🚀 Why Bitcoin Might Never Fall Below $100,000 Again

Welcome to the Daily for Tuesday, October 28, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, October 28, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the top stories from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

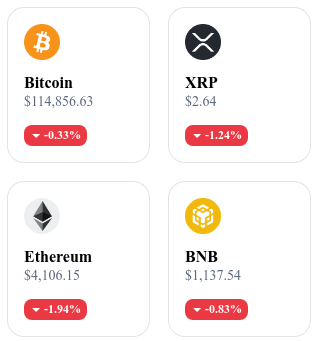

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🏦 BIS warns of regulatory grey zone around stablecoins

The Bank for International Settlements (BIS) has raised concerns over the lack of a clear legal framework for stablecoins, describing them as vulnerable to systemic risks. The institution is calling for a globally coordinated regulatory approach, arguing that their growing ties with traditional finance could amplify liquidity shocks.

💰 Strategy buys 390 BTC for $43M

Strategy Inc. has acquired 390 bitcoins for a total of $43 million, further strengthening its position among the largest institutional holders. This purchase brings its total holdings to over 640,000 BTC, reinforcing its long-term accumulation strategy.

👉 Read the full article

🇰🇬 Kyrgyzstan launches KGST stablecoin on BNB Chain and prepares CBDC

Kyrgyzstan has launched its first national stablecoin, KGST, built on BNB Chain to facilitate digital payments and cross-border transfers. The government is also preparing a national CBDC, currently being tested by the Central Bank.

👉 Read the full article

⛏️ Bitmine rides Ethereum rebound with $321M investment

Bitmine has invested $321 million to expand its mining and staking capabilities on Ethereum, taking advantage of the recent rise in ETH’s price. This move is part of a broader global expansion strategy to strengthen its presence in Web3 infrastructure.

👉 Read the full article

Crypto of the Day: Theta Network (THETA)

Innovation and Added Value 🧠

Theta Network is a decentralized video streaming blockchain designed to lower streaming costs and enhance digital content quality. Launched in 2019, it operates on a peer-to-peer (P2P) model where users share their bandwidth and computing resources in exchange for token rewards.

Theta aims to revolutionize the video streaming industry by eliminating intermediaries while maintaining high service quality. Its ecosystem includes Theta.tv, a live streaming platform integrated with the blockchain, and Theta Edge Network, a global network of distributed nodes that store, transcode, and deliver content.

Major partners such as Google, Sony, and Samsung have supported its development, solidifying Theta’s position as a credible Web3 video infrastructure.

The Token 💰

THETA is the network’s native token, used for protocol governance, validator staking, and network security.

Users can stake their THETA to become validators or “Guardian Nodes,” while the secondary token TFUEL is used to pay for transactions and reward users who share their bandwidth.

This dual-token economy (THETA/TFUEL) enables Theta to combine sustainability, incentives, and performance while maintaining community-driven governance.

Live Performance 📊

💵 Current price: $1.19

📉 24h change: –1.06 %

💰 Market cap: $1,190,000,000

🏅 CoinMarketCap rank: #67

🪙 Circulating supply: 1,000,000,000 THETA

📊 24h trading volume: $20,830,000

Standard Chartered sees Bitcoin staying above $100,000 “for good”

Bitcoin may have entered a new historical phase, according to Standard Chartered. Based on a mix of economic and geopolitical signals, the bank now believes the world’s leading cryptocurrency will never again fall below the symbolic $100,000 threshold.

A favorable backdrop for Bitcoin, says Standard Chartered

Geoffrey Kendrick, Global Head of Crypto Research at Standard Chartered, points to several reasons supporting a Bitcoin firmly anchored above $100,000. Chief among them is the easing of geopolitical tensions between the world’s two largest economies — the United States and China. The prospect of a summit between Donald Trump and Xi Jinping, coupled with tangible trade gestures such as China’s renewed imports of U.S. soybeans and the postponement of export restrictions on rare earth elements, has boosted market optimism.

These developments improve global risk sentiment, benefiting naturally volatile assets — starting with Bitcoin. One key indicator capturing analysts’ attention is the Bitcoin-to-gold ratio. Having returned to pre–October 10 crash levels, this ratio could mark a turning point if it surpasses 30 — a sign that fear is fading and renewed appetite for digital assets is taking hold.

Spot ETFs: the new market driver

Until recently, Bitcoin’s trajectory was largely dictated by its halving cycles — the periodic reduction in mining rewards every four years. However, Standard Chartered believes this model is giving way to one driven more by institutional demand. The rise of spot Bitcoin ETFs, now available across major financial markets, is changing the equation.

In just a few days, over $2 billion have flowed out of gold-backed ETFs — a shift the bank interprets as a strong signal of reallocation toward Bitcoin. These capital flows are seen as structural, reflecting growing adoption of the digital asset by traditional investors with a long-term perspective.

This transition could anchor Bitcoin in a new economic paradigm: that of a digital reserve asset less exposed to cyclical volatility and increasingly shaped by institutional portfolio allocation. If this trend continues, former psychological thresholds — like $100,000 — may cease to be peaks and instead become floors.