💥 Undervalued Bitcoin? Bitwise says it should be worth $270,000!

Welcome to the Daily for Wednesday, 03 December 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, 03 December 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

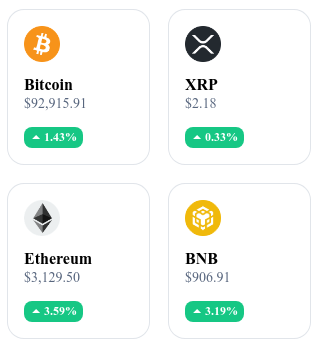

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏦 Bank of America recommends a 1% to 4% crypto allocation for its wealthy clients

The U.S. bank now advises its “wealth” clients to invest between 1% and 4% of their assets in cryptocurrencies through Bitcoin ETFs starting January 5, 2026. This decision marks a turning point for traditional finance and confirms the gradual integration of Bitcoin into institutional portfolios. 👉 Read the full article

📉 Ethereum loses $64 billion in leverage

The Ethereum market faces a collapse of $64 billion in liquidated leveraged positions, triggering massive withdrawals and strong volatility across ecosystem-related tokens. This shock highlights the risks associated with leverage in the cryptocurrency sector. 👉 Read the full article

🏛️ BlackRock announces a fully tokenized future for global markets

Asset manager BlackRock promotes tokenization as the reference model for capital markets, envisioning a transition toward digitized assets that are more liquid and more accessible. 👉 Read the full article

🤖 Artificial intelligence reaches a new milestone: It can now hack smart contracts at scale

A new type of automated attack based on artificial intelligence can detect and exploit vulnerabilities in smart contracts, threatening the security of numerous blockchain projects. This capability increases risks for users and requires stronger security audits. 👉 Read the full article

Crypto of the Day: Theta Network (THETA)

🧠 Innovation and Added Value

Theta Network is a decentralized infrastructure designed to improve video streaming, data delivery, and content distribution. The network relies on a system in which each user shares their unused bandwidth, reducing infrastructure costs for platforms and improving streaming quality.

This decentralized architecture strengthens the performance of video streams by bringing data closer to end users. Theta is gradually establishing itself as an alternative to traditional CDNs thanks to lower latency and large-scale optimization capabilities. The protocol targets use cases such as esports, online education, video-on-demand, and metaverses.

💰 The Token

THETA is the network’s governance token. It allows holders to participate in decision-making, voting, and security through validator nodes. The token also aligns incentives among participants: users who share their bandwidth or network resources receive rewards.

The economic model relies on two complementary tokens — THETA and TFUEL — which structure payments, rewards, and validation. Network activity mechanically increases demand for TFUEL, while THETA plays a role in governance.

📊 Real-Time Performance (CMC)

💵 Current Price: $0.3486

📈 24h Change: +1.03 %

💰 Market Capitalization: $348.69M

🏅 CoinMarketCap Rank: #123

🪙 Circulating Supply: 1B THETA

📊 24h Trading Volume: $23.07M

Bitcoin soon at $270,000?

Is Bitcoin being sold off cheap? According to Bitwise, one of the largest crypto asset managers in the United States, the current price of the leading cryptocurrency is far below its “fair value.” A new macroeconomic analysis estimates this theoretical price at $270,000. How do they reach such a number, and should it be taken seriously? Here’s a breakdown of a model linking Bitcoin to the evolution of global money supply.

A monetary model to evaluate Bitcoin

The study published by Bitwise is based on a concept from econometrics: cointegration. This method makes it possible to establish a long-term relationship between two economic data series. In this case, analysts compare the evolution of Bitcoin’s price with the evolution of the global M2 monetary aggregate, a broad measure of money in circulation in major economies.

According to Bitwise data, this monetary mass currently amounts to around $137 trillion. The model shows that historically, the price of BTC has tended to follow this curve. However, for several months, Bitcoin has been 66% below this theoretical trajectory.

This underperformance suggests a massive valuation gap. If BTC were to return to equilibrium with this monetary metric, its price should logically reach $270,000, the study’s authors estimate.

“Bitcoin massively underperforms global money supply. A rare opportunity is emerging.” — Bitwise report

This model has the advantage of moving away from a purely technical or psychological logic. It proposes a macroeconomic approach by considering BTC as an asset whose value adjusts in the long run to global monetary flows. It therefore goes beyond explanations linked to market cycles or hype.

Why does this estimate arrive now?

Bitwise does not limit itself to a mathematical projection. Their analysis also relies on the current monetary context, which, according to them, strengthens the credibility of their model. Several factors converge:

Global liquidity is expanding after a post-Covid contraction.

The U.S. Federal Reserve has ended its quantitative tightening program.

Several central banks have begun cutting interest rates.

Major fiscal stimulus plans are underway, notably in China and Japan.

These elements reinforce an upward trend in global money supply, where non-dilutable assets like Bitcoin could stand out. In theory, an environment of monetary expansion favors the rise of scarce assets.

And yet, the market does not seem to have anticipated it. BTC remains stable, even lagging behind macro signals. Bitwise sees a market asymmetry here: a scenario where downside risk is limited, but upside potential is significant if macro fundamentals eventually prevail.

This situation is reminiscent of past episodes in Bitcoin’s history, where institutional investors took time to integrate certain fundamental signals. For Bitwise, this “inertia” is precisely what makes the opportunity attractive today.

An indicator to think differently about Bitcoin

Behind this shock valuation at $270,000, Bitwise is mainly reopening a fundamental question: how to objectively evaluate Bitcoin’s price? The monetary approach proposed here encourages viewing BTC not only as a speculative asset but as an alternative monetary reference, whose value may be linked to imbalances in traditional currencies.

This vision aligns with a broader trend in finance, which sees Bitcoin as a hedge against monetary dilution and excessive fiscal policies. By linking its price to global money supply growth, Bitwise’s model offers an analytical framework that could appeal to long-term investors seeking “hard” assets in a world of “soft” currencies.

Whether the market will eventually reflect this reality remains to be seen. For now, the gap between the observed price and the estimated valuation remains a subject of debate… and perhaps an opportunity for some.