🏛️ Vanguard may consider giving its clients access to crypto ETFs

Welcome to the Daily for Saturday, September 27, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, September 27, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

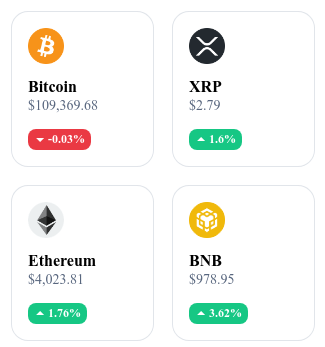

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📡 SWIFT tests on-chain messaging and a stablecoin on Linea

A report reveals that SWIFT is piloting an on-chain interbank messaging system on the Linea blockchain. The project also includes the issuance of a stablecoin for cross-border settlement tests.

👉 Read the full article

💳 WLFI launches a massive buyback operation

World Liberty Financial initiated in September 2025 a token buyback and burn program for WLFI, approved by a 99% community vote. The operation will be financed by fees generated on Ethereum, BNB Chain, and Solana.

👉 Read the full article

📈 Stablecoin boom: Moody’s warns of a threat

Moody’s Ratings published a report highlighting that stablecoin adoption in emerging economies could weaken monetary policy. It warns of a possible erosion of bank deposits and a risk of “cryptoization.”

👉 Read the full article

🏛️ Vanguard may grant clients access to crypto ETFs

Vanguard is preparing to integrate crypto ETFs into its brokerage platform. The asset manager, historically opposed to cryptocurrencies, could thus allow the purchase of spot Bitcoin and Ethereum ETFs.

👉 Read the full article

📌 Crypto of the Day: Injective (INJ)

Innovation and Added Value 🧠

Injective is a blockchain dedicated to decentralized finance (DeFi), designed to host exchanges, derivatives, prediction markets, and other fully on-chain financial products. Its unique feature lies in its decentralized order book, which provides an alternative to traditional AMMs and enables fast, transparent, and front-running-resistant transactions.

Thanks to its interoperability with networks like Ethereum and Cosmos, as well as its modularity, Injective allows the development of powerful financial applications with reduced fees and optimized execution.

The Token 💰

The INJ token plays a central role in the ecosystem. It is used to pay transaction fees, serve as collateral in derivatives markets, and participate in protocol governance.

Holders can stake or delegate their INJ to secure the network and earn rewards, while also having the ability to vote on strategic upgrades. The model also incorporates a burn mechanism for part of the fees, reducing supply over time. This design combines transactional utility, economic incentives, and a decision-making role, strengthening the ecosystem’s sustainability.

Real-Time Performance 📊

💵 Current Price: 11.61 USD

📈 24h Change: +3.45%

💰 Market Cap: 1,177,518,254 USD

🏅 Rank on CoinMarketCap: #72

🪙 Circulating Supply: 99,970,935 INJ

📊 Trading Volume (24h): 86,226,638 USD

Inflation under control in the U.S.: toward Fed easing?

The August figures confirm a trend that could redefine the course of U.S. monetary policy. As inflation stabilizes and consumption remains strong, attention turns to the Federal Reserve and its next moves.

PCE data confirm controlled disinflation

The Personal Consumption Expenditures (PCE) price index, the Fed’s main inflation gauge, rose 2.7% year-on-year in August, perfectly in line with expectations. On the month, the indicator increased by 0.3%. Excluding volatile energy and food sectors, core PCE rose 2.9% annually and 0.2% monthly.

Certain spending categories continue to drive price increases. Energy rose 0.8%, food 0.5%, and housing costs 0.4%. These increases remain contained and compatible with the Fed’s medium-term inflation target of 2%.

On the demand side, the data show a still-resilient U.S. economy. Household spending grew 0.6% in August, while personal income rose 0.4%. The savings rate, up to 4.6%, suggests households still have financial leeway to support consumption.

Fed positioned to ease monetary policy

The combination of contained inflation and strong consumption could give the Federal Reserve room to ease its monetary policy. Observers now expect a 25 basis point cut in the policy rate, potentially followed by a second cut by the end of 2025 if the disinflationary trend continues.

Core inflation falling back below the symbolic 3% mark gives policymakers additional justification to gradually loosen monetary constraints, while keeping an eye on risks linked to energy prices and geopolitical tensions.