🧨WLFi, the crypto project supported by the Trump family, prepares an airdrop

Welcome to the Daily Tribune of Wednesday, April 9, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, it’s Wednesday, April 9, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

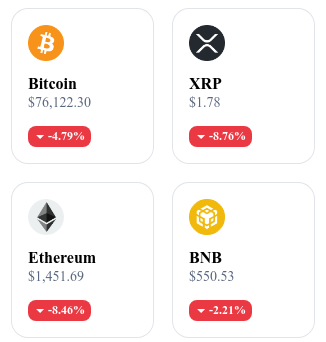

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

Pakistan appoints CZ to oversee the rise of cryptos

Pakistan entrusts Changpeng Zhao (CZ), former CEO of Binance, with a strategic role within the National Crypto Council. He will oversee regulation, modernize blockchain infrastructure, and attract foreign capital to a country already ranked 9th in crypto adoption in Asia.

James Murphy demands that the USA reveals what they know about Satoshi Nakamoto

Lawyer James Murphy is suing the US government to obtain evidence of a meeting between the DHS and Satoshi Nakamoto in 2019. He is requesting official documents regarding this supposed meeting, which could disrupt the global crypto ecosystem.

Coinbase and Uniswap invited to a SEC roundtable on crypto regulation

The SEC is organizing a roundtable on April 11 with Coinbase, Uniswap, the NYSE, and other players to discuss appropriate regulation for crypto trading. The goal: to create a clear and fair framework that protects investors without hindering innovation.

WLFI, supported by the Trump family, prepares an airdrop for its stablecoin USD1

WLFI will launch a test airdrop of its stablecoin USD1 to its token holders on Ethereum. The project, politically backed by the Trump family, raises questions about its governance and regulatory alignment.

Today's crypto : Pendle (PENDLE)

Pendle is a decentralized finance (DeFi) protocol that allows users to tokenize and trade the future yields of their assets. By separating the principal and the interests from the underlying assets, Pendle offers increased flexibility in yield management, enabling investors to sell their future interests for immediate liquidity or to buy fixed-rate yields. This innovative approach opens up new opportunities for risk management and yield optimization within the DeFi ecosystem.

The native token of Pendle, PENDLE, is primarily used for the governance of the protocol. PENDLE holders can propose and vote on modifications to the protocol, thereby influencing its future development. Additionally, the token can be staked to earn rewards, incentivizing users to actively participate in the ecosystem.

Recent performance:

Current price: $2.90 USD

24-hour change: -3.65 %

Market capitalization: approximately $468 million

Rank on CoinMarketCap: #100

Bitcoin hit by the 104% war: The Sino-American escalation alarms the markets

The trade war between the United States and China has crossed a new threshold of severity. After Donald Trump's announcement of historic tariffs of 104% on Chinese imports, Beijing retaliated by imposing 84% tariffs on American products. This tariff confrontation triggered without clear warning shakes the global trade order. Bitcoin, like traditional markets, violently absorbs the shock. The digital asset briefly plunged below $77,000 before cautiously rising, in a climate where uncertainty prevails over rationality.

A powerful Chinese response and a disoriented global market

The implementation of Trump's 104%, followed a few hours later by a Chinese tariff counterattack, triggered an immediate shockwave. Beijing, which was already applying rates of 34%, announced a rise to 84%, while warning that it had the means to continue the trade fight. The Chinese currency, under pressure, saw the offshore yuan hit a historic low, forcing the central bank to limit dollar purchases by public banks to contain depreciation.

In the financial markets, the S&P 500 suffered its steepest drop since the 1950s, while the dollar weakened against major currencies. Treasury bonds, typically sought during crises, were also abandoned, a sign that investors are turning away even from assets considered the safest. Europe's response was swift: the European Union is poised to activate similar countermeasures on a wide range of American products.

In this explosive climate, cryptos, often perceived as alternative assets in times of crisis, have not escaped the turmoil. Over 100,000 positions were liquidated on Bitcoin, resulting in over $300 million in losses following the latest US announcements.

Bitcoin caught between immediate fragility and potential strategic refuge

Despite this pressure, some analysts believe that Bitcoin could ultimately benefit from the disorganization of traditional markets. As confidence in major currencies and financial institutions erodes, Bitcoin is regaining its primary function: that of a decentralized value, not exposed to the decisions of a state. As recession looms and monetary policies become more erratic, the digital asset could emerge as a hedge against the widespread devaluation of fiat currencies.

Nevertheless, in the short term, prospects remain fragile. The technical support zone between $58,000 and $68,000 is once again mentioned by several observers, although some see it as an opportunity for a low-price accumulation phase. The Fed's position, now trapped between the need to contain inflation and the need to cushion a global crisis, will strongly influence market developments in the coming weeks.

China's response to the 104% imposed by Washington transforms a commercial confrontation into a systemic shock. Global markets are entering a phase of extreme instability, and Bitcoin finds itself at a crossroads: weakened by immediate panic but potentially strengthened by its role as an alternative to strained monetary systems. This new episode marks the beginning of a sequence where the global economy could be profoundly reshaped — and where cryptocurrencies will have to prove their resilience more than ever.