💣 Trump makes the markets tremble, cryptos and tech stocks dive

Welcome to the Daily Tribune of Thursday, April 3, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, April 3, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

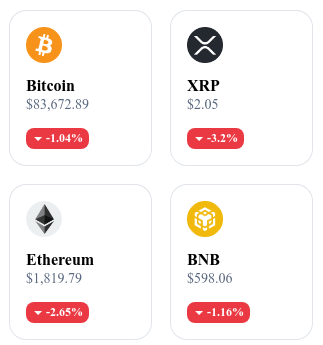

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

Trump causes markets to fall with his new customs tariffs

Trump announces a wave of tariffs on imports, including 25% on foreign cars. Stock markets immediately retreat, with marked losses in tech.

Ethereum surpasses Solana and becomes number 1 in DEX trading

Ethereum reaches 63 billion in DEX volume in March, compared to 51 billion for Solana. The decline of Pump.fun and the strength of Uniswap explain this return to the top.

Elon Musk defends the privacy of Coinbase users

Elon Musk takes the Supreme Court against the IRS practices regarding crypto clients' data. He denounces a violation of the right to privacy.

GameStop prepares a massive Bitcoin purchase after raising 1.5 billion

GameStop is about to add Bitcoin to its balance sheet after a record fundraising. Markets remain skeptical despite this bold strategy.

The crypto of the day: Ethena (ENA)

Ethena is a decentralized finance (DeFi) protocol built on the Ethereum blockchain, aiming to provide a crypto-native monetary solution independent of traditional banking infrastructures. Its flagship product, the USDe, is a synthetic dollar designed to be stable, scalable, and resistant to censorship. Ethena employs a delta hedging strategy to manage the volatility of the underlying crypto assets, ensuring the stability of the USDe's value relative to the US dollar.

The native token of Ethena, ENA, plays a central role in the protocol's governance. ENA token holders can participate in decisions concerning the evolution of the protocol, including voting on proposals related to risk management, the composition of USDe collateral, and potential partnerships. Additionally, ENA is used in various incentive mechanisms within the platform, including staking rewards and liquidity provision.

Recent performance:

Current price: $0.3232 USD

24-hour change: -8.64 %

Market capitalization: approximately $1.7 billion

Rank on CoinMarketCap: #49

Towards a low point before June? The markets under pressure

The cryptocurrency market faces an increased risk of correction in the coming weeks. According to data from Nansen, there is a 70% chance that cryptos will hit their lowest point by June 2025. The cause: the uncertain economic policy of the FED, the trade tensions provoked by Donald Trump, and the technical fragility of major digital assets. However, an unexpected factor could reverse the trend.

An impending macroeconomic and technical storm

The alert is first based on Donald Trump's protectionist decisions, including the introduction of aggressive tariffs intended to reduce the trade deficit. These measures have immediately caused a massive capital withdrawal, with an estimated loss of $130 billion in the crypto market within a few days. At the same time, American stock indices and the price of Bitcoin have failed to sustainably breach their 200-day moving averages, indicating a loss of technical momentum.

Nansen's analysis also emphasizes the importance of the upcoming economic indicators (employment, ISM, FED decisions) that could accelerate the retreat. The market remains in an unstable position, where the slightest bad news could lead to a deeper decline.

Whale accumulation: A glimmer of hope or a false signal?

One element, however, nuances this scenario: the movements of Bitcoin whales, those investors holding between 1,000 and 10,000 BTC. Since early 2025, these major players have been quietly accumulating, a behavior similar to that observed before the major bullish rally of 2020.

If this pattern repeats, June could mark an inflection point, where the market touches its low before moving upward again. A rebound in BTC could then act as a trigger for a broader recovery, bringing altcoins along with it, with a return of investor confidence.

The crypto market is walking a tightrope, between strong macroeconomic risks and internal bullish signals. If external pressures persist, a collapse is conceivable in the short term. But if the whales are correct, a new growth phase could start as early as summer. Caution is therefore warranted, but the worst may not be inevitable.