🍽️ Trump's Crypto Dinner Turns into a Fiasco

Welcome to the Daily Tribune for Tuesday, May 27, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, May 27, 2025, and as every day from Tuesday to Saturday, we summarize for you the last 24 hours' news you shouldn't have missed!

But first…

✍️ Cartoon of the day:

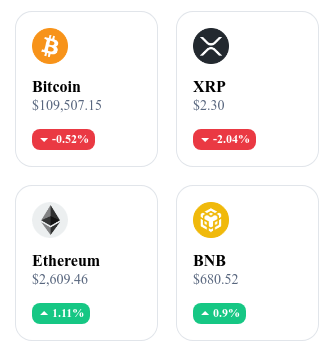

A quick look at the market…

🌡️ Temperature:

🌤️ Partly sunny

24h crypto recap! ⏱

🇺🇸 Trump's crypto dinner turns into a nightmare

On May 22, 2025, Donald Trump hosted an exclusive dinner at his Washington D.C. golf club for the main investors of his memecoin $TRUMP. The event brought together more than 200 investors who collectively spent 394 million dollars on the token issued by entities linked to Trump. The 25 largest holders were invited to a private reception. However, the dinner was marked by criticism, booing, and accusations of political corruption.

💸 Elon Musk confirms the imminent launch of X Money

Elon Musk announced yesterday the imminent launch of X Money, an integrated financial platform aimed at combining payments, banking services, and other financial features within a single application. The service will start in beta version with enhanced security for users' savings. Regulation remains a challenge, notably for obtaining the necessary licenses in all states.

📈 Michael Saylor announces a new massive Bitcoin purchase

Michael Saylor, CEO of MicroStrategy, announced a new massive Bitcoin purchase, strengthening the company's dominant position in the cryptocurrency market. He also expects Bitcoin's capitalization to reach 200 trillion dollars, surpassing the value of all global financial assets combined.

🔒 Crackdown on a criminal network targeting crypto entrepreneurs in France

Yesterday, May 26, 2025, the French judicial police conducted a major operation, arresting more than a dozen suspects involved in two kidnapping cases targeting entrepreneurs in the cryptocurrency sector. These arrests highlight an unprecedented wave of violence shaking the French crypto ecosystem.

The crypto of the day: Stacks (STX)

🧠 Technology and innovation

Stacks is a layer 1 blockchain designed to bring smart contract and decentralized application (dApp) functionalities to Bitcoin. Unlike Ethereum, Bitcoin was not designed to support complex smart contracts. Stacks fills this gap by enabling the development of secure dApps anchored in the robustness of the Bitcoin network.

The platform uses a unique consensus mechanism called Proof of Transfer (PoX), which links Bitcoin's security to that of Stacks. Developers can thus create decentralized applications that benefit from Bitcoin's security and stability, while leveraging the advanced features offered by Stacks.

💰 The STX token

The STX is the native token of the Stacks network. It is used for:

Staking: holders can lock their STX to support the network and earn rewards in BTC.

Payment of transaction fees: STX are used to pay fees associated with transactions and smart contract execution on the network.

Participation in governance: STX holders can influence decisions regarding the protocol's evolution.

The initial distribution of STX was structured to support the ecosystem, with allocations for developers, investors, and the community.

📊 Market data (as of May 27, 2025)

Current price: 1.45 USD

24-hour change: +0.05 USD (+3.57%)

Market capitalization: approximately 2.1 billion dollars

Rank on CoinMarketCap: #65

Circulating supply: 1.45 billion STX

24-hour trading volume: approximately 50 million dollars

Is XRP abandoned by institutions? Solana and Cardano on the rise

As the crypto market regains some appetite for risk, a silent but significant redistribution is happening within institutional portfolios. XRP, long presented as a regulated payment alternative, is losing its place in inflows. Meanwhile, Solana (SOL) and Cardano (ADA) are capturing a growing share of the attention of major investors.

XRP: Worrying capital outflows

According to recent data, XRP recorded capital outflows of 37.2 million dollars last week and 28.6 million dollars since the beginning of the month. Although annual inflows remain positive at 226 million dollars, this trend suggests a loss of confidence by institutions in XRP. Persistent regulatory uncertainties, notably disputes with the SEC, as well as a lack of clarity on Ripple's roadmap, contribute to this situation. Investors seem to be turning toward assets offering better visibility and stronger growth prospects.

Solana and Cardano: attractive alternatives

In contrast, Solana and Cardano benefit from renewed institutional interest. Solana attracted 4.3 million dollars in weekly inflows, while Cardano also posts positive flows. Solana's performance is supported by strategic partnerships, notably with major financial institutions via the Solana Foundation and the company R3, aiming to integrate the Solana blockchain into their operations. Cardano, for its part, appeals with its rigorous academic approach and clear roadmap, strengthening investor confidence.

The reallocation of institutional investments from XRP to assets like Solana and Cardano highlights the importance of regulatory clarity, technological innovation, and performance in investment decisions. For XRP, it is imperative to restore confidence by clarifying its regulatory position and strengthening its value proposition. Conversely, Solana and Cardano appear well positioned to capitalize on this dynamic and consolidate their place in institutional portfolios.