📊 The S&P 500 becomes riskier than Bitcoin

Welcome to the Daily Tribune of Saturday, April 12, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, April 12, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

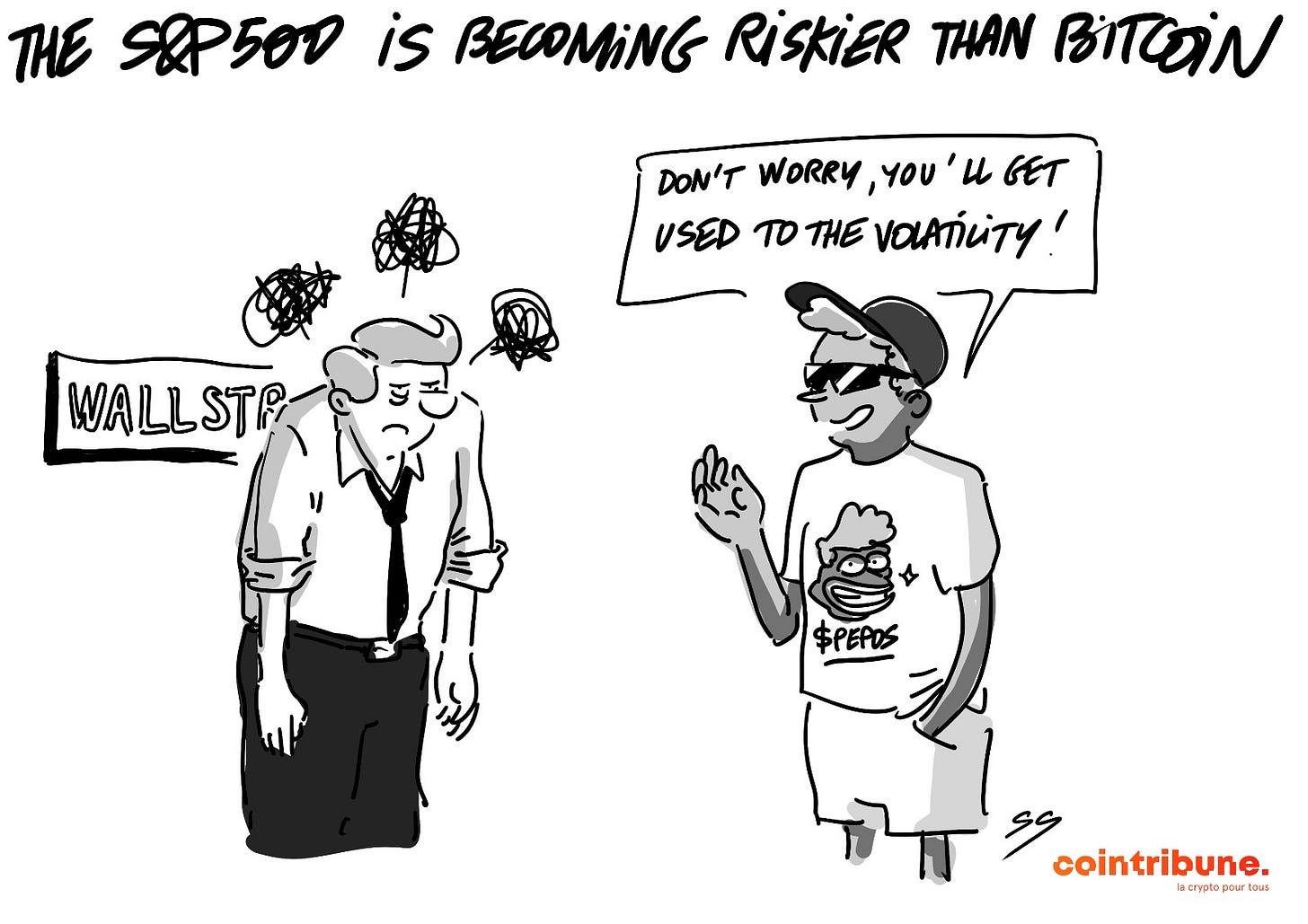

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

💰 BlackRock invests $3 billion in crypto in Q1 2025

BlackRock invested $3 billion in cryptocurrencies in the first quarter of 2025 and consolidates its position in the sector.

🛡️ Vitalik Buterin unveils a roadmap for privacy on Ethereum

Vitalik Buterin unveils an ambitious roadmap to enhance privacy on Ethereum through advanced cryptographic tools.

📉 The S&P 500 becomes more volatile than Bitcoin

The S&P 500 shows a volatility higher than that of Bitcoin, a first that raises eyebrows among investors.

⚡ Pakistan considers using its electricity surplus for Bitcoin mining

Pakistan is exploring the possibility of applying its energy surplus to Bitcoin mining to generate additional revenue.

The crypto of the day: JasmyCoin (JASMY)

JasmyCoin is the native token of the Jasmy platform, developed by the Japanese company Jasmy Corporation, founded by former Sony executives. The project aims to give users control over their personal data by combining Internet of Things (IoT) technologies and blockchain.

Thanks to a decentralized infrastructure based on IPFS (InterPlanetary File System) and services such as Security Knowledge Communicator (SKC) and Smart Defender, Jasmy enables secure and transparent management of data from connected devices. Users can thus choose to share or monetize their personal information with confidence.

The JASMY token, compliant with Ethereum's ERC-20 standard, is used for:

Pay transaction fees on the Jasmy platform.

Access and manage personal data stored on the network.

And participate in the governance of the protocol.

Recent performances

Current price: $0.01699 USD

24-hour change: +28.3 %

Market cap: approximately $821.5 million

Rank on CoinMarketCap: #69

Bitcoin: A double bottom forming according to John Bollinger

As Bitcoin hovers around $82,000, investors are questioning the possibility of a bullish reversal. John Bollinger, creator of the famous Bollinger Bands, identifies a "W" technical pattern on weekly charts and announces a potential rebound. However, the validation of this scenario depends on several technical and macroeconomic factors.

The "W" awaiting confirmation

The formation of a double bottom in "W" is considered a bullish reversal signal. According to Bollinger, the %b indicator, which measures the price position relative to Bollinger Bands, shows a plunge below zero followed by a rise, typical of this setup. However, to confirm this signal, Bitcoin must break through the 20-period central moving average, located around $85,000. Currently, the price remains below this resistance, leaving the scenario pending.

Macroeconomic factors: a determining influence

Besides technical signals, the macroeconomic context plays a crucial role. Bitcoin shows an increased correlation with the stock markets, notably the S&P 500, which is trading near its oversold levels. Economist Timothy Peterson highlights that Bitcoin might await stabilization of the Nasdaq, which could still drop by 10%, before rebounding. A key level to watch is the psychological threshold of $70,000, considered an important technical support.

The double bottom configuration identified by John Bollinger offers a bullish perspective for Bitcoin, but its confirmation depends on breaking through the central moving average and the evolution of traditional markets.