❌ The Fed Dampens Crypto Market Hopes

Welcome to the Daily for Saturday, November 15, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, November 15, 2025, and like every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

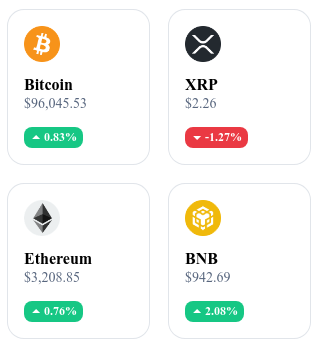

A quick look at the market…

🌡 Weather:

🌤️ Partly Sunny

24h crypto recap! ⏱

🎓 Harvard strengthens its position in the IBIT Bitcoin ETF with $443M invested

Harvard University’s investment fund now holds $443 million in BlackRock’s IBIT ETF, a 257% increase over the quarter. This strategy confirms Bitcoin’s growing role in U.S. institutional portfolios.

👉 Read the full article

💼 Bitmine changes leadership and holds $1.1B in Ethereum

The mining company has appointed a new CEO while revealing an Ethereum portfolio worth $1.1 billion. This transition comes amid expanded staking operations and asset diversification.

🪙 MicroStrategy continues Bitcoin accumulation despite sale rumors

Michael Saylor denied any BTC sale and confirmed new purchases through his company. MicroStrategy now holds over 233,000 bitcoins, reinforcing its status as the world’s largest institutional holder.

👉 Read the full article

🏮 Alibaba prepares a “deposit token” as Beijing tightens stablecoin rules

The Chinese group is developing a deposit token prototype backed by bank funds, in coordination with the People’s Bank of China. The project aims to merge blockchain innovation with strict national regulatory compliance.

👉 Read the full article

Crypto of the Day: NEAR Protocol (NEAR)

🧠 Innovation and Value Proposition

NEAR Protocol is a layer-1 blockchain designed for speed, scalability, and ease of use. It is based on Nightshade, a sharding system that divides the network into subsets capable of processing transactions in parallel, enabling fast finality and very low fees.

The protocol also stands out for its high compatibility with Ethereum through Rainbow Bridge and Aurora, two solutions that allow EVM applications to be deployed on NEAR.

Finally, NEAR is developing a vision focused on AI, autonomous agents, and accessible Web3 experiences, positioning itself as core infrastructure for next-generation decentralized applications.

💰 The Token

The NEAR token is used to pay transaction fees, secure the network via staking, and participate in protocol governance.

Holders can delegate their tokens to validators to earn rewards while contributing to the network’s security.

NEAR also plays a cross-chain role thanks to its Ethereum-compatible ecosystem, increasing its utility for developers and users. The protocol’s economic model is built on long-term incentives: usage, governance, and application development, all aimed at broader Web3 adoption.

📊 Real-time performance

💵 Current price: $2.46

📈 24h change: +1.78%

💰 Market cap: $3.14 billion

🏅 CoinMarketCap rank: #34

🪙 Circulating supply: 1.28 billion NEAR

📊 24h trading volume: $436 million

The Fed backs off rate cut: what consequences for crypto?

While markets were counting on imminent monetary easing, the U.S. Federal Reserve is changing course. The probability of a rate cut in December is now below 50%. A reversal that could disrupt investor plans… especially in the crypto space.

A fading rate cut, the Fed changes its tone

Markets had nearly priced it in: a Fed rate cut in December seemed certain. But according to the latest CME FedWatch Tool estimates, that probability dropped from 67% in early November to just 45.9% today. This reversal is significant.

The main catalyst? A clear statement from Fed Chair Jerome Powell: “A further reduction in the policy rate at the December meeting is not a given, far from it. Monetary policy is not on a preset path.”

This shift reflects a more cautious central bank strategy, choosing to wait amid recent economic indicators. In short, if inflation continues to decline and the labor market remains resilient, maintaining current rates may be favored into next year. This prudent approach shows the prevailing uncertainty and a desire to avoid reigniting inflationary pressure.

What impact on Bitcoin and crypto markets?

In crypto, where every macroeconomic signal is scrutinized, the Fed’s stance has been perceived as a brake on recovery. Hopes of a Bitcoin and altcoin rebound fueled by looser monetary policy are fading. Without a clear catalyst, investors face a market lacking direction.

The Fed’s caution is also driving volatility, especially for assets sensitive to liquidity flows like cryptocurrencies. A prolonged high-rate environment reduces interest in risky assets, increasing the appeal of guaranteed returns.

Since the shift in Fed expectations, Bitcoin fell below $96,000, hitting a six-month low. At the same time, the Fear & Greed Index plunged into extreme fear territory, posting a worrying score of 10.