⚡ XRP: A strong comeback or a passing illusion?

Welcome to the Daily Tribune of Tuesday, January 28, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, it is Tuesday, January 28, 2025, and like each day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

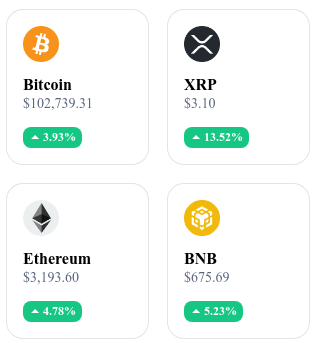

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

📉 Unexpected collapse of Bitcoin below $100,000

Bitcoin recorded a brutal drop yesterday, January 27, 2025, falling below the $100,000 mark to reach $98,800 at the beginning of the day. This decline is attributed to profit-taking ahead of the upcoming Federal Open Market Committee (FOMC) meeting, scheduled for January 28 and 29, where no interest rate cuts are expected. At the same time, the announcement by DeepSeek, a Chinese company, of a powerful economic AI model has heightened concerns about a possible overvaluation of American tech companies, impacting market sentiment.

The drop in Bitcoin was accompanied by a fall in the S&P 500 and Nasdaq 100 indices, along with an increase in put options anticipating a continuation of the bearish trend. BTC rose at the end of the evening and stabilized around $102,000.

🐾 XRP: The rebound of the dead cat

The cryptocurrency XRP is making a comeback despite its alleged obsolescence in the face of technologies like Bitcoin's Lightning Network. XRP, historically praised for its fast and low-cost transactions, faces the "blockchain trilemma," where decentralization and security are often sacrificed for speed. Unlike Bitcoin, which prioritizes decentralization with its small blocks, XRP claims 1,500 transactions per second, but remains centralized and vulnerable.

With the development of the Lightning Network, enabling instant and nearly free Bitcoin transactions, XRP's utility fades further. Despite this, XRP persists, buoyed by aggressive promotion and controversial redistribution practices by its creators.

📊 Too many tokens: Altcoins saturate the market

The crypto market is facing an unprecedented explosion of tokens, with over 36.4 million active assets in circulation compared to just 3,000 in 2017-2018, according to Dune Analytics. This abundance disrupts traditional altseasons, where altcoins like Ethereum, XRP, and Litecoin recorded spectacular performances.

Analysts like Ali Martinez and Alex Krüger point out that massive supply now exceeds demand, limiting the widespread rises of altcoins to very short periods. At the same time, the proliferation of memecoins and non-viable projects complicates asset selection. However, some experts like Michaël van de Poppe believe that utility-driven and robust tokens, backed by solid use cases, will attract institutions.

💸 Trump shakes up crypto ETPs with $1.9 billion influx

Donald Trump's recent pro-crypto decree has triggered a massive influx into exchange-traded products (ETPs), with an impressive total of $1.9 billion. Bitcoin captured the majority of these flows, accounting for 92%, equivalent to $1.6 billion, reinforcing its status as a leader with a record price of $109,000 recently reached. Short Bitcoin ETPs, betting on a price decrease, also recorded $5.1 million, reflecting the market's volatility.

Altcoins, though lagging, continue to attract inflows, with Ethereum garnering $205 million over the week, followed by players like Solana, Chainlink, and Polkadot. Meanwhile, giants like BlackRock dominate the inflows ($1.5 billion), while Grayscale suffers massive outflows. Trump's explicit support for crypto initiatives, coupled with his opposition to central bank digital currencies (CBDCs), redefines the American crypto landscape, creating opportunities for investors despite the challenges.

Crypto of the day: Hedera (HBAR)

Hedera stands out with its Hashgraph consensus technology, which is faster, cheaper, and more environmentally friendly than traditional blockchains. It offers solutions tailored to businesses thanks to its decentralized governance system, composed of giants like Google, IBM, and Boeing.

The native crypto, HBAR, fuels transactions, secures the network via staking, and confers governance rights. Holders benefit from staking rewards without complex conditions, making participation in the network accessible to all. Its applications include smart contracts, token creation, and solutions for businesses while respecting privacy standards.

Recent Performances

Current price: €0.3165

24h change: +5.91%

Market capitalization: €12.11 billion

Rank on CoinMarketCap: #18

🚀 2025: A pivotal year for Bitcoin, Solana, and XRP due to historic initiatives and a resurgence of confidence

The USA is considering the creation of a strategic Bitcoin reserve (SBR), granting Bitcoin unprecedented institutional recognition.

If this proposal materializes, it could solidify Bitcoin's status as a strategic asset, attracting massive investments and increasing its demand. This initiative could also extend to other cryptos like Solana and XRP, offering increased legitimacy to these assets. This project could potentially encourage other nations to adopt similar policies, transforming Bitcoin and these other cryptos into pillars of the global economy.

The current economic context, marked by historically low interest rates, favors investments in risk assets like cryptos. Investors, seeking superior returns, are turning to Bitcoin, Solana, and XRP as traditional placements lose their appeal. This global movement is amplified by similar monetary policies in Europe and Asia, creating a conducive environment for the rise of cryptos.

The year 2025 could mark a decisive turning point for cryptos, thanks to a resurgence of investor confidence following the previous bearish cycle. The convergence of factors such as pro-crypto government initiatives, favorable monetary policy, and growing institutional adoption could stimulate the growth of major cryptos. These developments will not only enhance their valuation, but also position these assets as strategic elements in the global economy.