The SEC goes after Uniswap, Bitcoin ETFs arrive in China! 🌏

Welcome to the Daily Tribune Wednesday, April 10, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, April 11, 2024 and like every day from Tuesday to Saturday, we summarize the news from the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

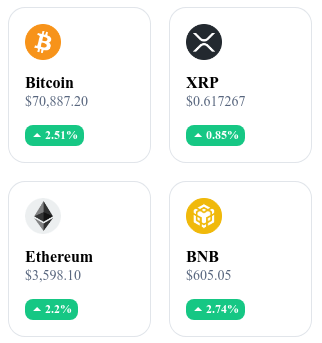

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

📉 Bitcoin: When the fall is looming

Bitcoin at a crossroads

Bitcoin is going through a period of great uncertainty, with alarming predictions emerging from all sides. According to a study by Deutsche Bank, Bitcoin could fall below $20,000 before the end of the year, a prospect based on the opinions of over 3,600 American, British, and European consumers. This drop would represent a significant decrease compared to its current price, bringing the cryptocurrency back to levels seen during the long crypto winter of 2022.

Divergent opinions on Bitcoin's future

The survey revealed that 40% of the participants still believe in the prosperity of Bitcoin, while 8% predict its imminent disappearance. Only 10% of those surveyed believe that the price of BTC could reach $75,000 by the end of this year. Between these grim predictions and measured optimism, the future of digital currency remains a hot topic.

🌪️ Uniswap: In turmoil

SEC targets Uniswap

Uniswap, the decentralized finance (DeFi) giant, is facing an inquiry by the Securities and Exchange Commission (SEC), preceding a thorough regulatory investigation. The financial watchdog's announcement had an immediate impact on the price of Uniswap's native cryptocurrency, UNI, which experienced a significant drop. The details of the inquiry remain confidential, but it is clear that it could have major implications not only for Uniswap but for the entire DeFi ecosystem.

The uncertain future of DeFi

In the short term, this inquiry highlights the regulatory risks for DeFi platforms and signals a period of uncertainty for Uniswap. In the long term, it could lead to clearer and more tailored regulations, beneficial for both users and innovators.

🚫 Ethereum ETF: Disappointed hopes

Ethereum Spot ETF fades away

Hopes for the approval of an Ethereum Spot ETF are diminishing due to opposition from the SEC. Expectations were high, but the reality is less promising, largely due to the regulatory ambiguity surrounding Ethereum compared to Bitcoin.

An uncertain future for Ethereum

Crypto and financial industry players, including influential asset managers like Cathy Wood's Ark Invest, are becoming increasingly skeptical about the approval of an Ethereum spot ETF.

📈 Chinese Bitcoin ETFs: The dawn of a new era

Bitcoin ETFs approaching in Hong Kong

According to Reuters, Bitcoin ETFs could enter China, specifically Hong Kong, as early as next week. Several Chinese investment funds, through their subsidiaries in Hong Kong, are competing for the approval of their Bitcoin ETFs, which could mark a major turning point for Bitcoin access in the region, despite the exchange and mining ban in 2021.

Potential impact of Chinese Bitcoin ETFs

The introduction of Bitcoin ETFs in China is a positive sign, especially considering that Bitcoin has experienced a 60% increase since the launch of similar American ETFs. With the growing interest in Bitcoin in China and Hong Kong, despite the restrictions, the arrival of these ETFs could further boost the market.

Crypto of the Day: 0x Protocol (ZRX)

0x Protocol positions itself as an infrastructure for decentralized token exchange on the Ethereum blockchain. Its innovative technology is based on smart contracts that facilitate peer-to-peer exchange without requiring a central entity. This approach offers a significant reduction in transaction fees and increased security, highlighting the added value of decentralization in crypto asset exchanges.

The native cryptocurrency of 0x Protocol, ZRX, has several key utilities, especially in protocol governance, where ZRX holders can vote on protocol upgrade proposals. ZRX was distributed through an initial coin offering (ICO), which financed the development of the protocol. ZRX holders benefit from governance rights and, in some cases, transaction fee discounts on platforms using 0x, emphasizing the advantages of being an investor in the token.

Recent performance

Current price: $0.655

Percentage increase/decrease: -0.33% (1-day decrease)

Market cap: $555,082,231

Rank on CoinMarketCap: #151

Technical analysis of the day: Toncoin (TON)

Toncoin, what an adventure lately! After a rather calm period during the summer of 2023, when its price was flirting with a modest $1, our dear TON has gained momentum, nearing its all-time high at around $3. But that's not all. The real excitement began with a long consolidation phase, a suspenseful four-month period that formed a fascinating symmetrical triangle. This was just the calm before the storm: at the end of February 2024, Toncoin broke free, soaring to new unexplored heights. Imagine, in just seven weeks, it climbed 258%, a remarkable feat especially considering that the rest of the crypto market was showing signs of fatigue.

From a technical perspective, this ascent of Toncoin is even more impressive because it is built on solid foundations: the 50-day and 200-day moving averages. These indicators confirm a bullish trend in the medium and long term. Market enthusiasm is palpable through oscillators, although this same enthusiasm can sometimes sound the alarm for possible overbought conditions. The market may have a bit too much appetite, which often sets the stage for a correction.

Now let's zoom in on the TON/USDT derivatives, and there it gets even more captivating. Open interest in these contracts has significantly increased, parallel to the rise in price. This clearly indicates a strong interest in buying, supported by a series of strategic liquidations based on market movements. Liquidation heatmaps reveal key buying areas around $5.4 and $6.5, essential reference points for investors. If TON holds above $5, we can expect the ascent to continue. However, if the price were to fall below this level, a retracement to $4 or even $3.5 is not excluded.