📈 The former US president wants to reshape the central bank. Could this boost or hurt Bitcoin?

Welcome to the Daily for Thursday, December 18, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, December 18, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ top crypto news!

But first…

✍️ Cartoon of the day:

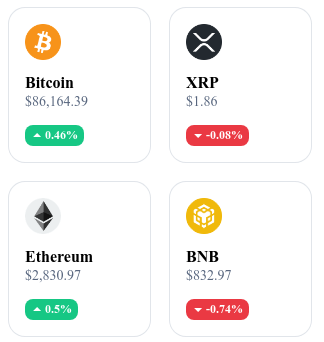

A quick look at the market…

🌡 Weather:

☁️Cloudy

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🔥 Hyperliquid proposes a vote to exclude $1 billion worth of HYPE from total supply

Hyperliquid has submitted a proposal to validators to officially recognize that around $1 billion worth of HYPE held in its assistance fund is technically inaccessible and should be excluded from the circulating supply. This fund is automatically fed by trading fees and is linked to an address with no private key, making it impossible to control or withdraw. The proposal does not involve an active burn, but aims to clarify how these tokens should be accounted for in supply metrics. 👉 Read full article

📊 Institutions are buying more Bitcoin than miners are producing

Recent data shows that wallets associated with institutional entities are accumulating Bitcoin at a faster pace than miners are generating new coins. This trend continues even as mining activity remains stable or slightly decreases. 👉 Read full article

🛡️ Binance warns against fraudulent agents and offers up to $5M for whistleblowers

Binance has issued a notice reminding that all token listings must go exclusively through its official channels, and no third party is authorized to offer or broker listings. The platform is offering up to $5 million in rewards for verifiable information that helps identify fake listing agents. Reports must be submitted via Binance’s official channels to qualify. 👉 Read full article

📈 Aave outlines 2026 growth roadmap after SEC investigation closes

Aave has announced that the U.S. Securities and Exchange Commission (SEC) has closed a four-year investigation with no enforcement action, according to a recent article. Founder Stani Kulechov unveiled a roadmap including the launch of V4, a “Horizon” expansion for real-world assets, and a mobile app expected in 2026. 👉 Read full article

Crypto of the Day: Monero (XMR)

🧠 Innovation and Value Proposition

Monero is a blockchain focused on transaction privacy. Its protocol hides the sender, receiver, and amount by default using a combination of ring signatures, stealth addresses, and confidential transactions.

This approach has made Monero a benchmark for privacy in the crypto ecosystem. The network ensures full fungibility, as each unit of XMR is indistinguishable from another. Monero is particularly suited for private payments, protection from financial surveillance, and censorship resistance.

💰 The Token

XMR is the native currency of the network. It is used for payments, transaction fees, and network security through proof of work. The issuance follows a gradual mechanism with no hard cap to provide ongoing incentives for miners.

XMR’s complete fungibility strengthens its utility as a medium of exchange. Its value is directly linked to network activity and demand for private transactions—offering a unique positioning in the crypto landscape.

📊 Live Stats (CMC)

💵 Current Price: €361.48

📈 24h Change: +0.14%

💰 Market Cap: €6.66B

🏅 CMC Rank: #14

🪙 Circulating Supply: 18.44M XMR

📊 24h Volume: €160.9M

Trump reignites the Fed: A new golden era for Bitcoin?

Former U.S. President Donald Trump has just laid the groundwork for a major shift at the Federal Reserve. By pledging a policy of “much lower” interest rates after 2026, he could be setting the stage for a new era for Bitcoin. While still early, the announcement is already making waves in both financial and crypto circles. What impact could this monetary pivot have?

A Trump-style Fed: Monetary easing and crypto openness

In May 2026, Jerome Powell’s term as Fed Chair will come to an end. Trump, already refining his economic strategy ahead of the midterm elections, stated he intends to appoint a Fed leader firmly committed to a looser monetary policy. According to him, it would be someone who believes in “much lower” rates to boost economic growth.

Among the potential candidates are Christopher Waller, a current Fed governor known for his crypto-friendly stance, and Kevin Hassett, Trump’s former economic advisor. This strategic move is not only aimed at reassuring financial markets—it also sends a strong signal to the crypto sector: looser interest rate policies could be highly favorable for digital assets.

So far, markets remain cautious. Immediate reactions have been subdued, but speculation is mounting over the impact of a “crypto-friendly” Fed.

Bitcoin on alert: Between historic opportunity and strategic caution

The link between low interest rate policies and Bitcoin performance is well-documented. In periods of monetary easing, investors often look for alternatives to traditional assets. Bitcoin, seen by many as a store of value or inflation hedge, typically thrives in such environments.

According to BitMine analyst Tom Lee, a Fed Chair supporting this kind of policy shift could trigger a new bullish cycle for the crypto market—especially around or shortly after Powell’s replacement.

Still, caution is warranted. According to the CME Group’s FedWatch Tool, 73.4% of analysts believe the Fed is unlikely to cut rates in the near term. This highlights the uncertainty at play: until an official announcement is made, markets remain on edge, awaiting potential surprises.