🤯 Trump finally finds interest in Bitcoin: Change of direction or electoral strategy?

Welcome to the Daily Tribune Saturday, February 24, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, February 24, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

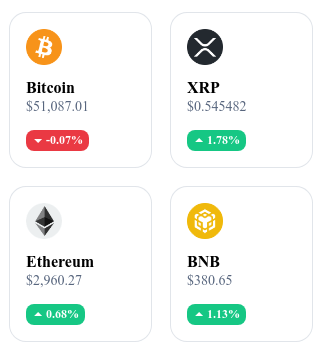

A quick look at the market…

🌡️ Temperature:

Partially sunny 🌤️

24-hour crypto summary ! ⏱️

🚀 Bitcoin and DeFi: Pantera Capital has big plans with 500 billion dollars

Decentralized Finance (DeFi) on Bitcoin could experience a major revolution, according to Pantera Capital, an investment fund specialized in cryptocurrencies. Until now dominated by Ethereum, the DeFi sector could see Bitcoin establish itself as a major player thanks to its reputation, massive adoption, and proven security. Pantera Capital estimates that Bitcoin could unlock a 500 billion dollar market opportunity in DeFi, by offering decentralized financial services based on its blockchain.

However, Bitcoin's blockchain presents challenges in terms of flexibility and programmability compared to Ethereum, which limits the possibilities of creating diverse DeFi applications. To overcome these obstacles, Bitcoin will have to rely on technical solutions such as sidechains, layer-two protocols, and synthetic tokens. Despite these challenges, the potential growth of Bitcoin in DeFi is closely followed.

Pantera Capital's enthusiasm for Bitcoin's potential in DeFi is not limited to a simple value prediction; it suggests a fundamental reevaluation of decentralized financial infrastructure. By identifying Bitcoin as a potential pivot for DeFi, Pantera highlights a possible transition towards increased security and liquidity in the DeFi space. However, this vision requires substantial technical evolution of Bitcoin to compete with Ethereum's flexibility. The success of this transition could not only significantly expand the DeFi market but also challenge Ethereum's primacy as the platform of choice for decentralized financial applications.

🐳 Ethereum: A whale makes waves with a massive investment

An Ethereum whale recently acquired $187 million worth of ETH, causing a stir. This massive acquisition, made in just three days, underlines the investor's confidence in Ethereum's growth potential. With a total estimated portfolio of $334 million, this whale demonstrates strong conviction in Ethereum's future, despite market fluctuations.

This buying activity coincides with a period of dynamism for the ether, which has seen its value increase significantly. Although the price of ether has recently retreated slightly, the community remains optimistic about its potential for appreciation. Experts like Michaël van de Poppe predict that the price of ether could reach between $3,800 and $4,500, surpassing its previous all-time high.

This massive purchase of Ether may reflect a strategic anticipation of Ethereum's future developments, such as the Ethereum 2.0 upgrade, which promises to improve scalability and efficiency.

🌐 Donald Trump warms up to Bitcoin ahead of 2024

Donald Trump, the 2024 US presidential candidate, is changing his position on Bitcoin, shifting from severe criticism to cautious acceptance. In a recent interview on Fox News, Trump acknowledged the growing use of Bitcoin, although he remains a staunch supporter of the US dollar. This change in his discourse seems to be a strategy to attract young and technophile voters, while maintaining support for the dollar as the global reserve currency.

Trump also emphasizes the need for regulation in the cryptocurrency market, although he remains vague on the details. This more nuanced position on Bitcoin and cryptocurrencies in general could reflect an adaptation to current economic realities and the expectations of a portion of the electorate, while remaining faithful to his vision of dollar supremacy.

Trump's softening position on Bitcoin could be interpreted as a political calculation rather than a true acceptance of cryptocurrencies. This maneuver suggests recognition of the growing influence of the crypto economy on American voters, especially the young and technophiles.

💼 Reddit bets on Bitcoin and Ethereum ahead of its IPO

Reddit has recently made a bold investment decision by allocating a significant portion of its cash reserves to Bitcoin and Ethereum, ahead of its planned IPO at the end of February 2024. This investment reflects the company's long-standing decentralized vision and its desire to break free from the control of web giants and traditional finance.

Reddit fully embraces this risky bet, preferring audacity and disruption over the usual prudence of listed companies. This investment is deeply rooted in Reddit's libertarian DNA, guided by convictions rather than financial conformity. With this commitment to Bitcoin and Ethereum, Reddit positions itself as a pioneer in the convergence between blockchain and social networks, aiming for a more democratic and community-oriented future.

By choosing two of the most volatile assets in the market, Reddit sends a strong signal to the crypto community and demonstrates its confidence in the long-term potential of blockchain and digital currencies.

Crypto of the day: Uniswap (UNI)

Uniswap, powered by its native crypto UNI, represents a major breakthrough in the world of decentralized finance (DeFi). As an Automated Market Maker (AMM) protocol on the Ethereum blockchain, Uniswap facilitates cryptocurrency exchanges without requiring a traditional order book, thereby reducing costs and entry barriers for users. Uniswap's added value lies in its ability to provide decentralized liquidity, allowing anyone to provide funds to liquidity pools and earn transaction fees in return.

The native crypto UNI was introduced to strengthen the decentralized governance of the protocol. UNI holders can vote on key proposals affecting the future of the protocol, including protocol updates and the use of treasury funds. UNI was initially distributed through an airdrop to existing protocol users, promoting fair distribution and engaging the community from the beginning. For holders, UNI offers not only voting rights but also a stake in one of the most influential DeFi protocols, with potential for value appreciation as the ecosystem expands. UNI can be used for governance, staking, and as an investment or speculative asset in the cryptocurrency market.

Recent performance of Uniswap (UNI)

Current price: Approximately $12.15

Percentage increase/decrease: UNI has experienced an impressive 71.04% increase in the last 24 hours.

Market capitalization: The current market capitalization is approximately $7.27 billion (approximately €6.76 billion).

Rank on CoinMarketCap: UNI is currently ranked 16th on CoinMarketCap.

Open Interest in Crypto Futures: A Market Barometer

Open Interest plays a crucial role in futures market analysis. It represents the total number of active futures contracts, providing insights into crypto market liquidity and sentiment.

The essence of Open Interest in crypto futures

In the crypto futures market, Open Interest measures the total number of contracts that have not yet been closed. Unlike trading volume, which captures daily transactional activity, Open Interest provides a perspective on the depth and sustainability of investor engagement in the market. An increase in Open Interest indicates an influx of capital and increased interest in crypto, potentially signaling significant price movements on the horizon.

Deciphering Open Interest signals

Open Interest offers valuable insights into the potential direction of the cryptocurrency market. A correlation between an increase in Open Interest and a rise in prices can signal sustained bullishness, while an increase in Open Interest accompanied by price declines suggests persistent selling pressure. These dynamics help traders anticipate trends and adjust their strategies accordingly.

While Open Interest and trading volume are both vital for understanding market liquidity and activity, they serve distinct analytical functions. Trading volume reflects immediate activity, while Open Interest reveals the level of long-term commitment from market participants, providing an overview of the health and stability of the crypto futures market.

In conclusion

Open Interest is essential for navigating the crypto futures market because it offers unique insights into market sentiment, liquidity, and potential trends. By combining Open Interest analysis with other technical indicators, traders can fine-tune their strategies and make informed decisions in the volatile cryptocurrency ecosystem. However, it is wise to recognize the limitations of Open Interest as a standalone indicator and use it in conjunction with comprehensive market analysis for a deep understanding of crypto dynamics.