Will Microsoft give in to the demand for Bitcoin investment?

Welcome to the Daily Tribune of Thursday, November 7, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, November 7, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

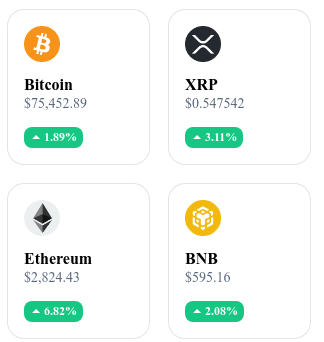

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

Trump and Bitcoin: 4 Promises that could revolutionize crypto under his presidency 🇺🇸

The potential reelection of Donald Trump could well propel Bitcoin as a strategic reserve currency for the United States. In fact, Trump proposes to exploit the potential of Bitcoin in light of the weakening dollar, claiming that "the threat to the dollar comes from the current government's policies, not from Bitcoin." His administration would retain all the Bitcoins that the government holds, thus offering an alternative to traditional reserves in the face of global economic tensions.

Trump also aims to have all remaining Bitcoin mined on American soil, in response to nations like China distancing themselves from the dollar. Furthermore, he would consider lifting the tax on small Bitcoin transactions, facilitating its everyday use and normalizing its role as legal tender, similar to what El Salvador has undertaken. Finally, with the support of big names like Michael Saylor and Elon Musk, a pro-Bitcoin strategy could encourage multinationals to integrate BTC into their reserves and trigger a new surge in its price, potentially bolstered by the adoption of a Bitcoin ETF supported by giants like BlackRock.

Microsoft faces a historic choice: Invest in Bitcoin or risk a shareholder conflict 💼

Microsoft is under pressure as a crucial vote approaches in December, initiated by the National Center for Public Policy Research (NCPPR), which could force the company to assess the opportunity of investing in Bitcoin. In fact, according to the NCPPR, Microsoft has a fiduciary duty to its shareholders and could face legal action if it neglects this opportunity and Bitcoin sees its value explode.

Although the board of directors recommends voting against it, stating that it is already evaluating various assets, the NCPPR deems this approach insufficient, especially considering the rise of MicroStrategy, a champion of the Bitcoin strategy. This debate puts Microsoft in a delicate position and could kick off a trend where large publicly traded companies are encouraged to seriously consider cryptocurrencies in their strategic reserves. If Bitcoin continues to grow, Microsoft might have to reassess its priorities to meet the expectations of its shareholders.

NVIDIA surpasses Apple: AI emerges as the new technological pillar 📈

NVIDIA has just dethroned Apple to become the most valuable company in the world, reaching a market capitalization of $3.43 trillion, driven by its strategic positioning in artificial intelligence. This turnaround symbolizes the growing weight of AI in the markets, contrasting with Apple’s slowdown, whose sales forecasts struggle to convince. By investing heavily in graphic processors and AI infrastructures, NVIDIA has tripled its value in a year, attracting investors convinced that AI will be at the heart of global digital transformation.

Despite competition from giants like Google and Amazon, NVIDIA capitalizes on the demand for GPUs, essential for the development of AI models. This technological advance reshapes economic prospects and positions NVIDIA as a key player in the digital revolution.

SWIFT, UBS, and Chainlink join forces to transform tokenized finance 🚀

SWIFT, UBS Asset Management, and Chainlink have just launched an innovative test to integrate traditional finance and digital finance. This project is part of Singapore's Project Guardian initiative, aimed at making fund management more efficient through blockchain. SWIFT uses its existing payment infrastructure to facilitate hybrid transactions, combining speed and transparency with the help of Chainlink, which acts as a blockchain oracle to connect digital assets to traditional systems.

This test marks a decisive step for investors and financial institutions, offering them the opportunity to diversify their portfolios without relying solely on native crypto solutions. With a tokenized securities market projected to reach $4 trillion by 2030, this advancement shows the major players' willingness to establish themselves in digital finance.

Crypto of the day: Raydium (RAY)

Raydium is a decentralized finance (DeFi) platform built on the Solana blockchain, offering crypto exchange (DEX) services with Automated Market Maker (AMM) features. This technology allows for fast and low-cost transactions, a key added value compared to platforms on Ethereum.

Raydium's native crypto, RAY, is used for staking, governance, and as rewards in its ecosystem, initially distributed to contributors and users of the platform. RAY holders benefit from rewards through staking and transaction fee discounts. RAY can be used to participate in the governance of Raydium, influencing future decisions of the platform.

Recent performances

Current Price: €4.88

24-hour Change: +23.19%

Market Capitalization: €1.29 billion

Rank on CoinMarketCap: #61

Technical analysis of the day: NEAR Protocol (NEAR)

After a marked decline, NEAR is showing signs of stabilization with increasing buying interest. After an initial rebound towards $5.2 followed by a correction to $3.4, NEAR has gradually formed ascending lows, a potential sign of a bullish reversal. Currently around $4.2, NEAR nonetheless finds itself below its key value zones, notably the monthly pivot of $5 and its 50 and 200-day moving averages. Although signs of recovery are visible, the cryptocurrency remains in an uncertain position, with a slight divergence in cumulative sell orders volume.

In the NEAR/USDT derivatives market, buying interest persists, despite a divergence in CVD, showing a balance between buyers and sellers. Notable liquidation zones, located around $4.8, $5.1, and as high as $5.7, represent strategic points that could induce volatility. If NEAR manages to break through $4.5, a test of $5 is conceivable, opening the way for a more pronounced progression. Conversely, if selling pressure intensifies, support might be found at $3.4, or even lower, between $2.7 and $2.45.

🔗 Read the full analysis here.