💡 The Fed acknowledges the power of Bitcoin

Welcome to the Daily Tribune of Friday, December 6, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, December 6, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

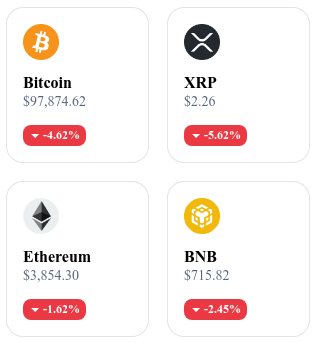

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🔥 Memecoins and altcoins: A spectacular surge in November

The month of November marked a meteoric rise for memecoins and some major altcoins. Solana experienced a 42% increase, reaching an all-time high of $262, with revenues of $177 million, doubling its previous record. Memecoins saw their on-chain activity explode by 95%, increasing volumes on decentralized exchanges. Platforms like Jito ($185 million) and Pump.fun ($92 million) shone, while the Phantom wallet became the number 1 free utility app on Apple.

Cardano also attracted attention with a 201% rise, driven by strategic initiatives and an increase of 180% in TVL. Polkadot, often discreet, surprised with its momentum in gaming via Mythos Chain. Despite criticism from figures like CZ from Binance about the sustainability of memecoins, their role in the ecosystem remains essential.

💡 Bitcoin: Jerome Powell reviews his speech

Jerome Powell, Chairman of the Fed, acknowledged the role of Bitcoin by describing it as the "digital version of gold," highlighting its speculative status, but not suited as a means of payment or traditional store of value. Comparing Bitcoin to gold in terms of use, he insisted on its volatility and its limited competition against the dollar.

Despite its limitations, notably its restricted transactional capacity and exchange fees, Bitcoin stands out for its fixed supply and resistance to censorship, becoming an alternative to global reserve currencies. While some countries consider diversifying their reserves in Bitcoin, Vladimir Putin has asserted its unstoppable character. A position that reflects the growing interest in Bitcoin as a strategic reserve and exchange tool between nations.

💥 Ripple falls despite Bitcoin's historic feat at $100,000

Bitcoin crossed a historic milestone by reaching $100,000 before retracting. However, this euphoria, though short-lived, was not shared by Ripple (XRP), which fell by 13% in 24 hours, with a drop of 25% over three days. This decline comes after a spectacular rise of 354% in November.

The pressure intensified with long position liquidations exceeding $12.8 million, revealing a disaffection from investors towards altcoins in the face of Bitcoin's growing dominance. The XRP/BTC ratio collapsed, while technical signals suggest a recovery, if key levels like $2.05 hold.

🚀 Bitcoin reaches $104,000 and regains 57% of the market

By crossing the threshold of $100,000, Bitcoin reinforced its dominance at 57% of the crypto market. This rise of BTC comes after a period when altcoins, like Ethereum, had gained market share.

Despite this feat, Bitcoin still experienced a sharp drop last night, losing up to 10% in just three minutes to reach a low of $93,000. This correction prompted the liquidation of $303 million in long positions, reflecting the persistent volatility of the asset. However, the queen of cryptos quickly rebounded and is now stabilizing around $98,000, marking a phase of consolidation after its meteoric rise.

Crypto of the day: Sui (SUI)

Sui is an innovative layer 1 blockchain, designed to provide an optimized user experience and high performance. Its uniqueness lies in its object-centered data model and its integration with the Move language, enabling parallel execution of transactions and enhanced security.

The native crypto of the ecosystem, SUI, serves multiple functions: it supports the delegated proof-of-stake mechanism, pays gas fees, fuels decentralized applications (DeFi, games, etc.), and grants a voting right for on-chain governance. Holders also benefit from staking rewards and the opportunity to participate in key decision-making processes, making SUI a versatile and attractive crypto.

Recent performances

Current price: €4.19

24h variation: +9.02%

Market capitalization: €12,271,483,013

Rank on CoinMarketCap: #20

When FOMO ruins portfolios: The emotional trap of crypto investors

A survey by Kraken reveals that 88% of investors regret missed opportunities, often under the influence of FOMO (Fear of Missing Out). The spectacular performances of certain cryptos, like Bitcoin and XRP, fuel impulsive decisions, with 63% of respondents admitting their choices were influenced by emotions.

This phenomenon, although common, accentuates potential losses in a market marked by constant volatility.

At the same time, FUD (Fear, Uncertainty, Doubt) also plays a major role, pushing 81% of investors to make hasty decisions under the influence of fear.

In the face of these emotional biases, Kraken advocates for rational strategies, based on technical analysis and planning. Adopting a methodical approach not only reduces risks but also transforms optimism into sustainable gains in this ever-evolving ecosystem.

As cryptos continue to reshape economic foundations, strict discipline and analytical management appear essential for fully seizing opportunities while mastering challenges.