📉 Why doesn't the crypto market react like before? Traders don't understand anything anymore!

Welcome to the Daily Tribune of Thursday, February 06, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, February 06, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

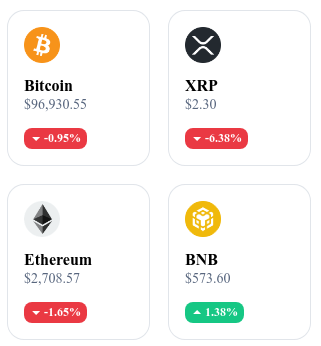

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🔥 Ethereum: 52% of validators approve a rise in Gas Limit!

The Ethereum network is preparing for a gas limit increase after a vote where 52% of validators expressed their support for this change. Currently set at 30 million, this cap could be raised to 36 million, or even 40 million in the long term. The goal? Increase the network's capacity, facilitate transactions and reduce fees. However, some experts are concerned about the congestion risks and increased pressure on node operators. Vitalik Buterin favors a gradual and controlled approach, which could be implemented during the Pectra fork scheduled for March 2025. 🔗 Read the full article

📉 Total chaos in the crypto market: traders understand nothing anymore!

The crypto market is going through a phase of total irrationality, with inconsistent movements that baffle investors. Despite the support from the U.S. government and a growing institutional adoption, Bitcoin struggles to hold onto $100,000, currently fluctuating around $97,925. Market sentiment has plummeted sharply, with the Crypto Fear & Greed index dropping from 72 to 54 in one day. Trade tensions and record volatility triggered the largest liquidation in crypto history ($2.24 billion in 24 hours), amplifying instability. In light of these contradictory signals, some experts believe that the market is on the verge of a brutal reassessment. 🔗 Read the full article

🛑 Google Play and App Store Infested: A Virus Steals Your Cryptos!

A new ultra-sophisticated malware, called SparkCat, threatens crypto users by infecting mobile applications on Google Play and the App Store. According to Kaspersky, this malware uses OCR technology to analyze images stored on devices and steal crypto wallet recovery phrases. Present in over 242,000 downloaded applications, SparkCat primarily targets Android and iOS users in Europe and Asia. To protect yourself, avoid storing your seed phrases as photos, use a secure password manager, and immediately delete any suspicious applications. 🔗 Read the full article

⛏️ Bitcoin: Soon 4 Times Bigger Blocks?

A Mempool Research report reveals that the average size of Bitcoin blocks could rise to 4 Mb, compared to 1.5 Mb currently, thanks to the massive adoption of inscriptions (ordinals, BRC-20). This development recalls the "block wars" of 2015-2017, where two camps opposed each other: those advocating for expansion to reduce fees and the defenders of decentralization. If this growth is confirmed, Bitcoin could reach 1 terabyte by 2029, strengthening its institutional adoption and DeFi capabilities. However, competition is intensifying with blockchains like Solana (128 Mb per block) and Celestia (1 Gb) which offer more scalable solutions. 🔗 Read the full article

Crypto of the Day: Ultima (ULTIMA).

HEX (PulseChain).

HEX is a crypto project based on PulseChain, a blockchain that offers a hybrid system combining Proof of Work (PoW) and Proof of Stake (PoS). This dual approach aims to improve the network's security and efficiency. HEX is designed to function as a daily currency, offering scalability and ease of use. It is fully decentralized, allowing users to mint their own rewards without intermediaries.

The native token, HEX, is used for mining within the PulseChain ecosystem. Users can choose a waiting period between 1 and 5,555 days to mint their rewards, with an average annual yield (APY) of 38%. The longer the waiting period, the greater the rewards, thereby incentivizing users to hold their HEX for long periods. HEX is compatible with wallets supporting PulseChain, such as Rabby Wallet, and can be stored securely in hardware wallets like Trezor.

Recent Performance:

Current price: $0.01337 (approximately €0.0123)

24-hour change: +21.97%

Market capitalization: $7.91 billion

Rank on CoinMarketCap: 3,106

Where does the "Bitcoin Strategic Reserve" stand?

The United States might soon establish a strategic reserve of Bitcoin, an initiative bolstered by the recent creation of a sovereign fund under the Trump administration.

This fund, overseen by Howard Lutnick, paves the way for institutional adoption of Bitcoin at the government level. Although Trump did not explicitly mention Bitcoin as an asset of the fund, Senator Cynthia Lummis hinted that this perspective was seriously considered. Meanwhile, David Sacks, a key advisor on crypto matters, confirmed that the inclusion of Bitcoin was a possibility, subject to Lutnick's approval. This initiative has already had an immediate impact on the market, with Bitcoin's price rising toward $100,000.

The implications of such a decision are significant. The U.S. government could accumulate up to 200,000 BTC per year, according to Senator Lummis's proposal in her Bitcoin Act. The inclusion of Bitcoin in a sovereign fund would mark a radical change in the management of national assets, akin to Norway, whose sovereign fund indirectly holds bitcoins through its shares in MicroStrategy. Additionally, lifting banking restrictions on Bitcoin, particularly after the withdrawal of the SAB 121 standard by the SEC, now allows U.S. banks to offer custody and Bitcoin-backed loan services. Cantor Fitzgerald, led by Howard Lutnick, has already invested heavily in Bitcoin and plans to develop financing solutions backed by this asset.

If the United States officially takes action, a global domino effect could unfold. Several countries like Argentina, Brazil, Japan, the Czech Republic, and Russia are already considering integrating Bitcoin into their national reserves. Conversely, the European Central Bank remains hesitant, with Christine Lagarde stating that no country in the eurozone would include Bitcoin in its reserves. This contrast between the United States and Europe highlights a significant strategic divergence. According to some estimations, a massive government adoption could propel Bitcoin to $200,000, or even $700,000 according to forecasts from Larry Fink, CEO of BlackRock. The future of Bitcoin as a strategic asset seems to be unfolding at the state level, with an imminent turning point on the American side.