⚡ The open interest explodes: Is BTC about to trigger a financial storm?

Welcome to the Daily Tribune on Wednesday, November 20, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, November 20, 2024 and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

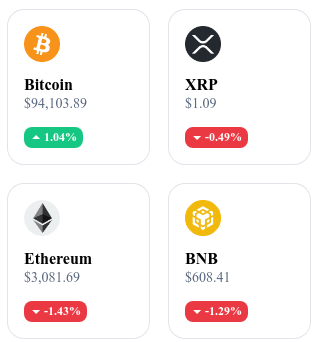

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🌊 Memecoins boiling on Solana

The Solana ecosystem is boiling, propelled by a wave of memecoins that are shaking up established platforms. Tokens like Peanut the Squirrel (PNUT) or Goatseus Maximus (GOAT) are attracting a fervent community, generating record fees for DApps. In a week, actors like Raydium have produced over 69 million dollars in fees, making Solana an essential network.

However, this dynamic raises concerns: these memecoins, often ephemeral, could create excessive volatility and divert serious projects. Despite these challenges, the Solana team sees an opportunity to expand its services and anchor sustainable adoption. The coming months will determine if this enthusiasm is a springboard for the blockchain or a bubble ready to burst.

🇫🇷 Gemini establishes itself in France: The crypto Eldorado?

The American platform Gemini, founded by the Winklevoss brothers, makes a noteworthy entry into France, betting on a rapidly expanding market and a stable regulatory framework. With an offer tailored to French investors, the platform provides deposits in euros, bank transfers, and integrations like Apple Pay.

More than 70 digital assets are available, reflecting an ambitious strategy that targets both individuals and institutions. This implantation relies on the growing attractiveness of France in the crypto universe, boosted by the European regulatory framework MiCA. Gemini also positions itself as a key player for institutional investors with its eOTC trading system. This strategic expansion underscores Gemini's ambition to become a reference in the European market.

🏦 Goldman Sachs: An autonomous crypto entity for finance 2.0

Goldman Sachs takes a major step by separating its crypto platform to make it an autonomous entity. This ambitious project aims to develop financial solutions based on blockchain, tailored to institutional needs. In collaboration with partners like Tradeweb Markets, this new structure will focus on technological innovation and trading of tokenized assets.

This repositioning fits into a broader strategy for the adoption of blockchain technologies and the development of financial instruments such as tokenized goods and ETFs. By relying on permissioned blockchains, the bank aims for speed and security to captivate a rapidly expanding market. This transformation could redefine the role of financial institutions in the crypto ecosystem, while addressing the challenge of a complex regulatory framework.

🔥 Bitcoin boiling: Open Interest soars

Bitcoin reaches a critical level as its open interest – an indicator of the total open positions on derivatives – explodes, reflecting massive speculative interest. At nearly $90,500, BTC saw a 10% increase in a week, fueled by a favorable macroeconomic context, notably the Fed's rate cuts and the impact of Donald Trump's policies.

However, this rise is accompanied by increased risks of mass liquidations, exacerbated by leverage effects. Historically, these overheating situations often trigger volatility spirals, where brutal corrections become inevitable. As interest in BTC reaches a peak, the balance remains fragile in the face of economic and geopolitical uncertainties, casting doubt on the sustainability of this ascent.

Crypto of the day: Stellar (XLM)

Stellar stands out for its role in global financial connectivity. Its innovative blockchain, based on the Stellar Consensus Protocol (SCP), enables fast and low-cost transactions between different financial institutions, blockchains, and systems.

The native crypto, XLM (Lumen), plays a central role in facilitating these transactions as an intermediate currency, reducing fees and delays for cross-border payments. Initially distributed through airdrop programs and strategic partnerships, XLM offers holders the opportunity to actively participate in the Stellar ecosystem while benefiting from the security and speed of transactions. It is used to pay network fees and avoid spam, thus consolidating its practical utility.

Recent performances

Current price: €0.2485

24h change: +7.03%

Market capitalization: €7.461 billion

Rank on CoinMarketCap: 24

Technical analysis of the day: Ethereum (ETH)

Ethereum is currently trading around $3,130, after breaking through a key resistance at $2,820 and reaching a peak of $3,400. This zone marks a period of consolidation, oscillating between $3,000 and $3,200, indicative of sustained bullish momentum but tempered by selling pressures.

Despite a recovery above its monthly VWAP and significant levels, moving averages remain crossed to the downside, indicating still fragile progress. Technical signals are mixed but suggest potential for bullish expansion, supported by a favorable market context.

Derivatives analysis shows an open interest on the rise, bolstered by positive funding rates but facing a divergence with the CVD, revealing persistent seller interest. Key zones to monitor include $3,250 and $3,350 for a bullish continuation, with an ambitious target of $4,000 (+26%). Conversely, if Ethereum falls below $3,000, a correction towards $2,750, or even $2,300, remains possible, marking a potential similar drop.

The situation will depend on market reactions at these critical thresholds, making developments in the coming days decisive.