Trump at the Gates of the White House: Bitcoin Explodes to $75,000! 💥

Welcome to the Daily Tribune for Wednesday, November 6, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, November 6, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

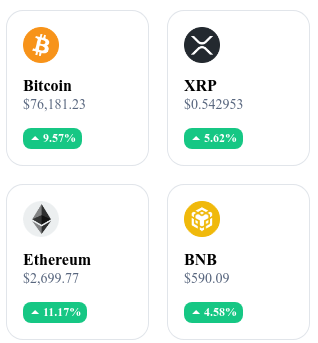

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

Trump Leads the Presidential Race, Bitcoin Hits $75,000 🇺🇸💰

Bitcoin reaches a new record of $75,000, boosted by partial results signaling the imminent victory of Donald Trump in the U.S. presidential election. In 24 hours, BTC soared over 7%, driven by expectations of a leadership perceived as favorable to financial markets and potentially deregulating.

Some experts believe that Trump's promises of deregulation and tax cuts could accelerate crypto adoption, while others see political uncertainty as a factor driving investors towards Bitcoin, often viewed as a safe haven. Although this surge offers new profit opportunities, analysts remind that the crypto market remains volatile, and sharp corrections are always possible. Is the $100,000 threshold within reach?

Binance Challenges the SEC with a New Court Motion ⚖️

Binance and its former CEO, Changpeng Zhao (CZ), reacted to the SEC's accusations by filing a motion on November 4, 2024, to dismiss the agency's amended complaint. The SEC accuses Binance of violating securities laws by involving several additional tokens, including Axie Infinity Shards (AXS), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), and Decentraland (MANA).

Binance's lawyers dispute the "securities" label placed on these assets and criticize the SEC for not clarifying the rules governing digital assets, leaving the industry in legal uncertainty. They also argue that secondary transactions should not be considered securities investments, an argument previously upheld by the courts in this case. This new legal battle is closely watched by the entire crypto industry, which hopes for a favorable decision for Binance that could redefine cryptocurrency regulation in the United States.

Bitcoin Crosses the 100 Trillion Difficulty Threshold! 🚀

The mining difficulty of Bitcoin has just reached a historic record by surpassing 100 trillion, a sign of the increasing complexity of the network and the raw power deployed by miners. This 6.2% increase occurs as the hash rate, an indicator of network security and activity, reaches an unprecedented level of 750 exahashes per second. This technological feat requires massive investments in infrastructure from miners, gradually excluding the less powerful players.

Following the last halving, which reduced the reward to 3.125 BTC per block, miners have to deal with reduced margins and increased energy costs, pushing smaller miners out of the sector. Competition is intensifying among institutional miners, particularly American ones, who dominate through their industrial operations and adaptability. This phase, marked by ultra-concentration, is transforming the mining landscape, where only the most robust and diversified players will be able to keep pace in this increasingly competitive sector.

Hamster Kombat Loses 86% of Its Users 🎮

Hamster Kombat, a crypto game launched on Telegram with a tap-to-earn model, is facing massive disengagement with a loss of 86% of its users since its peak in August. Although it captivated up to 300 million registered users, the game now only has 41 million active users, due to the monotony of its gameplay and unappealing AI-generated graphics.

Players, already tired, have been even more dissatisfied with the management of the HMSTR token airdrop, marked by rigid controls and the disqualification of 2.3 million accounts, causing a wave of frustration. Furthermore, international controversies, including accusations of social distraction in Iran and possible scam allegations in Russia, have heightened distrust around Hamster Kombat. The value of the HMSTR token has plummeted by 55% since October, jeopardizing the future of this crypto platform, which is now losing credibility.

Crypto of the Day: Bittensor (TAO)

Bittensor innovates in blockchain by integrating decentralized artificial intelligence technologies, enabling large-scale collaboration among neural networks. This infrastructure values the contributions of participants who provide computing power for machine learning, reinforcing decentralization and autonomy in the AI field.

The native crypto, TAO, is essential for rewarding participants and was initially distributed through a proof-of-work mechanism specific to the ecosystem. TAO holders benefit from advantages by earning rewards for their contributions to the network, notably by staking their crypto to receive shares of the generated resources. TAO can be used to interact with the network, participate in decisions, and optimize distributed machine learning.

Recent Performance

Current Price: €522.13

24h Change: +20.60%

Market Cap: €3.85 billion

Rank on CoinMarketCap: 25

Technical Analysis of the Day: Ethereum (ETH)

Bitcoin has reached a new all-time high, also boosting Ethereum towards renewed buyer interest despite a recent downward trend. Ethereum recorded a consolidation around $2,600, bouncing off support at $2,400 to form a double-bottom pattern, typically indicating bullish potential. Technical analysis shows oscillator support and ETH stabilizing above its 50-day moving average, although the underlying trend remains cautious.

In the derivatives markets, open interest and positive funding rates on ETH perpetual contracts show buying-oriented interest, although critical liquidation zones remain between $2,250 and $2,800. A progression towards $2,800, or even $3,000, could materialize if Ethereum stays above $2,400, but a pullback to lower support levels remains possible in case of renewed weakness.

🔗 Read the full analysis here.