🏛️Trump wants to sign the GENIUS Act… as soon as possible

Welcome to the Daily tribune of Friday, June 20, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, June 20, 2025 and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

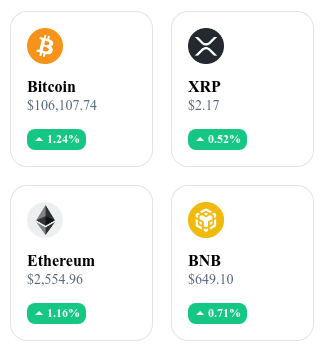

A quick look at the market…

🌡️ Temperature:

☀️ Sunny

24h crypto recap! ⏱

👪 CZ wants a "will function" on Binance

Changpeng Zhao proposes adding a testamentary function on Binance, allowing to designate a beneficiary and activate the transfer after death or prolonged inactivity, to secure unrecoverable digital assets.

⛏️ Bitcoin: scarcity sets in block after block

Each day, 566 BTC become inactive for more than ten years, while only 450 BTC are created, bringing to 3.4 million the total dormant BTC (17% of the total supply).

💵 Schiff rejects the idea of strengthening the dollar through stablecoins

Peter Schiff criticizes the idea that stablecoins will strengthen the dollar. He states they will essentially remain trading tools without interest and vulnerable to budget deficit.

🏛️ Trump urges the House to quickly adopt the GENIUS Act

Donald Trump urges the House of Representatives to adopt the GENIUS Act on stablecoins "ultra fast, very fast," just hours after its approval in the Senate (68 votes for, 30 against).

Crypto of the day: PancakeSwap (CAKE)

🛠️ Technology & Innovation

PancakeSwap is the main decentralized exchange (DEX) of the Binance Smart Chain ecosystem (and broadly multichain), using an AMM (Automated Market Maker) model. Its strength: providing fast and low-cost swaps while enabling staking, yield farming, and the creation of NFTs.

With more than 2.3 billion dollars locked, its platform rivals Uniswap thanks to a smooth user experience and minimal fees.

💰 Token CAKE – Utility & Governance

The CAKE token is the heart of PancakeSwap’s economy. It offers several innovative features:

Rewards: stakers receive CAKE as compensation for their participation (farming, staking).

Governance: holders propose and vote on protocol adjustments or community initiatives.

Deflation by burn: thanks to a buyback-and-burn system, PancakeSwap aims to gradually reduce the total supply of CAKE.

📊 Market data (as of June 20, 2025)

Current price: ≈ 2.24 $ USD

24h change (CoinGecko widget): +2.10%

Market capitalization: ≈ 719.8 M$ USD

CoinMarketCap rank: #88

Circulating supply: 321,250,280 CAKE

24h trading volume: ≈ 45.6 M$ USD

Ethereum overtakes Bitcoin in derivatives markets: a strong signal from investors?

While volatility shakes the crypto markets, Ethereum surprises by temporarily taking the lead over Bitcoin in the strategic derivatives product segment. A revealing development of new dynamics, where investor confidence remains steady despite market shocks.

Ethereum takes the upper hand over Bitcoin in derivatives volumes

For the first time in months, Ethereum has surpassed Bitcoin in market shares on derivatives products. According to aggregated data by CoinGlass, ETH now represents 34% of derivatives market volume, compared to 32% for BTC. This reversal occurred amid strong volatility, where a disengagement from risky positions might have been expected.

On the contrary, open positions remained stable, demonstrating sustained investor commitment, both institutional and retail. This shift could reflect a new perception of Ethereum as a strategic asset, boosted by expectations around the forthcoming launch of ETH-based ETFs.

Investor confidence remains intact despite volatility

Another notable element: liquidations remained moderate despite persistent price instability. A figure suggesting a high level of market actor confidence. Rather than succumbing to panic, investors seem to maintain their positions, adjusting their strategies without haste.

This behavior contrasts with previous turbulence episodes, where massive liquidations dominated the order books. The market’s apparent serenity is explained by positive anticipation of regulatory developments and upcoming financial products, notably the potential approval of a spot ETF on Ethereum. This catalyst could reshape institutional flows and sustainably strengthen ETH’s place in derivatives markets.

This rebalancing between Ethereum and Bitcoin reflects a possible evolution of investment preferences and strategies within a maturing ecosystem. If this trend confirms, it could signal a reconfiguration of the balance of power between the two historic pillars of the crypto market.