💥 U.S. Banks in Danger: Will Bitcoin Become a Liquidity Safe Haven Again?

Welcome to the Daily for Saturday, October 18, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, October 18, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ top news you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

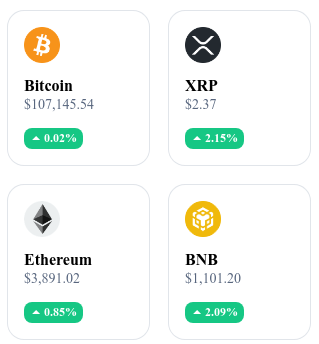

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

⚖️ GESPA Files Complaint Against FIFA’s NFT Platform

The Swiss authority GESPA has filed a complaint against FIFA for unauthorized gambling activities on its FIFA+ Collect platform. It argues that the sale of NFT packs, which rely on random rewards, constitutes a form of gambling requiring a license. GESPA is requesting an official investigation into the platform’s compliance.

💵 DeFi Development Invests $16 Million in Solana

The DeFi Development fund has invested $16 million to support the growth of the Solana ecosystem, focusing on emerging DeFi protocols. The goal is to strengthen liquidity infrastructures and foster the development of more efficient decentralized financial applications.

👉 Read the full article

🪙 Tokenized Gold Reaches $1 Billion in Daily Volume

Trading volumes for gold-backed tokens have surpassed $1 billion per day, according to Artemis Analytics. This record growth is driven by the success of Tether Gold (XAUT) and Pax Gold (PAXG), which together account for nearly $900 million in volume. The total supply of gold-pegged tokens now exceeds $3.1 billion.

👉 Read the full article

🇫🇷 France Increases Pressure on Binance and Crypto Exchanges

The ACPR has launched enhanced inspections on Binance and other exchanges to assess compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. The AMF and Bank of France are calling for tighter supervision at the European level under the MiCA framework.

👉 Read the full article

Crypto of the Day: Kava (KAVA)

Innovation and Added Value 🧠

Kava is a Layer-1 blockchain designed to unify the Ethereum and Cosmos ecosystems. With its dual compatibility (EVM + Cosmos SDK), it enables developers to deploy Ethereum smart contracts while benefiting from Cosmos’ native interoperability. This hybrid approach makes Kava an ideal platform for DeFi, NFT, and GameFi projects that want to operate across multiple networks without relying on external bridges.

The protocol is powered by a high-performance engine combining security, scalability, and low fees. In 2024, Kava also launched the Kava Rise Program, an incentive system rewarding developers based on their on-chain activity, aiming to attract innovation and expand its ecosystem.

The Token 💰

KAVA is the native token of the network. It’s used to secure the blockchain through staking, pay transaction fees, and participate in governance. Validators and delegators earn rewards in KAVA, while holders can vote on protocol upgrade proposals. The token also powers Kava’s incentive program, ensuring the continuous growth of the ecosystem.

With a progressively deflationary emission model and a community-driven distribution, Kava combines utility and governance to enhance the long-term sustainability of its network.

Real-Time Performance 📊

💵 Current Price: $0.3587

📈 24h Change: +0.89%

💰 Market Cap: $384,050,000

🏅 CoinMarketCap Rank: #146

🪙 Circulating Supply: 1,071,200,000 KAVA

📊 24h Trading Volume: $8,790,000

U.S. Banking Crisis: Bitcoin Faces a New Liquidity Test

As several regional U.S. banks experience sharp market turmoil, attention turns to Bitcoin — often seen as a barometer of liquidity stress. Can the crypto king truly benefit from a potential monetary easing cycle, or does its recent decline reveal a growing disconnect from the sector’s dominant narratives?

The U.S. Banking System Under Pressure: Warning Signs in the Fundamentals

In the United States, some regional banks are struggling to reassure investors. Zions Bank and Western Alliance Bancorporation are prime examples: their shares fell 12.5% and 9% respectively on October 16. The cause lies in heavy exposure to commercial real estate — weakened by high interest rates and persistently high vacancy levels.

The situation is reminiscent of the turmoil of spring 2023, marked by the collapse of institutions such as Silicon Valley Bank. Although regulators have tried to calm fears, doubts persist about the structural solidity of these institutions. Analysts now warn of a latent systemic fragility — one that could resurface if liquidity tightens again.

In this tense context, investors are seeking assets that can act either as a refuge or as an early warning signal for market shocks.

Bitcoin: Leading Indicator or Liquidity Mirage?

For some observers, Bitcoin is exactly that signal. Jack Mallers, CEO of Strike, argues that “Bitcoin is the most sensitive to liquidity. It will move first.” To him, the asset is not merely a store of value — it reflects the market’s expectations about monetary policy cycles.

Arthur Hayes, former CEO of BitMEX, shares this view. He considers Bitcoin to be “on sale,” predicting a surge if central banks are forced to intervene again to support banks. His strategy is straightforward: buy when panic hits and liquidity injections are imminent.

However, recent market behavior calls for caution. Bitcoin fell below $110,000 — even touching $103,000, its lowest in four months — despite growing concerns over the banking system. This divergence between narrative and price action raises questions: if Bitcoin truly reacts to liquidity, why isn’t it responding this time?

Several explanations emerge. On one hand, crypto markets may have already priced in a longer period of high interest rates. On the other, current hesitation could reflect investors repositioning themselves while awaiting a major macroeconomic trigger.

Absent a shock comparable to 2023’s banking crisis or a decisive shift by the Federal Reserve, the hypothesis of a Bitcoin rally driven by liquidity relief may remain on hold.