💥XRP outperforms Ethereum for the first time in 6 years

Welcome to the Daily Tribune of Friday, April 18, 2025 ☕️

Hello Cointribe! 🚀

Today, we are Friday, April 18, 2025, and as every day from Tuesday to Saturday, we summarize the latest news from the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

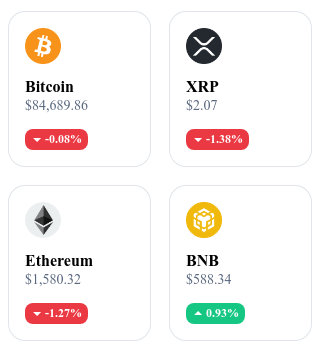

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🤖 AI tokens and memecoins dominate trends in 2025

AI-related tokens and memecoins capture 62.8% of investors' attention in the first quarter of 2025, according to CoinGecko.

🌐 Binance advises countries on the creation of Bitcoin reserves

Richard Teng, CEO of Binance, reveals that the platform assists several governments in establishing strategic Bitcoin reserves and developing regulatory frameworks.

📊 XRP outperforms Ethereum for the first time in 6 years

XRP surpasses Ethereum in market capitalization for the first time in six years, marking a turning point in the ranking of cryptocurrencies.

🇷🇺 Russia prepares a national stablecoin to replace USDT

In response to sanctions and Tether blockages, Russia plans to develop a national stablecoin backed by other currencies to reduce its dependence on foreign stablecoins.

Crypto of the day: Artificial Superintelligence Alliance (FET)

Artificial Superintelligence Alliance (ASI) was born from the strategic fusion of three major decentralized artificial intelligence projects: Fetch.ai, SingularityNET (AGIX), and Ocean Protocol (OCEAN). This alliance aims to build a global, transparent, and open-source ecosystem for the development and adoption of AI. Fetch.ai provides its infrastructure based on autonomous agents, SingularityNET contributes through its advances in AI research, while Ocean Protocol provides robust solutions for secure data sharing. Together, they aim to democratize access to artificial intelligence while reducing dependence on centralized tech giants.

The token FET remains the cornerstone of this unified ecosystem. It is used to access network services, compensate resource providers, and actively participate in decentralized governance.

Recent performance:

Current price: 0.5085 USD

24-hour change: +8.8%

Market capitalization: around 1.32 billion dollars

Rank on CoinMarketCap: #55

The dollar wobbles, Bitcoin in ambush: Towards a paradigm shift in monetary policy?

As the US dollar faces mounting pressure due to geopolitical tensions and economic uncertainties, Bitcoin is positioning itself as a credible alternative. Investors, shaken by the volatility of traditional markets, watch for signals indicating a possible rise of the flagship cryptocurrency.

The dollar under pressure: a favorable context for Bitcoin

Recent trade tensions between the United States and China have weakened the dollar, with the DXY index close to its historic lows. Meanwhile, gold reaches new heights, surpassing $3,300 per ounce, while Bitcoin remains subdued. However, analysts like those from BitBull and Bitwise believe that dollar weakness could offer Bitcoin a significant revaluation opportunity, reminiscent of the gains seen in 2023.

Towards a rebound of Bitcoin?

On the technical side, Bitcoin shows encouraging signs. Configurations such as a "double bottom" or a "head and shoulders inverted" on hourly charts suggest a possible trend reversal. Analyst Michaël van de Poppe emphasizes the importance of the $87,000 level: a durable breach of this level could open the way to new records by the end of the quarter.

In a context where the dollar shows signs of weakness, Bitcoin could benefit from a renewed interest as an alternative safe haven. Technical signals and macroeconomic analyses converge toward a possible bullish rebound of the cryptocurrency. Investors remain attentive to market developments, ready to adjust their strategies based on emerging opportunities.