🔮 What if the next cycle triggered the long-awaited global adoption? 🌐

Welcome to the Daily for Wednesday, September 3, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, September 3, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the last 24 hours’ news you shouldn’t miss!

But first…

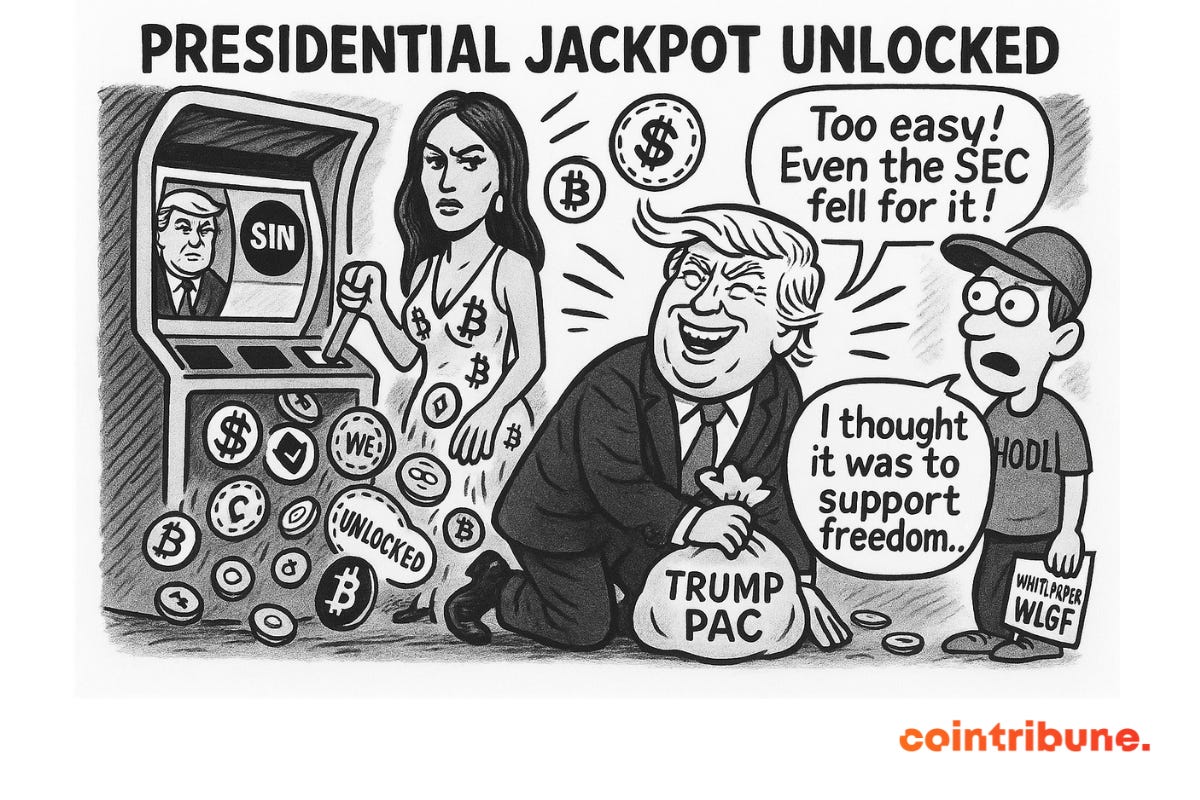

✍️ Cartoon of the day:

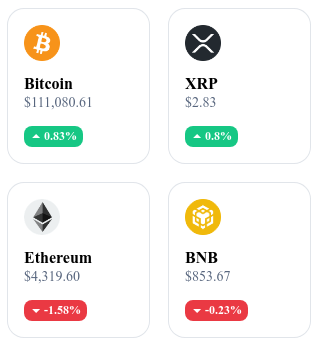

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

🟣 SharpLink buys 39,008 ETH for $177M at an average price of $4,531

SharpLink boosts its treasury to 837,230 ETH, valued at ~$3.6B, after acquiring 39,008 ETH financed through a $46.6M raise. The company also accumulated 2,318 ETH earned from staking since June and now shows an ETH/liquidity ratio of 3.94 — nearly $4 in ETH per $1 in cash.

👉 Read the full article

⚠️ ESMA warns against tokenized stocks

The European Securities and Markets Authority reminds investors that these assets do not confer voting rights or dividends, which may mislead their real nature. While supporting innovation through a blockchain pilot regime, the ESMA stresses the need for clear regulation to avoid legal and liquidity risks.

👉 Read the full article

💰 Tokenized gold hits a record market cap of $2.57B

The overall capitalization of gold-backed assets has surpassed $2.57B, driven by XAUT (Tether), which minted 129,000 tokens worth $437M, and Paxos’ PAXG, which saw ~$141.5M net inflows since June. This reflects strong demand for liquid, on-chain safe-haven assets.

👉 Read the full article

🇺🇸 Trump family secures $5B after unlocking 24.6B WLFI tokens

WLFI, a crypto project linked to the Trump family, unlocked 24.6B tokens — 22.5B of which are tied to DT Marks DEFI LLC and relatives — valued at ~$5B at peak. The move sparked criticism over transparency and concerns about initial lock-up commitments.

👉 Read the full article

Crypto of the Day: NEAR Protocol (NEAR)

🧠 Innovation and Added Value

NEAR is a Layer 1 blockchain with a Nightshade sharding architecture that partitions the network into shards, enabling parallel transaction processing. With blocks validated in just a few milliseconds, this approach ensures linear scalability, ultra-low fees, and controlled energy consumption.

NEAR also interoperates with Ethereum via Aurora (EVM-compatible) and the Rainbow Bridge, making it easier to bring Ethereum smart contracts into a high-performance and sustainable environment.

💰 The NEAR Token: Utility and Benefits for Holders

The NEAR token is used to pay transaction fees, secure the network through staking, and vote in decentralized governance. It is distributed in a way that supports validators and encourages ecosystem development while maintaining a transparent and inclusive monetary policy.

📊 Real-Time Performance (September 3, 2025)

Current Price: $2.43 USD

24h Change: +3.27%

Market Cap: ≈ $3.047B USD

Rank on CoinMarketCap: #38

Circulating Supply: ≈ 1.250B NEAR

24h Trading Volume: ≈ $157.7M USD

The Next Bull Run Could Push Crypto to 5 Billion Users

While the crypto sector is often perceived as a niche or speculative ecosystem, some signals point to a profound shift. At the WAIB Summit in Monaco, major players such as Crypto.com, OKX, and Coinbase presented an ambitious vision: a near future where cryptocurrencies grow from 659 million to 5 billion users. This projection relies less on market hype and more on concrete use cases at the heart of our digital lives.

Towards global adoption: Between technological maturity and the tipping point

Thomas Prévot of Crypto.com predicts a major shift within the next decade: 5 billion users, or nearly two-thirds of the world’s expected population by 2035. This impressive number is backed by structural developments.

On the technical side, platforms like Crypto.com and OKX can now handle user volumes far greater than during the 2021 bull run. This maturity provides the necessary infrastructure to absorb mass adoption without repeating past bottlenecks.

There’s also a psychological tipping point: reaching the first billion users, as Prévot highlights, could mirror the internet’s mass adoption in the early 2000s. Such a milestone would act as implicit validation, fueling wider adoption through collective trust.

Beyond speculation: the importance of everyday use cases

Mass adoption, however, cannot rely solely on speculation. For crypto to move beyond temporary hype, it must integrate into daily life: seamless payments, secure digital IDs, and cross-border transfers.

Chintan Turakhia of Coinbase stresses the need for simpler, more intuitive interfaces accessible to both newcomers and the unbanked. User-friendly experiences will be the real driver of democratization.

This focus is especially critical in emerging markets, where crypto can sometimes be the only viable alternative to unstable or absent financial systems. In such regions, adoption would be rooted in real-world use cases rather than speculation.

With stronger infrastructure, simpler interfaces, and broader use cases, the next crypto cycle could transform digital assets into daily tools for billions. The challenge is whether the ecosystem can turn that promise into reality.