The SEC Tightens the Noose on Mining, Visa Trusts Ethereum 🏛️💳

Welcome to the Daily Tribune of Friday, September 27, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, September 27, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

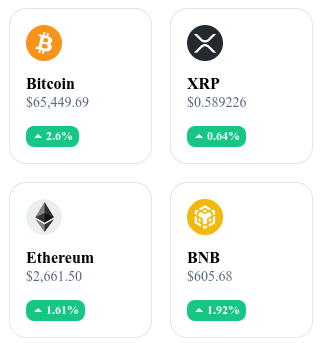

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

Bitcoin Confirmed as a Commodity 🏛️

Gary Gensler, president of the SEC (Securities and Exchange Commission), reaffirmed that Bitcoin is not a security but indeed a commodity. This regulatory clarification distinguishes Bitcoin from other cryptocurrencies, often subject to stricter regulations. Its decentralized nature, without a central entity, is one of the reasons why it is treated similarly to assets like gold or silver. This allows investors to access Bitcoin through ETFs on Nasdaq and NYSE, facilitating its adoption on traditional financial markets. Gensler, however, reminded that the crypto sector as a whole remains under strict surveillance and emphasizes protecting investors and complying with existing rules.

Visa Launches a Tokenized Assets Platform on Ethereum in 2025 💳

Visa announced an ambitious project for 2025: the launch of a platform allowing banks to issue tokenized assets on the Ethereum blockchain. This project aims to provide financial institutions with an opportunity to tokenize assets backed by trusts while complying with regulatory frameworks. The advantages of this tokenization are numerous: greater liquidity, the ability to split investments, and increased transparency thanks to the blockchain. Ethereum was chosen for its robustness and flexibility regarding smart contracts. Visa hopes that this pilot project will demonstrate the effectiveness of tokenized assets and pave the way for broader adoption in the banking sector, thus providing clients with direct and secure access to crypto markets.

BlackRock Propels the United States to the Top of the Bitcoin Market 🇺🇸

Last Wednesday, BlackRock made a major acquisition of 2,913 BTC, worth $184.3 million, thus consolidating its position as a leader in the cryptocurrency space. With an impressive total of 359,279 BTC, about $23 billion, BlackRock far exceeds players like MicroStrategy. This operation illustrates the growing interest in Bitcoin from the United States, notably due to ETFs which have seen a significant rebound following a slowdown in July. The BlackRock iShares Bitcoin Trust has managed to capture a large portion of institutional demand, reinforcing the position of the United States as a hotspot for Bitcoin investment. The resurgence of Bitcoin ETFs reflects a profound change in the perception of this cryptocurrency, once considered risky but now seen as a serious and promising asset.

The SEC Classifies Crypto Mining as a Security ⚖️

In a decisive turn for the mining industry, the SEC won a case in a federal court, which ruled that certain mining devices can be considered securities. The SEC based its decision on the famous Howey test, asserting that mining equipment, coupled with hosting agreements like those offered by Green United LLC, constituted investment contracts. This ruling could disrupt the industry as it requires mining companies to comply with securities regulations, including strict disclosure requirements. This new classification could force companies to revise their offerings to avoid potential sanctions for the sale of unregistered securities. The judgment opens the door to a tighter regulatory framework for the entire crypto mining sector in the United States.

Crypto of the Day: Conflux (CFX)

The Conflux Network blockchain is distinguished by its hybrid consensus protocol, combining Proof-of-Work (PoW) and an optimized transaction processing mechanism. This improves scalability and security, thus addressing the congestion issues of traditional blockchain networks. The blockchain also promotes interoperability among different networks.

The native cryptocurrency of Conflux, CFX, is primarily used to pay transaction fees, participate in the governance of the network, and secure the blockchain through staking. Originally distributed during a fundraising event (ICO) and through mining mechanisms, it offers advantages such as participation in network decisions and rewards for holders through staking. CFX can be used in decentralized applications (dApps) built on Conflux, facilitating fast and secure payments.

Recent Performance

Current Price: $0.1884 (approximately €0.18)

24-hour Change: +15.17%

Market Capitalization: €834,968,176

Rank on CoinMarketCap: #83

Hamster Kombat Ignites Exchanges with the HMSTR Token 🔥

The HMSTR token from Hamster Kombat made a remarkable entry onto exchange platforms, notably Binance, recording high volatility right from its launch. The token price quickly rose to $0.009186 before stabilizing around $0.007139 and then experiencing a decline.

This launch, supported by an aggressive promotion campaign, includes an airdrop for early investors and partnerships with several exchanges, contributing to a notable excitement around the project. With a total supply of 100 billion tokens and a market capitalization estimated at around $500 million, HMSTR could reach a target price of $0.01, which would propel its valuation to over a billion dollars.

However, long-term prospects remain uncertain. Analysts are closely watching the volatility patterns of similar tokens such as NOT and DOGS, which have seen rises followed by significant drops after their initial peaks. HMSTR's volatility in the next 48 hours could mimic these trends, with correction risks despite initial enthusiasm. Hamster Kombat's ability to maintain the token's value over the long term remains a crucial issue for its sustainability in the crypto ecosystem.

🔗 Read the complete analysis here.