📈Trump Appoints a Pro-Bitcoin Advocate to the Fed, BTC Surges!

Welcome to the Daily for Friday, August 8, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, August 8, 2025, and as we do every day from Tuesday to Saturday, here’s a recap of the past 24 hours’ must-read news!

But first…

✍️ Cartoon of the day:

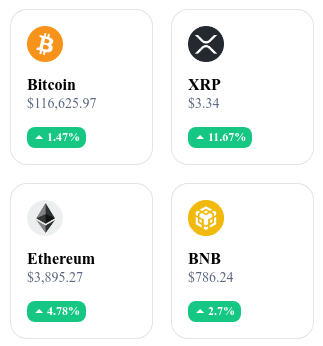

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

⤴️ Bitcoin Tops $116,000 After Trump’s Retirement Decree

BTC surged past $116,000 following a presidential decree on retirement plans seen as favorable to crypto investments. The market is anticipating inflows from savings plans, further fueling bullish momentum.

👉 Read the full article

🏛️ Trump Appoints Stephen Ira Miran to the Fed, Bitcoin Gains

On August 7, 2025, Donald Trump appointed pro-Bitcoin economist Stephen Ira Miran as a Fed governor, with a term running until January 31, 2026. BTC bounced around $116,000, while the market remains focused on inflation and the interest rate path rather than an immediate policy shift.

🐕 Dogecoin: Whales Add 1 Billion DOGE — Reversal Signal?

Major addresses accumulated about 1 billion DOGE over a short period. Traders are watching for a break above key resistance levels to confirm a real trend reversal.

👉 Read the full article

💼 Crypto Salaries Surge and Gain Ground

An increasing number of companies are paying in stablecoins or BTC to reduce cross-border friction. The trend is growing in emerging markets and within distributed teams.

👉 Read the full article

Crypto of the Day: Fetch.ai (FET)

🧠 Innovation and Added Value

Fetch.ai is a blockchain platform integrating artificial intelligence and automation through Autonomous Economic Agents (AEAs). These agents can perform complex tasks such as optimizing transportation, managing supply chains, or automating financial actions — all while interacting securely on a decentralized network.

Built on the Cosmos SDK with CosmWasm smart contracts, Fetch.ai combines multi-chain interoperability, on-chain machine learning, and highly scalable software automation.

💰 The FET Token: Utility and Benefits for Holders

The FET token is used for staking/participating in consensus, paying to deploy or activate autonomous agents, and incentivizing service quality within the ecosystem. Through staking, holders can earn rewards and take part in governance, while agent services create an active economic loop linking utility, security, and community participation.

📊 Real-Time Performance (August 8, 2025)

Current Price: $0.6897 USD

24h Change: +5.18 %

Market Cap: ≈ $1.642 B USD

CoinMarketCap Rank: #60

Circulating Supply: ≈ 2.378 B FET

24h Trading Volume: ≈ $110.5 M USD

XRP Faces a Dual Catalyst: The SEC and the Bitcoin/XRP ETF in Japan

XRP is at a strategic inflection point, driven by a crucial regulatory decision in the United States and growing institutional support in Asia. Between key technical levels and unprecedented initiatives, Ripple’s token could experience a major acceleration if current signals are confirmed.

United States: The Potential Starting Point for XRP’s Takeoff

Currently trading around $3, XRP is in a consolidation phase reflecting the uncertainty surrounding the SEC vs. Ripple case. The immediate focus is on the U.S. regulator’s decision regarding a possible withdrawal of its appeal.

If this withdrawal is confirmed, analysts expect XRP to break through the $3.30 and $3.50 resistance levels, opening the way to an ambitious target of $4.80. Technical indicators provide a favorable backdrop: a neutral RSI that leaves room for upward movement, and a MACD on the verge of a potential bullish crossover.

In this scenario, the $3.50 level serves as a psychological pivot. A clean breakout could trigger enough buying pressure to push prices toward the $4 mark — the first step before the final target.

Asia Takes the Lead with a Bitcoin/XRP ETF and Institutional Adoption

While U.S. investors watch the regulatory landscape, Asia is making bold moves. In Japan, SBI Holdings has filed to launch the country’s first Bitcoin/XRP ETF — a sign of strong confidence in the asset. The announcement includes potential purchases of up to $1 billion worth of XRP to diversify the group’s treasury.

In South Korea, BDACS, a regulated crypto custodian, has added XRP to its services. This integration enables institutions to access the asset via recognized platforms such as Upbit and Coinone, while adhering to local compliance standards. This comes as the country plans to launch spot crypto ETFs in the second half of the year, expanding institutional access to an already dynamic market.

A Rare Alignment of Favorable Factors

The current setup rests on two pillars: potential regulatory relief in the U.S. and significant institutional reinforcement in Asia. This alignment could create a powerful leverage effect on XRP’s value.

If the positive scenario materializes, the $4 and $4.80 thresholds could be reached faster than expected, supported by both encouraging technical indicators and increased institutional demand.