⚠️ "Users are lied to": Vitalik wants to break the taboo of Web3 vulnerabilities

Welcome to the Wednesday, July 9, 2025 Daily Tribune ☕️

Hello Cointribe! 🚀

Today is Wednesday, July 9, 2025 and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't have missed!

But first…

✍️ Cartoon of the day:

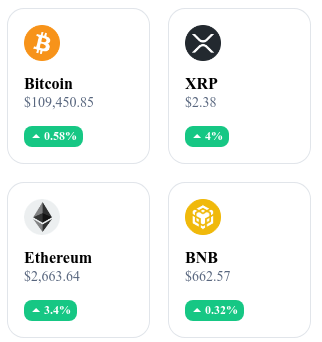

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏦 BlackRock surpasses 700,000 BTC in 18 months

BlackRock's iShares Bitcoin Trust (IBIT) ETF now holds over 700,000 BTC, approximately 75.5 billion USD, after an inflow of 164.6 million USD in a single day. This amount represents more than 55% of BTC held by US ETFs, making this solution the main revenue driver for BlackRock.

⚠️ Vitalik warns about the danger of an overly "closed" Ethereum

Vitalik Buterin warns against a drift of the Ethereum ecosystem towards proprietary practices, urging adoption of copyleft licenses to preserve open innovation. At ETHCC, he presented "three tests" designed to guarantee the real resilience of projects, especially in case of disappearance of founding teams.

🔐 Jack Dorsey launches BitChat, a secure offline messaging app

Jack Dorsey unveiled BitChat, an encrypted messaging application operating only via Bluetooth mesh, without Internet or central servers. Available in beta via TestFlight for 10,000 users, it enables ephemeral and resilient exchanges in areas without connection, with a range of over 300 m according to the white paper.

💼 DDC Enterprise adds 230 BTC to its treasury

DDC Enterprise acquired an additional 230 BTC, bringing its portfolio to 368 BTC, with a yield of 48.3% since its last increase. At an average cost of about 90,764 USD per BTC, the company aims to consolidate its long-term digital asset strategy.

Crypto of the day: Hedera (HBAR)

🧠 Technology and innovation

Hedera is based on Hashgraph, an alternative to blockchain that works like a directed acyclic graph (DAG). Thanks to the "gossip about gossip" consensus mechanism and virtual voting, Hedera ensures near-instant finality, over 10,000 transactions/second, 0.0001$ fees, and minimal energy consumption.

Hedera natively offers three key services: smart contracts (Solidity), asset tokenization, and consensus as a service, with governance ensured by a council of large companies like Google, IBM, LG, or Boeing.

💰 Utility of the HBAR token

The HBAR token plays a central role in Hedera network operation and powering its decentralized services:

Used to pay transaction fees on the network

Used for staking and securing the network

Allows shared governance, indirectly via the Hedera Council

Optimized for micropayments, enterprise applications, and tokenization

📊 Market data (as of July 8, 2025)

Current price: 0.1643 USD

24h change: +4.97%

Market capitalization: 6.97 billion $

CoinMarketCap rank: #19

Circulating supply: 42.391 billion HBAR

Trading volume (24h): 197.8 million $

Altcoins start their comeback!

While Bitcoin continues to impose its market dominance, several indicators reveal a possible capital rotation towards altcoins. The Altcoin Season Index and other technical data suggest these digital assets may soon return to the spotlight, as in past cycles.

Rebound of the Altcoin Season Index and reversal signals

The Altcoin Season Index recently rose to 27, a significant rebound after reaching 11 in June. This level remains below the 75 threshold, generally interpreted as the beginning of an altseason, but it recalls the beginnings of a similar movement observed in summer 2020, a period marked by explosive altcoin recovery.

Another major signal: the Total 2 index, which measures the market capitalization excluding Bitcoin, has grown by 35% since April. It forms a "higher low", a typical technical pattern of trend reversals, indicative of progressive accumulation. This pattern supports the idea that institutional and retail investors are beginning to reposition their allocations.

The analysis of the ETH/BTC ratio also provides important clues. Currently near 0.023 BTC, this level has held despite selling pressure. Crossing the 0.027 BTC mark would be seen as a technical confirmation that altcoins are ready to outperform Bitcoin.

A cyclic pattern already observed in previous years

Well-known figures in the sector, such as Michaël van de Poppe and analyst Daan, note an interesting cyclic recurrence. For five years, June months have often been the scene of capitulation phases, followed by significant rises in summer. This trend, reinforced by market behavioral analysis, lends credence to the hypothesis of a strong altcoin comeback.

The macroeconomic environment adds a layer of interest to this dynamic. Expectations of monetary easing (QE) and the emergence of financial instruments like Ethereum ETFs could promote renewed interest in alternative projects. In periods of liquidity expansion, capital tends to seek higher yields, often found in higher volatility assets – altcoins in the lead.