🚨 XRP and LINK in disarray, RLUSD gains strength

Welcome to the Daily Tribune of Thursday, January 9, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, January 9, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

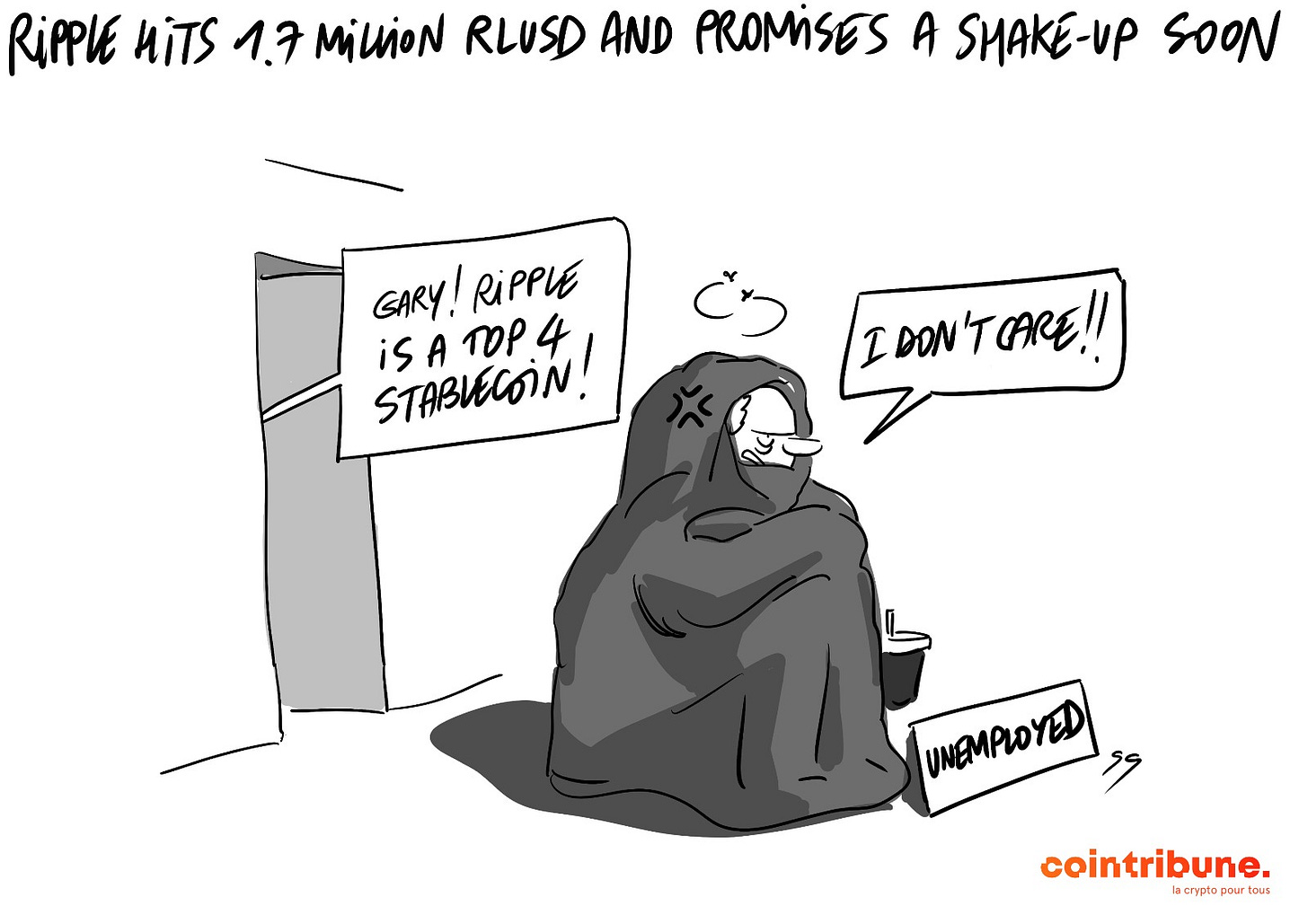

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🚀 Bitcoin: Massive adoption expected by 2025

Fidelity Digital Assets anticipates massive Bitcoin adoption by 2025, which should mark a strategic turning point for nation-states, central banks, and sovereign funds. Motivated by the success of examples like Bhutan and El Salvador, these actors could integrate BTC into their national reserves to counter inflation, currency depreciation, and budget deficits. A discreet race to accumulate Bitcoin may already be underway, with each country seeking to maximize its reserves without affecting its price.

Fidelity highlights the rise of tokenization as a key application, with an on-chain value potentially doubling in a year and reaching 30 billion dollars. This enthusiasm paves the way for a new era for digital assets, anchored in decentralized finance and technological innovations.

💥 XRP and LINK: The fall despite a strategically ambitious alliance

Ripple and Chainlink, partners on an ambitious project around the Ripple USD (RLUSD) stablecoin, could not avoid the significant drop in the prices of their respective tokens. This stablecoin, designed to provide robust cross-border payment solutions, relies on reliable data thanks to Chainlink oracles.

It aims to attract users of the XRP Ledger and Ethereum blockchains, particularly in DeFi applications such as lending and decentralized exchanges. Despite these promising innovations, XRP fell by 6%, reaching $2.28, and LINK lost over 11%, settling at $20.5. These declines reflect a more general correction in the crypto market, despite a favorable long-term momentum for XRP, which has seen its value increase by 300% in recent months, and optimistic outlooks for Chainlink in the DeFi ecosystem.

🌍 Bitcoin: A potential reserve for the Czech National Bank

The governor of the Czech National Bank, Aleš Michl, is considering integrating Bitcoin into national reserves alongside gold and foreign currencies. Although this decision is still under review and needs approval from a cautious board, it reflects a gradual opening of traditional institutions toward cryptocurrencies. This approach is part of a global trend, where similar initiatives, such as the "Bitcoin Act" in the United States, seek to use BTC as a strategic reserve.

However, Bitcoin's volatility remains a sticking point for many decision-makers, even if some analysts anticipate explosive valuation of crypto in the long term. If adopted, this strategy could redefine the standards for asset reserves for central banks.

⚠️ Cryptos in disarray in the face of a tense economic context

The crypto market has experienced a brutal drop, which has pushed Bitcoin below $100,000 and Ethereum below $3,400. This correction is fueled by global economic tensions: rising U.S. bond yields, rigorous monetary policy from the Fed, and inflationary pressures related to a resilient job market. High bond rates divert capital from risky assets like cryptos, while prospects for rate cuts by the Fed are diminishing.

Meanwhile, factors like the U.S. budget deficit and the Treasury's liquidity needs increase uncertainty. This volatility pushes some investors to liquidate their positions, while others see a buying opportunity. With a 5% drop for Bitcoin and an 8% drop for Ethereum, this correction phase highlights the heightened sensitivity of the crypto market to economic decisions.

Crypto of the day: AI16z ( AI16z )

AI16z is an innovative crypto project built on the Solana ecosystem, leveraging the power of artificial intelligence to revolutionize the venture capital sector. It is based on a DAO governed by AI agents, aiming to optimize investment decisions through collective intelligence.

The native crypto, also called AI16z, is used to participate in DAO votes and access exclusive services. Distributed through a combination of private sales and public exchanges, it offers holders governance rights, participation-based rewards, and usage in decentralized applications focused on artificial intelligence.

Recent performances

Current price: €1.48

24h change: -18.74%

Market capitalization: €1.63 billion

Rank on CoinMarketCap: 79

Ethereum to $12,000!

Ethereum (ETH) could reach $12,000 by 2025 due to two major levers.

On one hand, a pro-crypto Trump administration could provide a favorable regulatory environment and attract institutional investors towards ETH. On the other hand, the forthcoming technological update "Pectra", scheduled for the first quarter of 2025, promises to improve the scalability and efficiency of the Ethereum network. These developments should strengthen Ethereum's dominant position in the crypto ecosystem and intensify its adoption, particularly through increased integration of real-world assets (RWA) and capital influx via ETFs.

The crypto options market reflects a bullish sentiment, with strong growth in demand for ETH call options, outpacing put options by 250%. However, this potential could be compromised if the Ether ETF fails to capture institutional interest. Additionally, Ethereum faces increasing competition from alternative layer 1 blockchains, which offer higher risk and reward potential, thus threatening its market share.

The year 2025 looks pivotal for Ethereum. If the identified catalysts – the Trump administration and the Pectra update – materialize, Ethereum could set new records. Conversely, the absence of institutional support or strong competition could hinder its growth and keep ETH below $2,000.