The United States announces the sale of Silk Road Bitcoins 💰

Welcome to the Daily tribune Saturday, January 27, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, January 27, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

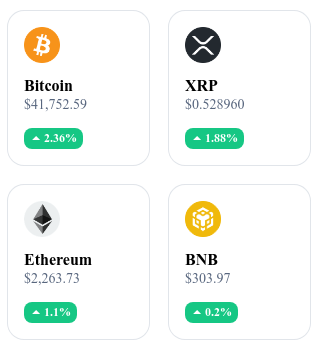

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24-hour crypto summary ! ⏱️

🌐 Bitcoin Halving 2024: Miners facing a crucial turning point

Bitcoin's halving scheduled for March 2024 is a major event for miners as it will halve the reward received for each validated block. According to Cantor Fitzgerald Bank's report, this decrease in revenue could be disastrous for many industry players if not offset by a significant increase in the price of Bitcoin. Currently, the average cost to produce a single Bitcoin is about $8,500, and the reward for validating a block is about to drop to 3.125 BTC. This drastic reduction in revenue, without a corresponding increase in the price of Bitcoin, could lead to a series of bankruptcies in the mining industry.

The report highlights the importance of a substantial increase in the price of Bitcoin before the 2024 halving in order to avoid a collapse of the industry. The long-term viability of the Bitcoin network depends on the survival of a sufficient number of profitable miners. Without a significant price increase, only the most competitive miners may survive this change, making the network more vulnerable to attacks and questioning its decentralized integrity. Miners are therefore in a delicate position.

Historically, halvings have preceded significant price increases, but this time, the global economic context and the evolution of the mining landscape could alter this pattern. Increased mining centralization could emerge and raise questions about network security and resistance to censorship. This halving will be a decisive test for Bitcoin's digital scarcity theory and its perception as a store of value, especially in an environment where alternative cryptocurrencies are gaining popularity and functionality.

📉 Bitcoin: A necessary purge for a rebound?

The price of Bitcoin has dropped by 13% since the SEC's approval of the first Spot ETF earlier this year, and some analysts predict that the worst is yet to come before a possible rebound. According to MAC_D, analyst at CryptoQuant, a Bitcoin capitulation is necessary, involving massive liquidation of leveraged long positions. As of January 2, the Bitcoin hourly funding rate had reached 0.049%, indicating an accumulation of speculative and risky long positions. A purge of these excessive positions through a sharp price decline seems necessary to cleanse the market.

Although a massive capitulation is synonymous with extreme pessimism, it could represent an opportunity for long-term investors. If prices fall sharply and the funding ratio turns negative, this could indicate an excess of pessimism among leveraged traders and provide a good opportunity to buy Bitcoin.

This correction phase could also be the catalyst for wider adoption of cryptocurrencies, as it cleanses the market of speculative investments and attracts more value-oriented investors.

🇺🇸 Uncle Sam and the Silk Road treasure: An unprecedented auction

The U.S. government is *preparing for a spectacular auction of $130 million in bitcoins, seized in the infamous Silk Road scandal. This virtual black market, specialized in money laundering and drug trafficking, has been a dark stain on the history of cryptocurrency. However, the sale of these bitcoins raises ethical and legal questions, particularly regarding the possibility of laundering criminal acts through government auctions.

As bidders prepare to seize this unique opportunity, the Silk Road market on the Dark Web remains a dark stain in the history of crypto. Meanwhile, Senator Elizabeth Warren is launching an offensive against cryptocurrencies, accusing them of enabling rogue nations to bypass sanctions and compromise national security. The U.S. government, particularly with the SEC, is increasing pressure to regulate the use of digital assets in dubious political maneuvers.

The auction of Silk Road bitcoins by the U.S. government is an unprecedented event that establishes a legal and financial framework for the treatment of seized cryptocurrencies. This action could serve as a model for the future management of digital assets seized in criminal cases, influencing the perception of cryptocurrency as a legitimate asset.

🌍 Crypto and AI: A Major Energy and Climate Challenge

The rapid development of cryptocurrency and artificial intelligence (AI) could have a considerable impact on global energy consumption by 2026. According to a report by the International Energy Agency (IEA), services like ChatGPT, which are experiencing exponential growth, are extremely energy-intensive. The report estimates that ChatGPT could consume the equivalent of the annual electricity production of 700,000 U.S. households by 2026, about 10 TWh. At the same time, the cryptocurrency industry, particularly Bitcoin mining, represents significant electricity consumption, estimated at 120 TWh in 2023 and projected to reach 160 TWh by 2026. The combined consumption of these two sectors could exceed 1000 TWh by 2026, equivalent to the consumption of 70 million U.S. households.

Faced with these environmental concerns, efforts are being made to make these sectors more environmentally friendly. After the ban on crypto mining in China for environmental reasons, American mines have started adopting renewable energy sources, with over 50% of Bitcoin mining now using green electricity. However, despite these advances, the industry faces enormous challenges in its energy transition. Innovative solutions are emerging, such as the carbon credit exchange platform launched by the United Arab Emirates at COP28, powered by blockchain. This initiative could accelerate the decarbonization of the sector.

The increase in energy consumption due to crypto and AI represents a major challenge for the industry, but also an opportunity to catalyze innovation in sustainable technologies.

Crypto of the day: Osmosis (OSMO)

Osmosis (OSMO) is an innovative cryptocurrency that stands out in the blockchain ecosystem thanks to its unique nature as a non-transferable token. Launched on the Cosmos blockchain, Osmosis positions itself as a key player in the Cosmos and Injective ecosystems, providing significant added value in terms of modularity and flexibility.

The native crypto OSMO primarily serves as a governance and staking token in the Osmosis ecosystem, allowing holders to participate in important decisions and contribute to the network's security. The initial distribution of OSMO was designed to encourage broad community participation, offering benefits such as staking rewards and influence over the project's evolution.

Recent performance

Current price: $1.54 (about €1.40)

Price change (24h): +4.23%

Market cap: Approx. $760.98 million (about €691.29 million)

Rank on CoinMarketCap: 84th

SBTs and their revolutionary impact on Web3

Soulbound Tokens (SBTs), while not an entirely new concept in the blockchain ecosystem, are gaining importance and practical applications. These distinctive tokens, characterized by their non-transferable nature, bring an innovative dimension to the representation of identities and reputations in the world of Web3. They open up fascinating possibilities for managing digital identities, offering extensive opportunities in decentralized finance (DeFi), DAO governance, and beyond. Let's take a closer look at how SBTs are shaping a more integrated and transparent decentralized society.

What is a Soulbound Token?

Soulbound Tokens (SBTs) are a new class of non-fungible tokens (NFTs) that represent a person or entity's digital identity and reputation. Unlike traditional NFTs, SBTs are non-transferable and permanently linked to a wallet or digital identity called a \"Soul.\" This unique characteristic allows SBTs to serve as verifiable proof of qualifications, experiences, or affiliations.

The potential of SBTs

SBTs provide a foundation for a decentralized society (DeSoc), where communities and individuals interact in a more authentic and transparent manner. In this system, SBTs can represent various aspects of a person's social identity, such as employment history, academic achievements, or affiliations with organizations. This digital representation of social identity opens the door to new forms of collaboration and interaction in the Web3 ecosystem.

Practical applications and implications

SBTs have the potential to transform many areas, ranging from decentralized finance (DeFi) to governance of decentralized autonomous organizations (DAOs). For example, in the field of DeFi, SBTs could enable reputation-based undercollateralized loans. In DAOs, they could be used to allocate voting rights based on reputation rather than the quantity of tokens held. SBTs could also play a key role in combating Sybil attacks by making voting and participation more transparent and identity-based.

In conclusion, Soulbound Tokens represent a significant advancement in the blockchain and Web3 space, offering unprecedented opportunities for the representation of digital identity and the construction of more transparent and equitable social and economic systems.