💥 The crypto market breaks $2 trillion

Welcome to the Daily Tribune, Wednesday, February 21, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, February 21, 2024 and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

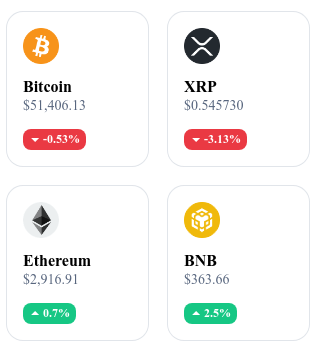

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24-hour crypto summary ! ⏱️

🚀 BlackRock revolutionizes the crypto world with its Bitcoin ETF campaign

BlackRock, the world's largest asset management company, recently launched a bold advertising campaign for its Bitcoin ETF, marking a historic turning point in the perception of cryptocurrency by the traditional financial sector. This campaign, symbolized by a simple image of an airplane and a runway accompanied by the slogan "Get your share of progress", goes far beyond just an announcement. It represents a strong statement from BlackRock, asserting that Bitcoin and, by extension, cryptocurrency, are the future of finance. This initiative is particularly significant as it comes from a major player in traditional finance, which until now had taken a rather cautious approach to cryptocurrency.

The campaign not only promotes BlackRock's Bitcoin ETF, but also aims to establish the firm as the undisputed leader in the crypto ETF market. With billions of dollars already under management and performance that dominates the industry, BlackRock is sending a clear message to competitors and investors: cryptocurrency is not just a passing fad, but a financial revolution in progress. This BlackRock initiative could well change the game for Bitcoin and cryptocurrency in general, moving them from niche phenomena to recognized and respected components of the global financial system.

BlackRock's support for cryptocurrency legitimizes it in the eyes of traditional investors and may encourage other financial giants to follow its example, thus redefining the global financial landscape.

💥 Crypto Market Cap surpasses $2 trillion!

The cryptocurrency market has just surpassed a historic milestone by exceeding $2 trillion in market capitalization. This step marks not only a recovery of investor confidence in digital assets, but also the revival of general enthusiasm for the sector. Investors, whether institutional or individual, are diving back into the crypto market, attracted by the promises of high returns. This positive momentum is also echoed by mainstream media, which now see cryptocurrencies as the future of finance, thus contributing to the full throttle revival of the crypto machine.

Beyond the giants Bitcoin and Ethereum, altcoins are also benefiting from this bullish wave. Cryptocurrencies such as Solana, Binance Coin, Polygon, and Avalanche, as well as stablecoins like Tether and USD Coin, are recording impressive gains. This historic rally benefits the entire crypto ecosystem, suggesting that if this trend continues, new records could be reached in 2023. With this spectacular breakthrough, the cryptocurrency market is making a triumphant return to the global financial scene.

The crossing of the $2 trillion market capitalization threshold for cryptocurrencies reflects not only a market recovery; it indicates an increasing integration of crypto into the global economy. This capitalization reflects a diversification of digital assets, with an increased adoption of blockchain technologies beyond mere speculative trading.

🌪️ Bitcoin dethrones Gold

Bitcoin is redefining the concept of a safe haven traditionally associated with gold, thanks to a massive influx of capital into Bitcoin ETFs, totaling $3.89 billion in just the past week. This trend marks a significant shift in investor perception, particularly among Americans, who now see Bitcoin as a credible and attractive alternative to gold. The advantages of Bitcoin, combining the properties of a stable store of value and a dynamic investment, enable it to attract the majority of financial flows destined for safe havens.

The impact of this transition is being felt in the gold market, which has experienced net outflows of nearly $2.4 billion in recent months. Investors are increasingly turning to Bitcoin, viewing it as a more effective means of hedging against inflation and geopolitical uncertainties. Although gold remains a major player with a market capitalization of $10 trillion, projections suggest that Bitcoin could surpass it by 2026. This revolution in the safe haven investment field reflects a profound change in capital protection strategies, with Bitcoin on its way to becoming the new standard for a secure store of value.

The shift of investors from gold to Bitcoin as a new safe haven asset is a fundamental reevaluation of what constitutes a "safe asset" in the digital age. This transition is indicative of a generation of investors who value the transparency, portability, and programmed scarcity of Bitcoin compared to gold.

⚡️ Russia climbs to the podium of Bitcoin mining

Russian Bitcoin miners, now accounting for 12% of the global hashrate, are on track to surpass China in this industry. The recent Bitcoin halving, which halved the block reward, is testing the profitability of miners, particularly those using older ASIC models. According to a report by Galaxy Digital, only recent ASIC models will remain profitable after this reduction unless they have access to extremely cheap electricity. This situation could lead to a migration of miners to regions with more advantageous energy costs, including the Middle East, South America, Bhutan, and Russia, the latter already experiencing significant growth in the sector.

Russia, with its competitive advantages such as tax incentives and reduced energy costs, especially in regions like Siberia, is becoming a major hub for Bitcoin mining. Bitriver, one of the largest mining operators in Russia, continues to expand its presence with new sites and increased capacity, benefiting from government support to attract more mining activities. With a forecast of global hashrate growth and a significant portion of this expansion attributed to Russia, the country is well positioned to become a leader in the Bitcoin mining industry.

The emergence of Russia as a major center for Bitcoin mining reflects the complex geopolitics surrounding cryptocurrency production. This rise in power highlights how nations can use Bitcoin mining as a strategic tool to monetize their energy resources, circumvent economic sanctions, and increase their influence over blockchain technology. However, it also raises questions about the centralization of the hashrate and the vulnerability of the Bitcoin network to manipulation or interruption by state actors.

Crypto of the day: Starknet (STRK)

Starknet, positioned as a key player in the cryptocurrency ecosystem, stands out for its innovative approach to blockchain scalability and security through the use of Zero-Knowledge Proofs. This technology allows Starknet to offer faster and cheaper transactions while maintaining a high level of privacy and security. As a layer 2 on Ethereum, Starknet aims to improve the overall efficiency of the network by reducing congestion and gas fees, thus providing significant added value for decentralized application (DApp) developers and end users.

Starknet's native crypto, STRK, serves several key functions within the ecosystem, including governance, payment of transaction fees, and potentially participation in network security through staking. Although specific details of its initial distribution are not specified here, STRK holders generally benefit from voting rights on network improvement proposals, a share of transaction fees generated on the network, and incentives to contribute to the security and efficiency of the platform. These advantages make STRK an attractive asset for investors and users who believe in Starknet's potential to revolutionize blockchain infrastructure.

Recent Performance

Current Price: $1.93 (approximately €1.79)

Percentage Change: -18.00% (1-day decrease)

Market Cap: $1,401,424,183.91 (approximately €1,299,322,650.42)

Rank on CoinMarketCap: 55

Crypto Analysis of the Day: Internet Computer (ICP)

Today, let's dive into the depths of the technical analysis of Internet Computer (ICP), a project that continues to captivate our community with its disruptive potential. ICP, after navigating through turbulent waters, seems poised to set sail for new heights. Let's take a closer look at what lies behind the numbers and charts.

After reaching a remarkable peak at $16.28, ICP experienced a correction, briefly touching the bottom at $9.5. However, far from being defeated, the price rebounded with strength, demonstrating a resilience that deserves our attention. This dynamic has formed an ascending wedge, often interpreted as a bearish reversal signal. But the story doesn't end there. Recently, ICP flirted with the $14 level, a threshold that we highlighted as significant in our previous analyses. This zone, fluctuating between $12 and $14, proves to be a magnet for investors, indicating sustained interest in the project.

However, the cryptocurrency market is an unpredictable sea, where currents can change in the blink of an eye. Technical indicators, such as the 50-day moving average and oscillators, suggest a bullish trend, but caution is advised. The open interest of ICP/USDT perpetual contracts and liquidations provide us with insight into traders' mindset, oscillating between optimism and caution. The liquidation heatmap reveals areas of high activity that could trigger increased volatility, highlighting the importance of keeping an eye on these key levels.

In conclusion, Internet Computer finds itself at a crossroads. If the price manages to stay above the symbolic $10 mark, we could witness a rise to uncharted heights. However, the path is strewn with obstacles, and a fall below this threshold could lead to a slide into darker depths. In this financial ballet, every step, every price level, plays a role in the complex choreography of the market. As always, I invite you to navigate these waters with caution, armed with your analytical compass and technical sextant, while remaining open to the changing winds of fundamental news.