Hello Cointribe! 🚀

Today is Wednesday, September 24, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the last 24 hours of news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

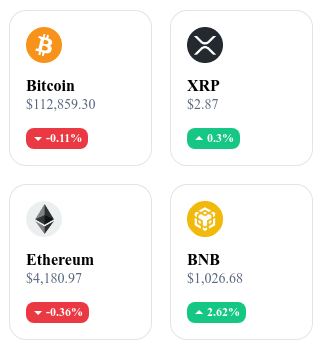

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

🇺🇸 The SEC wants to speed up crypto innovation with an unprecedented exemption The SEC is preparing a temporary regulatory exemption allowing crypto startups to test new products without going through full registration. The agency aims to create a controlled innovation environment, inspired by the UK’s “sandboxes,” to attract capital and talent to the United States.

👉 Read the full article

⚖️ FTX claims $1.15B from Genesis Digital Assets

FTX’s liquidator has filed a lawsuit against Genesis Digital Assets, accusing the mining company of receiving $1.15B in unjustified payments. The case is part of the recovery strategy intended to reimburse creditors of the former exchange, already engaged with several counterparties.

👉 Read the full article

💳 World Liberty Financial launches a debit card and retail app

World Liberty Financial introduces a crypto debit card linked to a mobile app enabling payments, savings, and rewards. The offer targets the U.S. market and aims to compete with PayPal and Revolut in digital financial services.

👉 Read the full article

🇰🇿 The Central Bank of Kazakhstan launches a national stablecoin with Solana

The Central Bank of Kazakhstan announces the issuance of the KZT-E, a stablecoin backed by the tenge, built on the Solana blockchain. This project is part of a financial modernization strategy and could serve as a basis for regional international payments.

👉 Read the full article

📌 Crypto of the Day: Hedera (HBAR)

🧠 What innovation and added value?

Hedera is not a traditional blockchain: it relies on a technology called hashgraph, a distributed ledger that offers fast, secure, and low-energy consensus. This model allows it to process up to 10,000 transactions per second with near-zero fees, while guaranteeing finality in just a few seconds.

Hedera also stands out for its unique governance, entrusted to a council made up of major global companies (Google, IBM, Boeing, LG, Ubisoft, etc.), which strengthens its institutional credibility. Its use cases cover asset tokenization, DeFi, data authenticity, and instant payments.

💰 The token: Utility and benefits for holders

HBAR is the native token of the Hedera network. It is used to pay transaction fees and to power applications deployed on the hashgraph. It also plays a central role in security through the staking mechanism: validators lock their HBAR to contribute to consensus and earn rewards.

Holders can also delegate their tokens to help secure the network without running a node themselves. Finally, HBAR enables indirect participation in governance by supporting the ecosystem and projects built on Hedera, aimed at both enterprises and dApp developers.

📊 Real-time performance (September 20, 2025)

💵 Current price: 0.073086 USD

📉 24h change: −3.64%

💰 Market cap: 2,624,611,157 USD

🏅 Rank on CoinMarketCap: #47

🪙 Circulating supply: 35,902,752,494 HBAR

📊 Trading volume (24h): 58,839,679 USD

Interest rates: the Fed’s hesitation clouds economic signals

The U.S. Federal Reserve is moving through treacherous ground. After cutting rates by a quarter point, conflicting signals from the U.S. economy blur the outlook. Inflation, still above the target, and a slowing job market weaken unity within the Fed. This situation fuels uncertainty about upcoming decisions, political criticism, and speculative moves, particularly in crypto markets.

Between persistent inflation and economic slowdown: the Fed at an impasse

The latest FOMC meeting resulted in a 25-basis-point cut in the benchmark rate. A seemingly modest measure, but one that highlights internal tensions within the Fed. While the PCE, the main inflation indicator tracked by the Fed, is still at 2.9%, the 2% target remains out of reach. In this context, Jerome Powell reminded that every monetary decision carries risk and emphasized the need to “navigate by sight.”

This cautious stance is challenged by more interventionist voices, such as FOMC member Stephen Miran, who is calling for a sharper cut of up to 50 basis points. According to him, the current rate level harms employment and could worsen the ongoing economic slowdown. This disagreement reflects a growing rift between officials who fear a resurgence of inflation and those concerned about a prolonged weakening of activity.

Consequences on markets and questions on monetary independence

Donald Trump did not hesitate to publicly criticize the Fed’s slowness in easing policy, accusing the institution of harming growth. These attacks, although frequent, raise questions about the central bank’s independence from political pressure.

In the markets, this uncertainty fuels increased volatility. Investors struggle to anticipate upcoming moves, boosting the appeal of assets seen as detached from central banks. In this context, Bitcoin is gaining legitimacy as a monetary alternative, especially among those who see the Fed’s hesitation as a structural weakness of the system.