The X Account of Mbappé Hacked, Fans Lose Millions of Dollars!

Welcome to the Daily Tribune Friday August 30, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, August 30, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

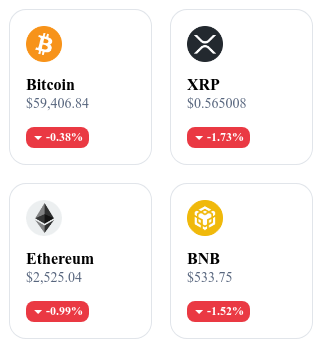

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

📉 Ether ETFs in free fall: 500 million dollars of net outflows

Ether ETFs are going through a tough period, with net outflows reaching 500 million dollars in just five weeks since their launch in the United States. This contrast is all the more striking compared to Bitcoin ETFs, which have attracted over 5 billion dollars over the same period. According to JPMorgan, the "first-mover advantage" of Bitcoin has greatly contributed to capturing the attention of institutional investors, to the detriment of Ether ETFs. Grayscale, a major player in the field, has seen its Ether ETF lose 2.5 billion dollars, well beyond initial forecasts. 🔗Read the full article here.

🚨 Kylian Mbappé hacked: Millions $ lost in a crypto scam

The X account (formerly Twitter) of Kylian Mbappé was hacked on August 29, 2024, causing a massive scam with the creation of a fraudulent cryptocurrency called $MBAPPE. Hackers exploited the popularity of the football player to promote this token, attracting millions of dollars in investments from his subscribers before the value of $MBAPPE collapsed abruptly. Some users have lost colossal sums, such as an investor who spent over a million dollars to see his funds reduced to just $9,200. This incident illustrates the vulnerability of public figures to crypto scams and reminds investors to verify the authenticity of information, even when it comes from seemingly reliable sources. 🔗 Read the full article here.

⚖️ Binance disputes accusations of freezing Palestinian assets

Binance finds itself at the center of controversy following accusations by Ray Youssef, CEO of Noones and CEO of Paxful, claiming that the exchange has frozen funds from Palestinian clients under pressure from Israeli authorities. Richard Teng, CEO of Binance, has strongly rejected these allegations, calling them false and unfounded, stating that Binance has never received directives to freeze Palestinian assets. Since 2021, however, Israel has seized several Binance accounts suspected of financing terrorist groups, highlighting increased risks of holding cryptocurrencies on centralized platforms, particularly in tense geopolitical contexts. The exchanges between Binance and its detractors highlight the challenges of regulation and fund security in the crypto world, and remind of the importance of controlling assets through hardware wallets. 🔗 Read the full article here

🐶 Irony and disillusionment: Dogecoin co-creator makes fun of Bitcoin traders

In the face of Bitcoin's recent decline, Billy Markus, aka Shibetoshi Nakamoto, co-creator of Dogecoin, did not hesitate to express his biting irony on X (formerly Twitter). Following a drop of over 7% in Bitcoin, Markus mocked traders by sarcastically commenting on profit-taking. He also launched a thought-provoking reflection on the relationship between wealth and well-being, triggering a wave of memes and online debates. For Markus, investing in Bitcoin is like "throwing money into a bonfire", a striking image that reflects the frustration shared by many investors in this turbulent market. 🔗 Read the full article here.

Crypto of the day: Conflux (CFX)

Conflux is a unique blockchain that stands out for its Tree-Graph consensus mechanism, combining Proof of Work (PoW) and a Directed Acyclic Graph (DAG) structure, which significantly increases transaction throughput while maintaining security and decentralization. The blockchain provides a solution to scalability problems encountered by other networks, offering an ideal platform for the development of dApps and smart contracts.

The native crypto of Conflux, CFX, is used to pay transaction fees on the network, participate in governance, and reward miners and validators who secure the network. Initially distributed through an ICO and incentives for network participants, it offers holders the opportunity to actively participate in the development of the Conflux ecosystem while generating returns through staking.

Recent performances

Current price: €0.1409

Percentage increase/decrease: +4.97% (increase in 1 day)

Market capitalization: €608,543,792

Rank on CoinMarketCap: #93

💸 Bitcoin: Massive withdrawals in August, investors flee crypto exchanges!

The Bitcoin market is experiencing a wave of record withdrawals, marking a major strategic shift among investors. Since July 2024, massive negative flows have been recorded, with successive outflows of 60,000, 50,000, and 45,000 BTC. These withdrawals reflect a broader trend of asset conservation in private wallets. Investors seem to be opting for a long-term approach, preferring to secure their funds outside of exchange platforms to minimize exposure to market fluctuations. This behavior underscores increased confidence in the long-term potential of Bitcoin, despite an unstable economic and regulatory environment.

However, this bullish trend is taking place in a complicated global context, where regulatory pressure and economic uncertainties are increasing. Increasingly strict regulations and geopolitical crises add layers of complexity to the market, posing challenges for investors. Nevertheless, by reducing the available supply on exchange platforms, these massive withdrawals could contribute to stabilizing prices and mitigating short-term volatility.