📉 XRP plunges 12% 💥 Ethereum falters: Surprise correction?

Welcome to the Thursday, July 24, 2025 Daily Tribune ☕️

Hello Cointribe! 🚀

Today is Thursday, July 24, 2025 and as every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

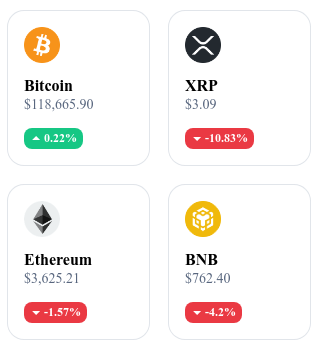

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

💵 Polymarket plans to launch its own stablecoin

Polymarket plans to create an internal stablecoin to capture the revenues generated by the reserves currently backed by Circle’s USDC. No decision has been made yet: the company is also considering the possibility of entering a revenue-sharing partnership with Circle.

🐳 A Cardano whale threatens legal action against IOG

A whale holding more than 6 million ADA has launched a revolt against IOG and Charles Hoskinson, citing financial waste with no tangible returns. Hoskinson responded that he would "resort to the courts" if the accusations continued, and calls for a debate based on the reality of the projects.

📈 Thirteen consecutive days of gains: institutions flock to Ethereum

Ethereum records 13 consecutive days of gains, a remarkable streak accompanied by an influx of 726 million USD via ETFs, and a price peaking near 3,848 USD. This bullish momentum is steadily attracting institutional investors and reinforcing ETH’s role in professional portfolios.

🌍 Bitcoin breaks records with the arrival of Real-World Assets (RWA)

Bitcoin reached a new all-time high as Real-World Assets (RWA) begin to be widely integrated into crypto portfolios, illustrating greater market maturity. This evolution shows Bitcoin’s expanding role, now valued both as a store of value and a vehicle for tangible assets.

🌍 We have entered a foreseeable global economic crisis

According to historians Neil Howe and William Strauss, our world has entered a major historical cycle called the "Fourth Turning," characterized by deep crises that occur every 80 to 100 years and revolutionize social and economic systems. This cycle implies the collapse of existing structures, laying the groundwork for radical transformation.

🧠 The foundations of the "Fourth Turning"

The theory proposes an invariable sequence of four phases — prosperity (High), awakening (Awakening), fragmentation (Unraveling), and crisis (Fourth Turning). Historically, these periods coincided with events such as the American Revolution, Civil War, or the Great Depression.

Three key factors drive, according to the authors, the risk of collapse: record global debt since 2008 and dependence on cheap credit; growing political and social fragmentation; and geopolitical tensions between powers such as the United States and China, which could precipitate a global war.

🔻 Probable economic scenarios

Facing imbalances, three outcomes are considered: drastic budget cuts, default, or runaway inflation. Inflation, already underway post-pandemic, could erode savings to the point of triggering authoritarian financial repression to force citizens to hold government assets.

A confrontation in sensitive zones like Taiwan could multiply supply chain disruptions and trigger worldwide panic, exacerbated by growing diplomatic polarization between the West and BRICS countries.

💡 Bitcoin as a potential safe haven

In this unstable context, Bitcoin emerges as a safe asset: decentralized, limited in quantity, and not subject to inflationary policies of central banks, it offers an alternative to protect savings against currency devaluation.

Crypto of the day: Celestia (TIA)

🧠 What innovation? What added value?

Celestia introduces a unique modular architecture by focusing exclusively on data availability and consensus, without transaction execution. Rollup and L2 developers can thus deploy specialized blockchains without building their own backend.

The technology relies on the Cosmos SDK and a Tendermint consensus (PoS), combined with true Data Availability Sampling (DAS), which enables light nodes to verify data presence without downloading every block.

Launched on mainnet October 31, 2023, Celestia offers a specialized network where each rollup can benefit from security and accessibility without infrastructural complexity.

💰 The TIA Token: What utility? What distribution? What advantages?

The TIA token is the core element of Celestia’s economic model:

It funds data publishing on the network, essential for rollups.

It is used for staking, ensuring consensus integrity and incentivizing validators to stay honest.

It supports deployment of modular blockchains, as it is the common currency to access Celestia’s services.

Its distribution helped finance the launch, internal research, and support for developer ecosystems.

This model encourages rapid adoption by teams wishing to create their own secure and lightweight blockchains.

📊 Recent performance (July 24, 2025)

Current price: 1.83 $ USD

24h change: –16.90 %

Market capitalization: ≈ 1.29 billion $ USD

CoinMarketCap rank: #70

Circulating supply: ≈ 720.96 million TIA

24h trading volume: ≈ 216 million $ USD

XRP drops 12%, Ethereum slides: correction or warning signal?

A bearish wind blows through crypto markets: Ethereum and XRP show notable losses, plunging in a context where no obvious catalyst emerges. This sudden retreat raises questions about underlying market dynamics.

Ethereum and XRP free-fall, without apparent reason

The last few hours have been tough for altcoins. Ethereum fell 4%, down to 3,565 $, while XRP gave up 12.7%, reaching 0.305 $. This drop happens amid a general correction, despite no specific macroeconomic news or sector event justifying such a decline.

The market seems to slide smoothly, but without clear cause. Several observers agree to qualify this decline as a technical correction rather than a reaction to an announcement or precise data.

Fragile market or strategic capital redeployment?

Beyond the numbers, this drop questions the current positioning of capital in the crypto universe. With the recent reduction in volatility and absence of clear bullish signals, part of investors may have opted for discreet profit-taking, temporarily draining the market of its upward momentum.

The depth of XRP’s correction, harsher than Ethereum’s, may also reflect increased sensitivity to technical moves and concentration of orders on fragile support levels. Added to this is the possible influence of trading algorithms, which can cascade and amplify bearish moves by triggering conditional orders.

In such a reactive market, the absence of catalyst becomes itself a factor for caution, or even temporary distrust. It remains to be seen whether this setback will settle permanently or will only be a temporary readjustment within an overall bullish trend.