The surprising reaction of Bitcoin to ETF 🌪️

Welcome to the Daily Tribune Friday, January 12, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, January 12, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

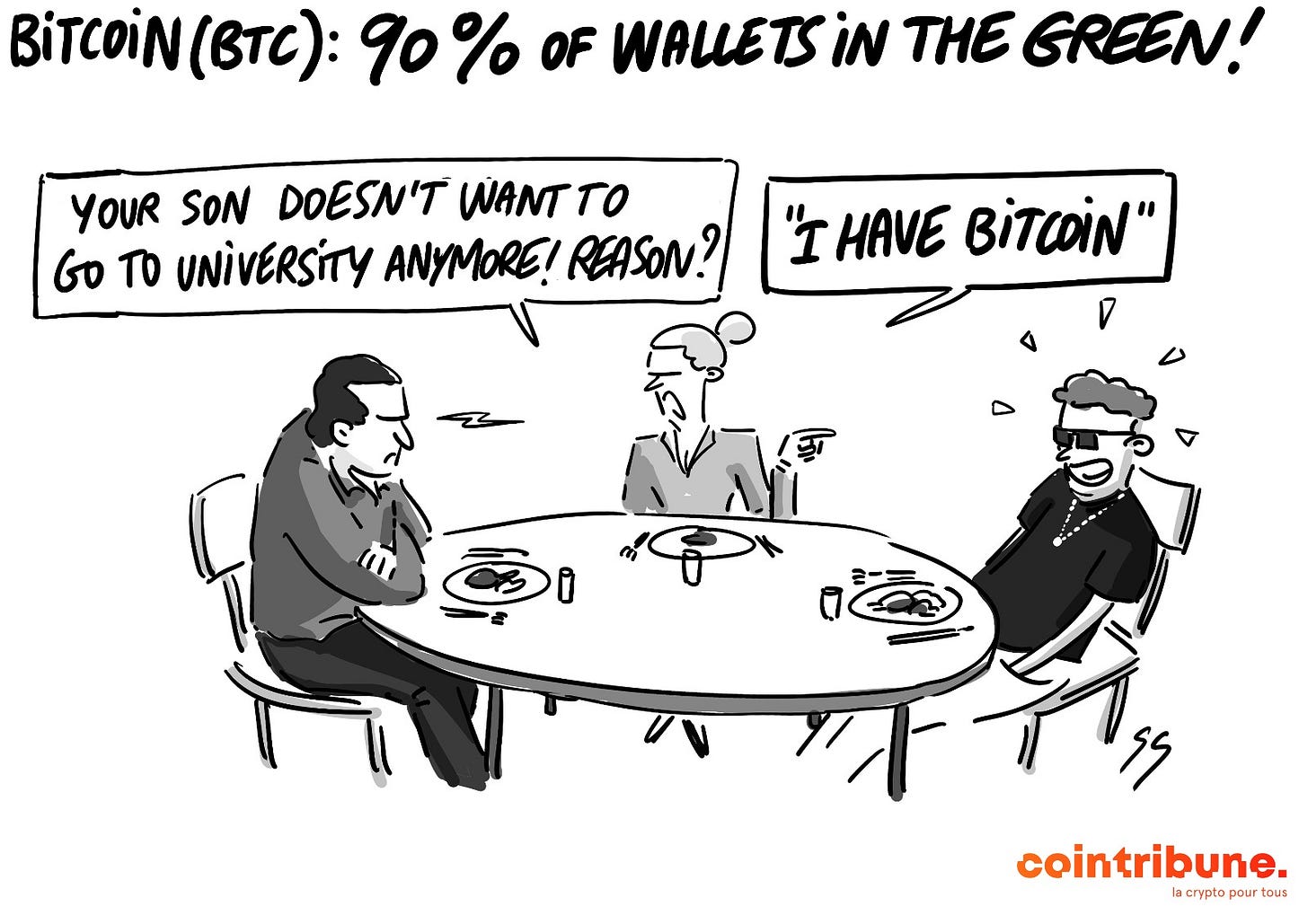

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24-hour crypto summary ! ⏱️

📉 Bitcoin: An unexpected drop!

On January 11, 2024, the launch of the first Bitcoin ETFs in the United States, a historic event for the crypto world, was marked by an unexpected drop in the price of Bitcoin. The initial enthusiasm saw the price of Bitcoin rise above $49,000, nearing the psychological threshold of $50,000, with transaction volumes skyrocketing, especially for the BlackRock ETF. However, this euphoria was short-lived, as the price of Bitcoin dropped below the $46,000 mark in just two hours, erasing a significant portion of the initial gains.

This sudden drop in Bitcoin, despite the promising arrival of ETFs, has sparked various hypotheses among market observers. Some attribute it to profit-taking after the morning rally, others to the conversion of the Grayscale Bitcoin Trust (GBTC) into an ETF, or even to the influx of new entrants such as hedge funds and market makers, accentuating the volatility.

The drop in Bitcoin on the day of the ETF Bitcoin launch is a classic example of the 'buy the rumor, sell the news' dynamic in financial markets. The anticipation of the introduction of Bitcoin ETFs likely led to speculative accumulation, followed by rapid selling once the event was realized.

🚀 Elon Musk and Bitcoin: A potential opening

Elon Musk, in an interview with Cathie Wood on X Space, shared his thoughts on Bitcoin, stating that he is 'open to the idea of using Bitcoin on X'. Although he confirmed holding DOGE and BTC through SpaceX, Musk clarified that he doesn't spend much time thinking about Bitcoin but doesn't rule out the idea of its integration on X. However, he refused to discuss the Bitcoin topic during the exchanges, which sparked mockery from the Bitcoin maximalist community.

Musk's opening to the idea of using Bitcoin on X, despite his usually passive stance on cryptos, indicates a possible future integration of Bitcoin into his "everything app."

Elon Musk's interest in integrating Bitcoin into the X (Twitter) ecosystem is significant, as it represents a potential merger between social media and decentralized finance. This could pave the way for new forms of monetization and engagement on social platforms, while strengthening the legitimacy and practical utility of Bitcoin.

⛽ Vitalik Buterin and the Ethereum gas limit

Vitalik Buterin, co-founder of Ethereum, has proposed increasing the gas limit of the blockchain by 33%, from 30 million to 40 million gas per block. This suggestion, made during an Ask-Me-Anything on Reddit, aims to improve the throughput and capacity of the Ethereum network, which have not changed in nearly 3 years. The current gas limit determines the maximum amount of gas validators are willing to spend to process transactions and smart contracts, ensuring that blocks are not too large and do not slow down the network.

Increasing the gas limit could alleviate pressure on the Ethereum network and provide more space for transactions and smart contracts. However, it would also impose a heavier load on validator hardware and an increased risk of spam and attacks. Buterin clarifies that this measure would be temporary, pending the full deployment of the Ethereum 2.0 update.

The proposed increase in the gas limit on Ethereum by Vitalik Buterin is an attempt to solve the blockchain trilogy dilemma: security, decentralization, and scalability. By increasing the gas limit, Ethereum can process more transactions, but it also increases the load on nodes, potentially threatening decentralization. This proposal illustrates the inherent challenges in optimizing a blockchain network and underscores the importance of finding a balance between different requirements to ensure the longevity and efficiency of the network.

💹 Bitcoin: Majority of wallets in profit

The recent surge in the valuation of Bitcoin has led to a significant increase in the number of profitable Bitcoin wallets, with 90% of these wallets in profit. This rise follows the recent surge in the price of Bitcoin, breaking the $45,000 resistance level and pushing the majority of BTC addresses into profitability.

This increase in Bitcoin profitability is not an isolated phenomenon but rather a recurring trend in crypto bull cycles. However, with sustained profitability of Bitcoin wallets, some holders may consider selling their holdings to capitalize on these gains. This prospect is reinforced by the enthusiasm surrounding Bitcoin's momentum and the potential formation of a golden cross, a technical event that could influence the short-term Bitcoin price.

Despite the current trend, Bitcoin remains a highly volatile asset. Investors need to be aware of the inherent risks and consider Bitcoin as part of a diversified portfolio. Risk management, including understanding cryptocurrency market cycles and external factors influencing prices, is essential.

Crypto of the day: Jito (JTO)

Jito Network stands out in the Solana ecosystem with its liquid staking pool JitoSOL and its Maximum Extractable Value (MEV) products. This innovation is based on optimizing profit opportunities related to the specific order of transaction execution on the blockchain. By creating an open-source validator client, Jito Network aims to establish a competitive market for MEV extraction, thus increasing transparency and fair distribution of profits in the ecosystem.

Utility and Distribution of JTO: JitoSOL allows users to exchange their SOL for JitoSOL, providing sustained liquidity for SOL and DeFi opportunities while generating staking rewards. JitoSOL holders benefit from additional rewards from transaction revenues associated with MEV extraction on Solana. This unique approach adds significant value to JTO holders, enabling them to actively participate in the Solana DeFi ecosystem while enjoying additional income.

Advantages for JTO Holders: JTO holders not only benefit from staking rewards but also from the advantages related to MEV extraction. This includes increased participation in profits generated by algorithmic trading opportunities and arbitrage on the Solana blockchain. Furthermore, involvement in the Jito network offers increased transparency and fair distribution of profits, which is often a challenge in the DeFi space.

Uses of JTO: JTO can be used for staking in the Solana ecosystem, providing users with a method to earn passive rewards while contributing to the security and efficiency of the network. Additionally, as the native token of the Jito network, JTO plays a key role in transactions and interactions within the Jito ecosystem, including activities related to MEV extraction.

Recent performance of Jito (JTO)

Current price: €1.97

Percentage change: 10.63% (1-day increase)

Market capitalization: €230,982,161

CoinMarketCap rank: 179#

Address Poisoning: The other threat to your cryptos 🔒

Address poisoning is a growing threat to cryptocurrency holders. This scam technique targets all cryptocurrency users, including those who use cold wallets. The process begins when a scammer sends a very small amount of a popular cryptocurrency to your blockchain address. This transaction is then recorded in your transaction history, and the scammer ensures that their address closely resembles yours.

The scam relies on the usual address verification by users, who often focus solely on the first and last characters. Digital wallets typically display an abbreviated version of addresses, making deception easier. The scammer hopes that you will mistakenly copy their address from your transaction history when sending funds, resulting in the transfer of your cryptocurrencies to their account.

To protect against address poisoning, it is crucial to meticulously verify all characters of the address before confirming a transaction. Avoid copying addresses from transaction history and instead use the address directory in your wallet for frequently used addresses. For important transactions, consider sending a small test amount first, although this incurs additional fees.

In summary, address poisoning is a cunning tactic that exploits the habits of cryptocurrency users. Increased vigilance and thorough verification are essential to protect against such scams.