🚨 Trump accused of wanting to replace the dollar with his own crypto!

Welcome to the Daily Cointribune of Friday, April 04, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, we are Friday, April 04, 2025 and as every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you should not miss!

But first…

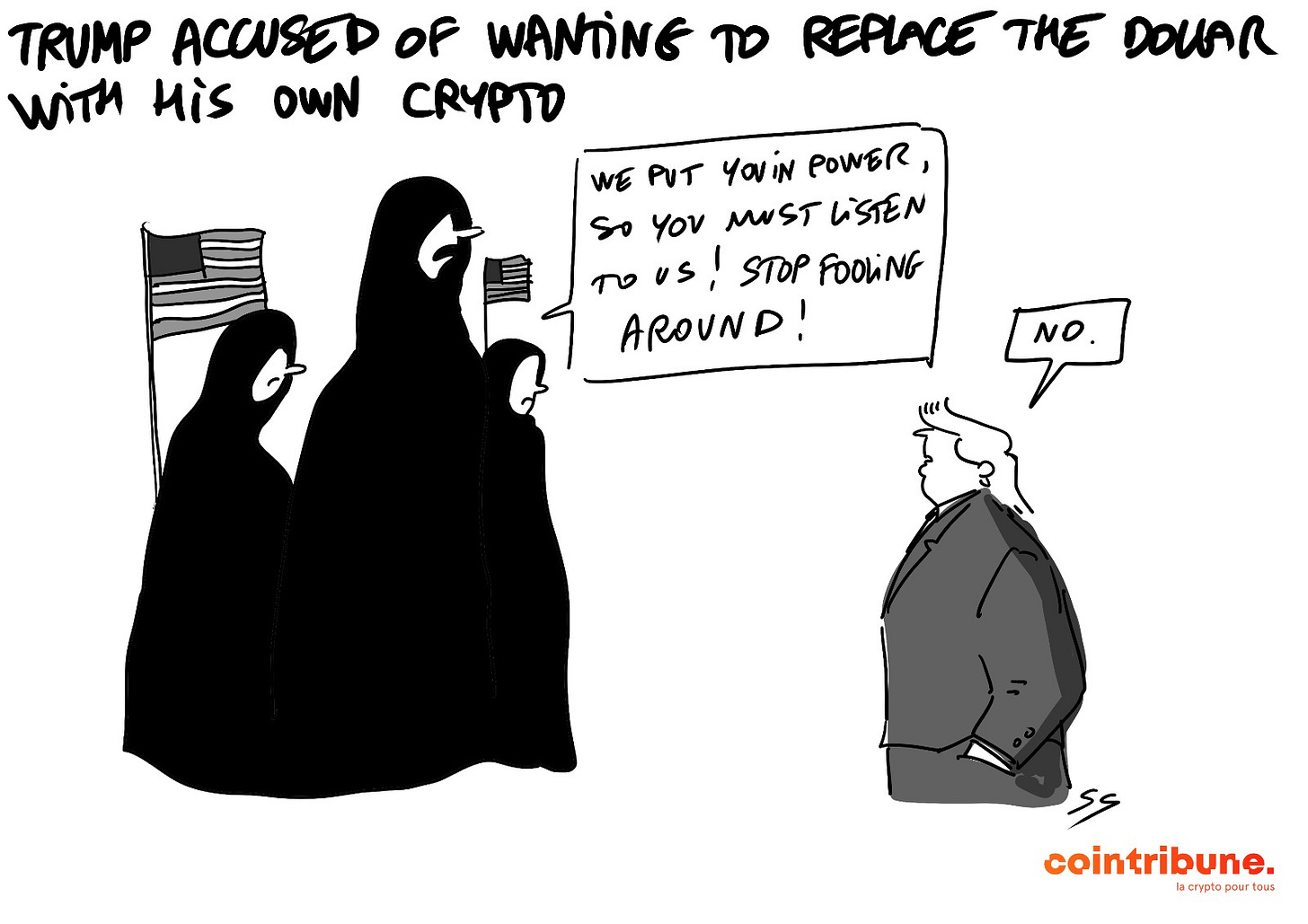

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

Trump accused of wanting to replace the dollar with his own crypto

Maxine Waters accuses Trump of supporting a stablecoin linked to his family to impose a parallel currency in the United States. She denounces a conflict of interest and calls for legal limits to protect monetary sovereignty.

Crypto platforms offer better returns than Nasdaq

CEXs like Binance or Coinbase show an average yield of 80% over six months, compared to 51% for Nasdaq. Despite criticism of listing practices, their performance exceeds that of traditional IPOs.

PayPal expands its crypto offering with Solana and Chainlink

PayPal integrates SOL and LINK into its app for American users. The company drops MoonPay and strengthens its ecosystem around its stablecoin PYUSD.

The price of crypto Pi Network at its lowest as millions of tokens are released

Pi Network drops to $38, victim of the release of 3.9 billion tokens and a lack of transparency. Users accuse the project of manipulation and demand an official listing.

Avalanche (AVAX) ready to outpace Bitcoin? Standard Chartered believes so by 2029

In a bold study, Standard Chartered projects that Avalanche (AVAX) could see a rise of 1,326% by 2029, reaching $250, compared to a "modest" increase of +500% for Bitcoin, forecasted at $500,000. This bet relies on the technological acceleration of the Avalanche network and the growing interest from financial institutions, factors that could make this blockchain an unexpected leader of the next crypto decade.

An ambitious and structured growth trajectory

According to Geoff Kendrick, head of crypto research at Standard Chartered, Avalanche has overperformance potential compared to BTC and ETH thanks to its modular technology and the growing adoption of its App Chains (subnets). Since the Etna update, the cost of creating a layer 1 on Avalanche has significantly decreased, favoring the arrival of new projects.

The bank outlines a very precise growth scenario for AVAX:

2025: $55

2026: $100

2027: $150

2028: $200

2029: $250

In comparison, the historical peak of AVAX in 2021 was around $145, highlighting the ambition of the projection.

An expanding ecosystem, ready for institutional adoption

Standard Chartered's optimism also relies on the potential arrival of an AVAX ETF, currently under review by the US SEC, and backed by Grayscale. The Nasdaq exchange has already filed the application, with Coinbase Custody as the custodian. Acceptance of this structured product could trigger a massive influx of institutional capital.

Moreover, approximately 25% of active layer 1 blockchains are now compatible with Avalanche, indicating real technical adoption. This convergence between technological development and regulatory structuring places Avalanche in a strategic position for the years to come.

Standard Chartered's report sends a strong message: innovation and modularity could prevail over the seniority and current dominance of Bitcoin. If the forecasts were to be confirmed, AVAX could embody the next generation of crypto leaders. It remains to be seen whether technical advances and institutional adoption will be able to maintain this ambitious course by 2029.