has increased by 5.5%, ETH has not fully benefited from this bullish momentum, underperforming BTC by 22% since the beginning of 2024. Macroeconomic data from the United States, particularly the 3.4% year-on-year increase in the Consumer Price Index (CPI) in April, has supported the rally of certain rare assets, but has not been enough to boost Ethereum in the same way.

Growing investor uncertainty regarding the imminent SEC decision on VanEck's application for a cash-settled Ethereum ETF is one of the main reasons for this underperformance. Scheduled for May 23, 2024, this decision keeps traders waiting, delaying their investment decisions. If the SEC rejects this application, a market correction could result in the short term, although long-term optimism for Ethereum remains intact. In the meantime, Ethereum still needs to prove its ability to follow Bitcoin in this bullish trend.