🗳️ Will Cryptos Really Swing the US Elections?

Welcome to the Daily Tribune for Friday, November 1, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, November 1, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

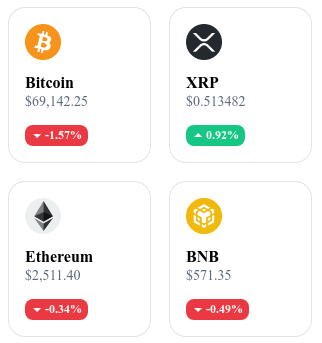

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

🗳️ Cryptos, Key Factor in American Elections?

As the American presidential elections approach, the importance of "crypto voters" becomes a strategic topic. A survey by Paradigm reveals that 5% of voters consider themselves as "single-issue crypto voters," meaning they are focused exclusively on the protection and development of cryptocurrencies. These voters, mainly young and from varied demographic groups (11% are between 18 and 34 years old, 8% are men, 7% are African American, and 8% are Hispanic), could be decisive in swing states such as Pennsylvania, Michigan, and Wisconsin, where margins can sometimes be just one or two points.

Although crypto voters show distrust towards both major parties, the trend slightly favors Republicans, seen as more supportive of cryptos. Donald Trump, leading in political betting odds, is viewed by the crypto community as a figure promising looser regulation. However, suspicions of manipulation in prediction markets cast shadows over certain influential investors, underscoring the complexity of this issue.

💵 Stablecoins: A Bridge to US Treasury Bonds

Stablecoins, stable digital assets backed by fiat currencies, are generating increasing interest for US Treasury bonds. The reserves of major stablecoins, mostly invested in Treasury bonds and repurchase agreements, stimulate heightened demand for these traditionally safe assets, providing crypto investors with a form of stability during volatile periods.

In response, the Treasury is considering the tokenization of its bonds, a potentially revolutionary advance that would allow their exchange in the form of tokens on a state-controlled blockchain. This project aims to improve transaction efficiency, although some experts warn of the financial risks associated with increased volatility. The convergence between traditional finance and cryptocurrencies is therefore intensifying, heralding a re-invention of secure investment standards.

📈 Solana Surpasses Ethereum: A Breakthrough in Decentralized Exchanges

Solana records a record increase in trading volumes on DEX, reaching 168% of Ethereum's activity thanks to Raydium, which has seen its market share grow from 7.6% to 18.4% since January. This surge, supported by the influx of new tokens like "pump.fun," positions Solana as a preferred ecosystem for dynamic trading, attracting users eager for new opportunities.

In parallel, Ethereum retains a more stable audience, particularly via Uniswap and its Layer 2 solutions, which further enhance its overall activity. Solana has even surpassed Ethereum in terms of fees generated in a day, recording $2.54 million compared to $2.07 million for its rival. As the two blockchains differentiate themselves in their uses, the competition remains intense and promises exciting developments in the coming months.

💼 MicroStrategy Launches Colossal Bitcoin Investment Plan

MicroStrategy, the largest institutional holder of publicly traded Bitcoin, has revealed its "Plan 21/21," an unprecedented initiative aimed at raising $42 billion to bolster its Bitcoin reserves. This plan is divided into $21 billion from capital increase and $21 billion in fixed-income securities. With a current portfolio of 252,220 BTC, valued at $18.2 billion, the company is making a massive bet on Bitcoin, despite significant quarterly losses and a 10% drop in its revenue.

This unique positioning as an alternative to ETFs and exchanges attracts institutional investors seeking direct exposure to BTC, transforming MicroStrategy into a "proxy" for Bitcoin. As Bitcoin reaches $72,209, this initiative could significantly impact its institutional adoption and redefine investment standards in the crypto world.

Crypto of the Day: Dogecoin (DOGE)

Dogecoin operates on a Proof of Work (PoW) model based on the Scrypt algorithm, allowing for fast transactions and low fees, which distinguishes it in the crypto universe as a smooth medium of exchange. Its blockchain, inspired by Litecoin, adds a humorous touch to the industry, aiming for mass adoption through its accessibility.

The main utility of DOGE lies in online payments and tips, used to reward online content. DOGE had no pre-mine and was distributed through its mining. For holders, the benefits include low-cost transactions and increasing acceptance as a payment method. This crypto can be used for donations, tips, and even purchases from certain businesses.

Recent Performances:

Current price: $0.1547 (approximately €0.1458)

Percentage drop (1 day): -10.16%

Market capitalization: $22.68 billion (approximately €21.39 billion)

Rank on CoinMarketCap: #8

📈 Bitcoin on Fire: Towards a Historic Bull Run Before the Elections?

The enthusiasm for Bitcoin is experiencing a historic rise, fueled by record inflows into ETFs, particularly those from BlackRock, which recently absorbed nearly $872 million in Bitcoin on its best day.

The ETFs dedicated to BTC, which have accumulated over $43 billion, are particularly attracting retail and institutional investors, with over one million Bitcoins now held by the funds. This context is reinforced by expectations of a Donald Trump victory in the American elections, an openly cryptocurrency-friendly candidate. At the same time, Bitcoin reaches $72,000 before pulling back, and experts are considering a possible breakthrough of $73,800, a threshold that could trigger an additional rally.

The role of expansionary monetary policies and interest rate cuts in this rise is notable, as investors turn to Bitcoin in search of a store of value. The prospect of new institutional decisions, such as Microsoft possibly investing in Bitcoin for its treasury, also contributes to the prevailing optimism.

This economic and political context, combined with increasing institutional interest, suggests that Bitcoin could be on the brink of an unprecedented bull run, marking a new phase of institutional adoption and a renewed confidence in the potential of the asset.

🔗 Read the full analysis here.