🕵️ The Verdict is out: Craig Wright is not Satoshi Nakamoto!

Welcome to the Daily Tribune Friday 15th March 2024 ☕️

Hello Cointribe! 🚀

Today is Friday 15th March 2024 and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

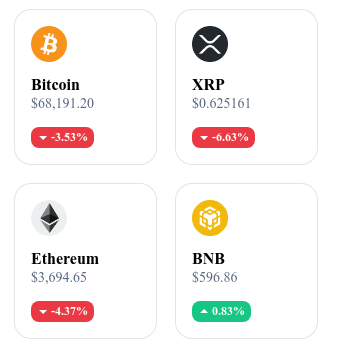

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24-hour crypto summary ! ⏱️

🚗 Dogecoin hits the road with Tesla!

Elon Musk shook the crypto world by announcing that Tesla could soon accept Dogecoin (DOGE) as a means of payment, describing the cryptocurrency as the "people's crypto". This statement led to an immediate 10.40% increase in the value of DOGE. Dogecoin, originally created as a joke, has seen its value and recognition dramatically increase, becoming the 10th largest cryptocurrency with a market capitalization of $23 billion, proof of its popularity and resilience in the market.

Musk's announcement is part of a larger context of DOGE adoption by Tesla, as the company had already accepted DOGE for the purchase of merchandise in January 2022. The integration of Dogecoin as a payment option for Tesla vehicles represents a historic milestone and marks an important step towards widespread acceptance of cryptocurrencies.

The excitement surrounding the potential acceptance of Dogecoin by Tesla goes beyond a mere marketing novelty or a publicity stunt by Elon Musk. It is an indicator of a deeper change in how we perceive value within the digital economy. The adoption by a renowned company could signify the beginning of a new era where the perceived value of tokens, based on community and culture rather than traditional economic fundamentals, becomes a driving force in the real economy.

🌐 Solana & Memecoins: An unprecedented connection!

Asset manager Franklin Templeton has published a study highlighting a surprising connection between Solana and memecoins and a symbiotic relationship between internet culture and decentralized finance. This study highlights BONK, an emblematic memecoin that has illustrated the potential of Solana as a welcoming platform for these unique tokens. The relationship between Solana and memecoins reveals the importance of communities and their influence on the blockchain ecosystem, with nearly half of the crypto wallets associated with memecoins residing on Solana.

The popularity of memecoins, although related to a fleeting trend, plays a significant role in the crypto ecosystem, affecting liquidity and user engagement. However, Franklin Templeton warns against the volatility and lack of intrinsic value of memecoins, while highlighting their contribution to innovation and community participation. This study paves the way for a deeper understanding of the interactions between popular culture and decentralized finance, presenting Solana and memecoins as potential catalysts for change in the crypto world.

The demographic evolution of Bitcoin whales suggests a maturing market, where large holders are becoming more strategic and perhaps more institutionalized. This change reflects a transition from a market of rampant speculation to a more calculated and strategic adoption by institutional investors and family offices. This maturation can lead to greater market stability for Bitcoin, making it more attractive as a long-term asset class for portfolio diversification.

💸 Bitcoin: The $55,000 Bar, an impassable floor according to Novogratz

Mike Novogratz made a bold statement, claiming that Bitcoin will never again fall below $55,000. This prediction is supported by the success of recently launched Bitcoin spot ETFs in the United States, which have attracted over $11 billion in investments, signaling strong interest in Bitcoin. The success of these funds, notably BlackRock's, solidifies Bitcoin's position as a legitimate asset class and reflects a shift in public perception of cryptocurrencies.

The approval of Bitcoin ETFs by US regulators marks a turning point in the acceptance of Bitcoin and suggests an increasing openness towards cryptocurrencies. Novogratz sees in this development a significant vote of confidence that foreshadows increased integration of Bitcoin into the global financial system.

The influx of institutional investors, as indicated by the interest in Bitcoin ETFs, suggests a democratization of crypto assets and their integration into traditional finance. This evolution could lead to greater price stability and reduced volatility, making Bitcoin and other crypto assets more attractive for long-term investors.

⚖️ Verdict is out: Craig Wright is not Satoshi!

The UK High Court of Justice has delivered its verdict: Craig Wright is not Satoshi Nakamoto, the creator of Bitcoin. This decision ends years of speculation and controversies surrounding Satoshi's identity. Judge James Mellor described the evidence presented by Wright as overwhelming, stating that he failed to provide a single reliable document to support his claims. This case also involved the COPA association, representing major players in the industry such as Coinbase and Block, who pursued legal action against Wright for his claims.

The outcome of this trial could have significant implications, not only for Wright's reputation but also for the public perception of Satoshi Nakamoto. The COPA association is considering pursuing criminal charges against Wright for perjury and obstruction of justice, highlighting the importance of transparency and integrity in the crypto community. This judicial decision serves as a reminder to the entire industry of the importance of honesty and could serve as an example to avoid future false claims.

The decision confirms that the identity of Satoshi Nakamoto remains a mystery, preserving a part of Bitcoin's original culture and history. This anonymity contributes to the mythology surrounding Bitcoin and may continue to generate interest and discussions about its origins and fundamental principles.

Crypto of the day: Conflux (CFX)

Conflux (CFX) stands out as a layer 1 public blockchain designed to power decentralized applications (dApps), e-commerce, and Web 3.0 infrastructure by offering a more scalable, decentralized, and secure solution than existing protocols. Conflux's major innovation lies in its Tree-Graph consensus mechanism, which, combined with Proof of Work (PoW) and Proof of Stake (PoS) algorithms, achieves consensus while keeping transaction costs low and avoiding network congestion. This approach makes the transfer of valuable assets both fast and efficient, a crucial feature for widespread adoption and use.

Conflux's native cryptocurrency, CFX, plays a central role in the ecosystem as it financially incentivizes users to participate and engage more in the network. CFX is used to pay transaction fees, participate in network governance, and reward miners for their contribution to network security through staking. For CFX holders, this translates into benefits such as active participation in the network's evolution, influence over governance decisions, and potentially gains through mining and staking.

Recent Performance of Conflux (CFX)

Current price: €0.3474

Percentage increase/decrease: 5.47% (1-day increase)

Market capitalization: €1,453,531,165

Rank on CoinMarketCap: #73

Technical Analysis: Internet Computer (ICP)

The current price action of Internet Computer (ICP) perfectly illustrates the unpredictable nature of cryptocurrencies. Having oscillated from a peak at $16.30 to a low of $10, before stabilizing around $14.5, ICP shows us that the crypto market is inherently an ecosystem where change is the only constant. This volatility is not only a challenge for traders; it is also a source of opportunities for those who can read between the lines of charts and technical analysis.

The resistance encountered after reaching the $16.30 threshold, followed by a decline to $11, indicates a struggle between buying and selling forces, with selling pressure ultimately prevailing. However, the rebound to $14.5 demonstrates some resilience and significant buying interest at lower prices. Maintaining ICP above its 50-day moving average suggests that, despite recent setbacks, the overall trend remains bullish. Investors should closely monitor these indicators to adjust their strategies accordingly.

Examining the liquidation heatmap, we can identify key liquidation zones that loom as real minefields for the ICP price. The identified thresholds around $15 to $16 and support levels at $13 and $10 are crucial. Breaking through them could trigger significant movements, making these areas particularly important for anticipating the next steps in ICP's journey. The ability of the price to stay above $13 is an encouraging sign for the continuation of the bullish trend, with potential targets at $20 and beyond. However, a failure to maintain this level could signal a deeper correction with significant consequences for investment strategy.