🔥 The Fed Eases, Crypto Soars: Bitcoin and Ether Surge

Welcome to the Daily for Saturday, August 23, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, August 23, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the last 24 hours of news you shouldn’t miss!

But first…

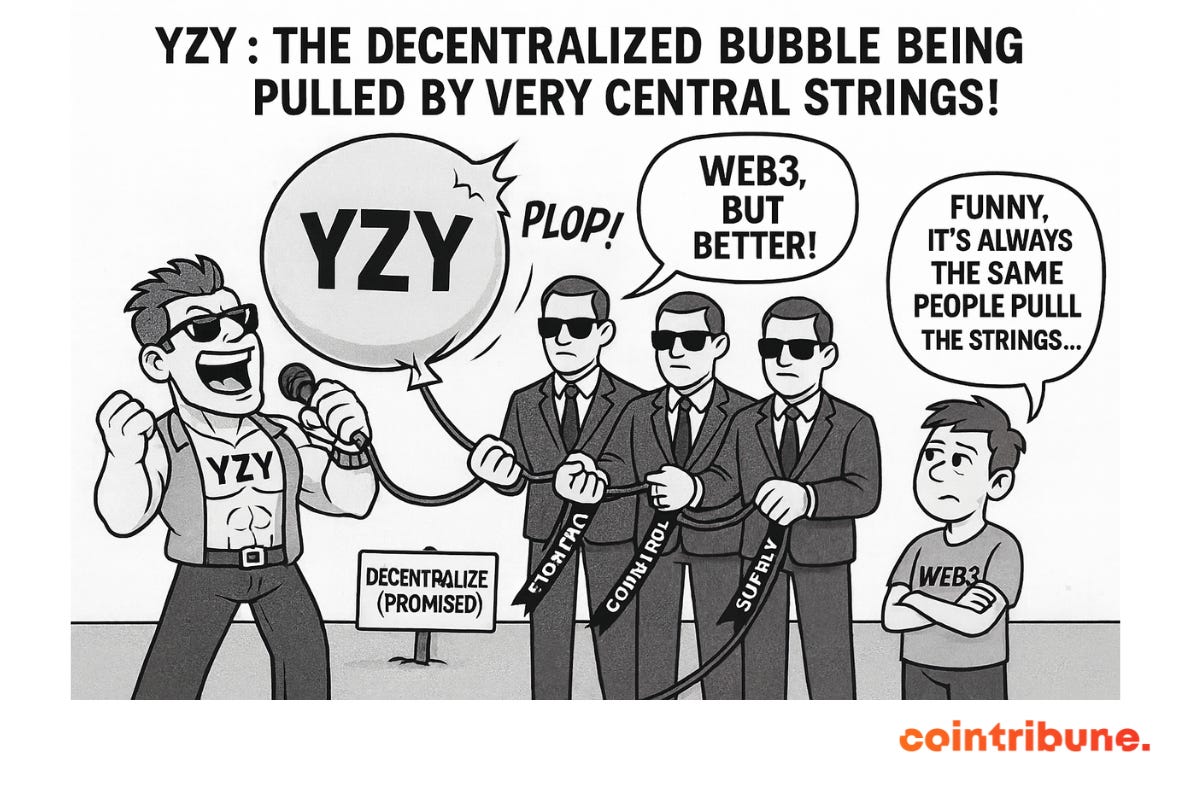

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🦊 MetaMask enters the stablecoin arena with mUSD

MetaMask is launching mUSD as its native stablecoin, relying on Bridge (Stripe) and M0 infrastructure for issuance and compliance. The token is integrated into the wallet and targets DeFi use cases and payments via the MetaMask card on the Mastercard network by the end of 2025, positioning itself against USDT and USDC. 👉 Read the full article

🎭 YZY token hits $3B before collapsing on centralization fears

Ye’s (Kanye West) token YZY on Solana briefly reached a $3B market cap in ~40 minutes before dropping to ~1.05B. On-chain analysis shows ~94% of supply controlled by insiders (87% in a multisig before redistribution), fueling concerns of market manipulation. 👉 Read the full article

⚖️ DOJ says it will not prosecute blockchain developers who respect decentralization

The Department of Justice, through Matthew Galeotti, clarified it will no longer use Section 1960(b)(1)(C) against non-custodial, decentralized developers without criminal intent. This update follows the Roman Storm verdict and takes immediate effect, though other charges remain possible in cases of abuse. 👉 Read the full article

🏛️ Coinbase lists Trump-backed World Liberty USD1 stablecoin

Coinbase has listed USD1 (ERC-20) from World Liberty Financial, a project tied to Donald Trump, cautioning users about off-Ethereum transfers. Circulating supply surged to ~2.4B after $205M in new minting, with the token already listed on Binance since May 22. 👉 Read the full article

Crypto of the Day: Fantom (FTM)

🧠 What innovation and added value?

Fantom is a Layer 1 blockchain that relies on an innovative consensus mechanism called Lachesis, a variation of asynchronous Byzantine Fault Tolerance (aBFT). Unlike traditional blockchains that validate block by block, Fantom uses a Directed Acyclic Graph (DAG) structure, allowing it to process multiple transactions simultaneously and achieve near-instant finality (≈ 1 second).

It is also compatible with the Ethereum Virtual Machine (EVM), making it easy to port smart contracts and ensuring interoperability with the existing ecosystem. Thanks to its extremely low fees, speed, and modularity, Fantom positions itself as a credible alternative to Ethereum and Layer 2 solutions for DeFi, DEXs, stablecoins, gaming, and NFTs.

💰 The FTM token: utility and advantages for holders

FTM is used to pay transaction fees, for staking (securing the network and earning rewards), and for on-chain governance. This model aligns incentives, security, and ecosystem growth while keeping the user experience fast and cost-effective.

📊 Real-time performance (August 23, 2025)

Current price: $0.3413 USD

24h change: +6.10%

Market capitalization: ≈ $727 million USD

CoinMarketCap rank: #65

Circulating supply: ≈ 2.134 billion FTM

24h trading volume: ≈ $218.9 million USD

Bitcoin rebounds after Jackson Hole: What message is the Fed sending?

The stage was set, but the message surprised. During his annual Jackson Hole speech, Jerome Powell shifted course. Dropping his strict stance on inflation, the Federal Reserve Chair revived hopes of monetary easing. Crypto markets reacted immediately: Bitcoin broke above $116,000 and Ether surged more than 11%.

The Fed abandons its aggressive strategy, Bitcoin takes off

Powell’s remarks marked a clear break from the Fed’s previous policy. Far from the inflexible tone of recent months, he called recent price increases “largely temporary” and emphasized the fight against unemployment, now at 4.2%. Markets interpreted this strategic pivot as a dovish signal.

In response, Bitcoin jumped from $112,000 to a high of $116,063. The rally was fueled by strong technical moves, driven by mass liquidations of short positions. The Fear & Greed Index climbed back to 60, signaling a renewed wave of optimism. This confirms Bitcoin’s role as a barometer for global economic policy.

Ether, market sentiment and anticipation of a monetary pivot

Beyond Bitcoin, Ether positioned itself as the leading indicator of rate sensitivity. The asset climbed 11.51% in 24 hours, reaching $4,851 — its highest level since 2021. According to Jeffrey Zirlin, co-founder of Axie Infinity, Ether is “the most interest rate-sensitive element in the crypto universe.” This underscores its status as a semi-institutional asset, often used as a proxy for liquidity conditions.

The enthusiasm also stemmed from CME FedWatch projections, which show that 75% of market participants now expect a rate cut at the September meeting. Market sentiment is clearly tilting toward monetary easing, fueling bullish bets across digital assets.

This Jackson Hole speech may well prove historic. By softening its tone, the Fed triggered an instant surge of confidence in crypto markets, breathing new life into digital assets. If confirmed at future central bank meetings, 2025 could mark the return of positive volatility. The question remains whether this reversal will prove lasting — or purely strategic.