📉 Trump triggers a storm: $19 billion in positions liquidated

Welcome to the Daily for Saturday, October 11, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, October 11, 2025, and as every day from Tuesday to Saturday, here’s your recap of the last 24 hours of news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

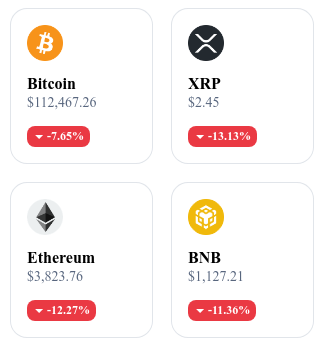

A quick look at the market…

🌡 Weather:

🌧️ Stormy

24h crypto recap! ⏱

🏦 Morgan Stanley opens its crypto funds to all investors

Morgan Stanley announced that all its clients — including those with individual retirement accounts (IRAs) and 401(k)s — will be able to invest in crypto funds. The first available options will be Bitcoin ETFs managed by BlackRock and Fidelity, with allocations governed by automated systems.

👉 Read the full article

⚠️ CZ targeted by state-backed hackers

The Google account of Binance CEO Changpeng Zhao was targeted by hackers linked to North Korea, notably the Lazarus Group. Since early 2024, these actors have stolen over $1.34 billion in cryptocurrencies.

👉 Read the full article

🏦 Global banks unite to launch their own stablecoin

Several major international banks — including ING, UniCredit, and Santander — have announced a joint project to issue a stablecoin backed by fiat currencies. The initiative aims to facilitate cross-border payments, secure interbank transactions, and provide a regulated alternative to existing private stablecoins.

👉 Read the full article

💻 Nvidia hits $468 billion market cap amid AI demand and global expansion

Nvidia’s market capitalization has reached $468 billion, driven by surging demand for AI chips and its expanding global operations. Quarterly revenue exceeded $12 billion, reflecting sustained growth in both data centers and AI applications for consumers and enterprises.

👉 Read the full article

Crypto of the Day: Immutable X (IMX)

Innovation and Added Value 🧠

Immutable X is a Layer-2 solution built on Ethereum, designed to deliver a fast, scalable, and gas-free NFT trading experience. Using zk-rollup technology, Immutable X can process over 9,000 transactions per second while maintaining Ethereum’s security and decentralization.

The platform is especially suited for Web3 games and NFT applications, offering development tools such as SDKs for Unity, Unreal, and JavaScript, as well as a global order book for maximum liquidity.

The Token 💰

IMX is the native token of the Immutable X network. It is used to pay transaction fees, for staking, and for governance. Holders of IMX can participate in transaction validation and in key decisions regarding the protocol’s evolution.

With a maximum supply of 2 billion tokens, and about 1.96 billion currently in circulation, the token follows a deflationary model, with a portion of protocol-generated fees being burned.

Real-Time Performance 📊

💵 Current Price: $0.5041

📉 24h Change: −27.77 %

💰 Market Cap: $991,482,552

🏅 Rank on CoinMarketCap: #73

🪙 Circulating Supply: 1,964,455,311 IMX

📊 24h Trading Volume: $130,675,085

Crypto: A Flash Crash Wipes Out $19 Billion in 24 Hours

Panic has swept through the crypto markets. In a single day, more than $19 billion worth of positions were liquidated, wiping out overexposed investors’ hopes. This rare and violent movement, triggered by a major geopolitical announcement, raises questions about the systemic fragility of crypto markets, their interconnection with macroeconomic factors, and the excesses of leveraged trading.

A shock driven by geopolitics and leverage

The trigger came from the political arena. U.S. President Donald Trump announced his intention to impose a 100% tariff on all Chinese imports starting November 1st. The declaration, seen as a direct threat to global supply chains, immediately dented market confidence. On the crypto front, the reaction was swift: Bitcoin fell from $125,000 to $112,000, while Ethereum lost over 12% during the same period.

Meanwhile, the temporary unavailability of certain U.S. economic indicators—caused by the partial government shutdown—further deepened uncertainty. This combination of macroeconomic elements acted as a catalyst, amplified by crypto derivatives. Data from CoinGlass revealed that 1,618,240 accounts were liquidated within 24 hours, totaling $19.13 billion, with $16.7 billion coming from long positions.

This figure illustrates the destructive power of leverage, widely used in perpetual contracts. When markets reverse abruptly, margin calls trigger cascades of forced sales, accelerating the decline. In such a sentiment-sensitive environment, structural fragility becomes a driver of uncontrollable volatility.

Resilience or warning sign?

Beyond the immediate shock, the question of market resilience remains open. For some observers, this purge could be a healthy correction. Former BitMEX CEO Arthur Hayes, for example, remains decidedly optimistic: “A crash is no longer possible for Bitcoin,” he said, betting on the market’s growing maturity.

However, this view is controversial. The mechanism of mass liquidations shows that the market remains vulnerable to external shocks, especially when they involve major economies. Overleveraged long positions reflect excessive risk-taking, poorly aligned with the current geopolitical instability.

Moreover, the risk of contagion to other asset classes cannot be ruled out. While crypto still functions largely as a parallel market, certain segments — particularly stablecoins, crypto ETFs, or publicly traded companies with crypto exposure — could become channels of propagation in the event of repeated systemic shocks.

For seasoned investors, this phase of turbulence might also represent an opportunity window — provided they master risk, understand the underlying dynamics, and diversify effectively. In this case, chaos becomes the raw material for building tomorrow’s strategies.