Will Bitcoin soar? Discover Michael Saylor's visions!

Welcome to the Daily Tribune on Wednesday, May 8, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, May 8, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

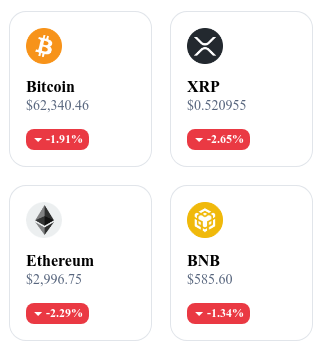

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

⚡ Michael Saylor's latest predictions

Michael Saylor shares a bold vision of Bitcoin's future, considering the approval of Bitcoin spot ETFs by the SEC as an important milestone in establishing Bitcoin as a leading digital asset. He emphasizes that the SEC's potential refusal to approve ETFs for other cryptocurrencies would strengthen Bitcoin's unique position. These statements come at a time when attention is turning to Ethereum with the SEC set to rule on the approval of the VanEck Ethereum spot ETF by May 23, 2024. Read the full article here.

🕵️♂️ Arkham unveils secret US government Bitcoin wallet

Arkham, a company specialized in cryptocurrency analysis, has recently discovered a Bitcoin wallet held by the US government, raising questions about the government's intentions and strategies regarding the use of this cryptocurrency. This asset, acquired as a result of a seizure operation in a drug trafficking case, highlights the potential role of Bitcoin as a tool for economic or security policy. Arkham's revelation of this secret wallet adds an additional dimension to the complexity of interactions between cryptocurrencies and government regulation, and could influence how cryptocurrencies are regulated in the future. Read the full article here.

🚀 Solana: Institutional players place their bets

Solana, often considered a competitor to Ethereum, is regaining the confidence of institutional investors, attracted by its technological innovations and a thriving ecosystem. The price of Solana is on the verge of breaking out of a double bottom pattern and indicates significant potential for a rise. The recent increase in capital inflows, marked by a $4.1 million investment increase in one week, shows a renewed interest that could catalyze a major rally for SOL. Read the full article here.

🇦🇷 Meeting between Elon Musk and pro-Bitcoin Argentine President

Elon Musk and Argentine President Javier Milei, both strong Bitcoin advocates, have met. This meeting could signal future initiatives to integrate Bitcoin into the Argentine economy, potentially as a legal currency. The impact of such cooperation could be considerable and stimulate technological innovation in Argentina and possibly beyond, in other Latin American countries. Read the full article here.

Crypto of the day: Tellor (TRB)

Tellor is a blockchain that positions itself as a decentralized oracle, providing reliable and secure data to smart contracts on Ethereum and other compatible blockchains. Tellor's major innovation lies in its proof-of-work (PoW) consensus mechanism, which allows miners to submit data values in exchange for rewards in TRB, the network's native cryptocurrency.

The main utility of TRB is to serve as an incentive token to encourage miners to submit accurate data. TRB holders benefit from governance rights, allowing them to participate in decisions regarding system changes and data integrity management. The tokens can also be staked to dispute data submissions, adding an additional layer of security and user engagement in the ecosystem. This system creates significant added value by ensuring the integrity and accuracy of data used by decentralized contracts, which is essential for reliable decentralized operations.

Recent performance of Tellor

Current price: €132.97

Percentage increase: 21.29% (1-day increase)

Market capitalization: €342,507,818

Rank on CoinMarketCap: 175

Technical analysis of the day: Bitcoin (BTC)

Bitcoin has recently experienced increased volatility, dropping more than 23% from its all-time high before showing signs of recovery, once again surpassing the $60,000 threshold. After hitting a floor around $57,000, a level previously identified as a bearish target in the April 27 analyses, Bitcoin managed to recapture and surpass this critical threshold. The current price is around $62,300, but the resistance observed at the $64,000 level has led to a period of consolidation, hinting at persistent uncertainty regarding the continuation of the bullish trend. The presence of this resistance combined with interaction with the 50-day moving average highlights investors' caution about a possible extension of the recovery.

From a technical standpoint, open interest in Bitcoin/USDT contracts has maintained relative stability, indicating a balance between buying and selling forces since mid-April. Liquidations, although mainly sellers, haven't been significant enough to cause a marked shift in the market. However, if Bitcoin manages to break the resistance at $64,000, it could then target an upper range between $67,000 and $68,000. Conversely, a break below $60,000 could reactivate support around $57,000, with the potential for a drop to $54,000 in the case of increased selling pressure. These levels are critical thresholds to monitor in the coming days, as they could determine the short-term trajectory of the cryptocurrency. Traders must remain vigilant and be prepared to adjust their strategies based on imminent market fluctuations.