⚖️ Tornado Cash Founder Convicted for Illegal Transmission

Welcome to your Daily Briefing for Thursday, August 7, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, August 7, 2025, and as we do every day from Tuesday to Saturday, we bring you a roundup of the top crypto news from the past 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

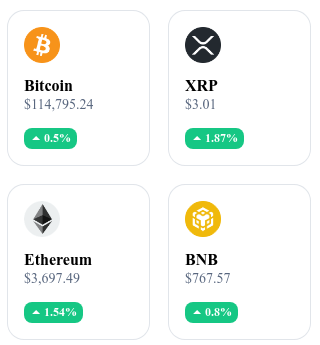

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

⚖️ SEC Issues Warning on Legal Risks of Liquid Staking

The U.S. Securities and Exchange Commission has flagged regulatory concerns over the legal status of staked tokens and the classification of their yield. The agency warned that platforms offering liquid staking services could face legal action for unregistered securities offerings. It urges full compliance with securities laws before launching such products.

👉 Read the full article

🏛 Roman Storm Found Guilty of Money Transmission, Acquitted on Sanctions Charges

Tornado Cash co-founder Roman Storm was convicted for unlicensed money transmission, but the court cleared him of violating international sanctions. The ruling weakens the scope of laws targeting crypto mixers while reaffirming the legal requirement for money service licenses.

❄️ “Glacier” Airdrop Sparks Backlash Among Cardano Users

Many ADA holders claim they did not receive the promised Glacier tokens, triggering frustration across forums and social media. Charles Hoskinson announced an internal investigation to determine the cause of the issue and explore compensation options.

👉 Read the full article

🇺🇸 Trump Threatens Sanctions on Banks That De-bank Crypto Companies

In a letter to the Treasury Secretary, former President Donald Trump warned that banks refusing accounts to crypto-related businesses could face punitive measures. He framed the move as a defense of free market principles and technological innovation.

👉 Read the full article

Crypto of the Day: The Graph (GRT)

🧠What’s the innovation and added value?

The Graph is a decentralized protocol designed for indexing and querying blockchain data. It allows developers to build subgraphs—open APIs that can be queried via GraphQL—making real-time on-chain data easily accessible.

Used by major projects such as Uniswap, Aave, and Decentraland, The Graph functions as a sort of "Google for Web3." Its infrastructure is built on a network of indexers, curators, and delegators, all of whom are rewarded based on their role in maintaining the ecosystem. It's a core technical pillar for data decentralization in dApps.

💰 The GRT Token: Utility and Benefits for Holders

The GRT token is used to compensate indexers, ensure data accuracy, and foster participatory governance. Holders can delegate their tokens to indexers and earn a share of the query fees generated by subgraph activity.

GRT is also required to pay for queries on the network and to incentivize curators to highlight valuable subgraphs. This economic model promotes data decentralization while maintaining a secure and reliable infrastructure.

📊 Recent Performance (August 7, 2025)

Current Price: $0.09273

24h Change: +3.69%

Market Cap: ≈ $966.3 million

CoinMarketCap Rank: #77

Circulating Supply: ≈ 10.42 billion GRT

24h Trading Volume: ≈ $39.6 million

💶 The Digital Euro Won’t Replace Cash: What the ECB Really Plans to Do

As debates around the end of physical cash heat up in political and media circles, the European Central Bank (ECB) has stepped in to clarify its stance: the digital euro is not meant to eliminate cash.

ECB Reassures: Cash Will Remain Available

Amid growing speculation about the imminent disappearance of paper money, the ECB has made it clear: the digital euro will not mark the end of cash. Instead, this new instrument is meant to expand payment options for citizens—not replace existing ones.

The ECB’s position is backed by data: as of 2024, 52% of purchases in eurozone retail outlets are still made in cash. And it’s not just habit—62% of Europeans have expressed a clear desire to keep using physical money.

The ECB describes the digital euro as a kind of "electronic banknote", emphasizing that it will be a digital means of payment backed by the same stability and security as traditional central bank-issued currency. The goal is to guarantee equal access to public money in a landscape increasingly dominated by private payment solutions.

Still in Testing: No Launch or Final Decision Yet

Contrary to some alarmist claims, no official decision has been made to issue a digital euro. The project is still in the preparatory phase. A legal framework is under discussion within the European Union, but nothing has been finalized. The digital euro remains a technical concept under evaluation, not an imminent monetary reform.

Ongoing pilot programs are focused on building an infrastructure that allows offline payments, even without an internet connection. This feature is seen as key to ensuring accessibility and financial inclusion, especially in rural or underserved areas. The ECB has also stressed privacy protection, making clear that the digital euro will not be a surveillance tool.