🚖Uber considers adopting cryptos as means of payment

Welcome to the Daily Tribune of Saturday, June 7, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, June 7, 2025 and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you couldn't miss!

But first…

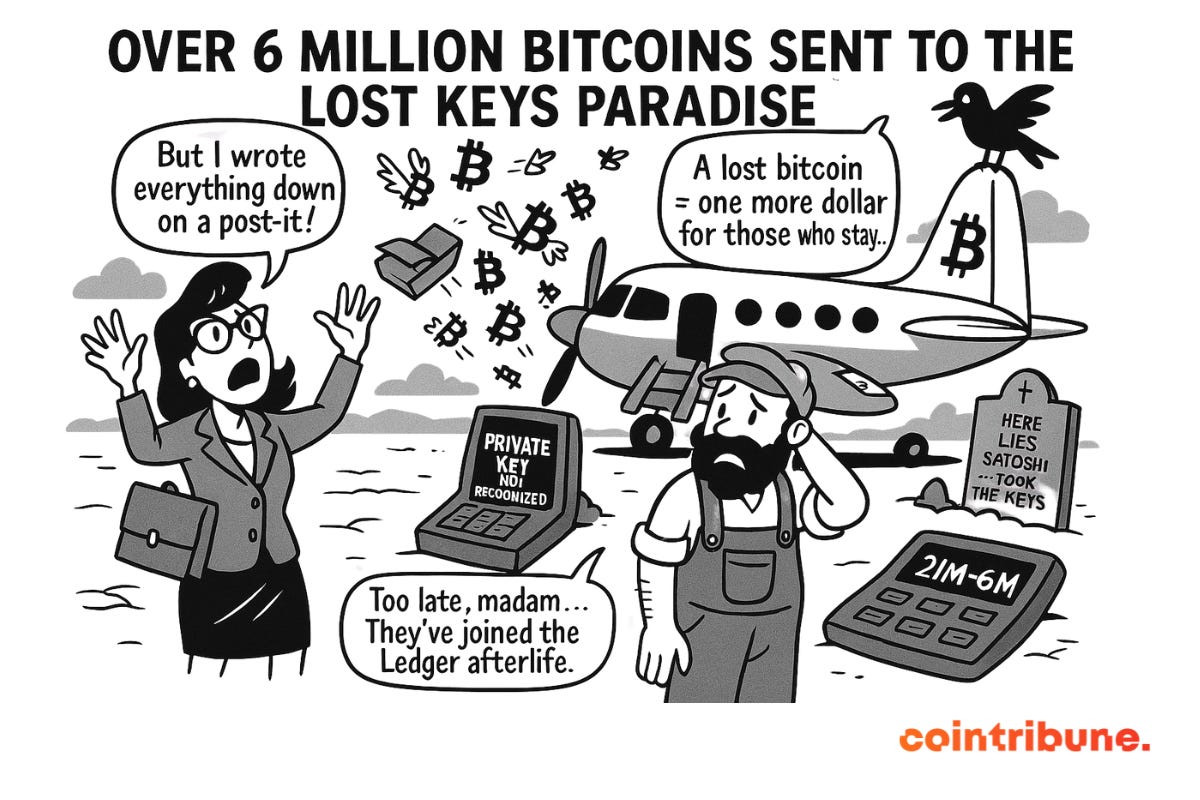

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

☀️ Sunny

24h crypto recap! ⏱

🕵️ AlphaBay behind the donation of 300 bitcoins received by Ross Ulbricht

Ross Ulbricht, founder of Silk Road, recently received a donation of 300 bitcoins, about 31 million dollars. Chainalysis analyses traced the origin of these funds back to AlphaBay, a former darknet black market. The funds would come from a former major seller, who used laundering techniques to hide their origin.

🐊 Crocodilus: The new Android malware targeting your crypto and bank accounts

Crocodilus is a new malware targeting Android devices. It spreads via fake Facebook ads related to banking services and cryptocurrencies. Once installed, it takes full control of the device, stealing recovery phrases and private keys from crypto wallets. Watch out!

📈 Crypto and RWA: A 260% growth in 2025

Tokenized real-world assets (RWA) experienced a 260% growth in 2025, driven by clearer regulation. Tokenized private credit has become the investors’ favorite asset. Bitcoin and RWAs now establish themselves as pillars of companies’ financial strategies.

🚖 Uber will accept cryptos

Uber announced its intention to accept cryptocurrencies as means of payment. This decision aims to offer users more flexibility by adding crypto to existing payment options such as PayPal or Apple Pay. CEO Dara Khosrowshahi also mentioned the possibility of a future crypto wallet, without providing a specific timeline.

Crypto of the day: Akash Network (AKT)

🧠 Technology and innovation

Akash Network is a decentralized cloud computing platform that allows users to rent or offer excess computing power. It aims to provide a more economical, flexible, and censorship-resistant alternative compared to traditional cloud providers like AWS, Google Cloud, or Microsoft Azure.

Built on the Cosmos SDK, Akash uses an open market model where providers and clients can negotiate contracts transparently. Deployments are automated through smart contracts, ensuring enhanced security and efficiency.

💰AKT Token – Utility and distribution

The AKT is the native token of Akash Network. It is used for:

Payment for services: users pay for cloud computing resources in AKT.

Staking: holders can lock their AKT to secure the network and earn rewards.

Governance: holders participate in decisions regarding the protocol’s evolution.

The initial AKT distribution was done through private and public sales, with particular attention to community engagement and developer support.

📊 Market data (as of June 7, 2025)

Current price: $1.25 USD

24-hour change: +$0.03 (+2.46%)

Market capitalization: about 309.8 million dollars

Rank on CoinMarketCap: #155

Circulating supply: 248,285,795 AKT

24-hour trading volume: about 9.5 million dollars

Bitcoin: Over 6 million BTC lost forever

A recent study by Cane Island Digital Research sheds light on a little-known but fundamental fact for Bitcoin’s economy: over 6 million BTC — nearly a third of the theoretically available supply — are irretrievably lost. This estimate, based on the analysis of inactive addresses, dormant wallets, and management errors, significantly changes the perception of Bitcoin’s actual scarcity.

In an increasingly sensitive market to supply and demand dynamics, this data could constitute a structural catalyst for long-term bullish pressure.

Dormant addresses, fatal errors and deaths: the multiple causes of disappearance

Unlike a temporary loss due to a bug or hacking, these 6 million bitcoins are not stolen but lost with no hope of recovery. The main causes are now well identified:

Loss of private keys: During Bitcoin’s pioneering era, many users neglected security rules. Result: wallets sometimes containing thousands of BTC became permanently inaccessible.

Death without access transmission: Due to lack of inheritance planning, a significant portion of assets held personally remained orphaned with heirs having no chance to access them.

Handling errors: Sending BTC to invalid addresses, intentional destruction due to cypherpunk ideology or simple negligence — all scenarios that led to permanent losses.

The study relies on detailed blockchain history and behavioral metrics (notably inactivity over several years) to conclude that the amount of "active" BTC in circulation is well below the theoretical 21 million.

Extreme scarcity and economic implications: towards prolonged bullish dynamics?

The Bitcoin market is based on a simple equation: fixed supply, growing demand. If this fixed supply is actually reduced by a third, the asset mechanically becomes rarer than expected, changing the economic fundamentals of BTC.

Effect on valuation: Fewer BTC available means increased price pressure as ETFs, institutions, and individuals flock to the market.

Impact on liquidity: Less BTC in circulation intensifies volatility spikes in case of supply tensions, notably during phases of euphoria or panic.

Strengthening of the “digital gold” narrative: The analogy between Bitcoin and digital gold is reinforced as this unforeseen scarcity strengthens BTC’s store-of-value function.

Moreover, the possibility that other losses may add up in the future due to negligence or transmission failures reinforces the irreversible nature of this scarcity.

Behind the algorithmic immutability of the 21 million cap hides a harsher reality: only 14 to 15 million BTC are truly available, and this number slowly but surely decreases.

For strategic investors, this information is not a simple past anecdote but a key long-term valuation element. Scarcity, in finance as in economics, creates value. And for Bitcoin, it is now more extreme than previously thought.