📉XRP plunges after a lightning-fast Bitcoin pump and dump ⚡

Welcome to the Daily for Wednesday, December 17, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 17, 2025, and just like every day from Tuesday to Saturday, we’re bringing you a recap of the last 24 hours of must-know crypto news!

But first…

✍️ Cartoon of the day:

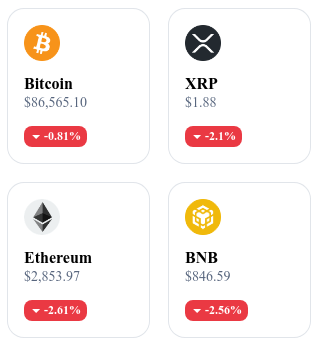

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

Spain officially defines the MiCA transition period before full enforcement

The Comisión Nacional del Mercado de Valores (CNMV) has published a FAQ to clarify how the European MiCA regulation will be implemented in Spain. The regulator sets the transition period for crypto service providers until December 30, 2025. The document outlines authorization requirements, eligibility criteria, and conduct rules for affected actors.

👉 Read the full article

⚔️ Solana withstands historic DDoS attack without network outage

Solana reports it has endured one of the largest distributed denial-of-service (DDoS) attacks ever recorded on a decentralized system. The network maintained its performance without interruption or visible downtime during the assault, according to the Solana team. The attack occurred over the past week but did not affect node operations or on-chain transactions.

👉 Read the full article

⚡ Bitcoin’s Lightning Network sets new capacity record above 5,600 BTC

The Lightning Network, Bitcoin’s off‑chain payment layer, has reached a total capacity of 5,606 BTC, surpassing its previous peak, following liquidity inflows from major exchanges. The number of Lightning nodes stands at 14,940, slightly below earlier highs, while the number of channels has reached 48,678. The Taproot Assets v0.7 update introduces new features, such as reusable addresses and support for additional asset types.

👉 Read the full article

💰 BitMine’s Ethereum reserves hit $11B after major acquisition

BitMine added 48,049 ETH to its treasury through a transaction worth approximately $140M, confirmed by on‑chain data and market observers. This brings the total market value of its Ethereum holdings to around $11.6B. The move follows a previous $320M investment in ETH, further consolidating Ethereum’s place in the company’s treasury.

👉 Read the full article

Crypto of the Day: Quant (QNT)

🧠 Innovation and Value Proposition

Quant is building an interoperability infrastructure aimed at enterprises, financial institutions, and public sector actors. The project is powered by Overledger, a system that enables multiple blockchains to connect and interact without altering their underlying protocols.

This approach allows the development of multi-chain applications capable of interfacing with distributed ledgers, traditional banking systems, and existing databases. Quant focuses primarily on institutional use cases: interbank payments, tokenized securities, data management, and critical infrastructure. Its strategy stands out with a clear B2B orientation and a gradual rollout in regulated environments.

💰 The Token

The QNT token serves as an access key to the Overledger ecosystem. Enterprises and developers use QNT to pay for licenses, unlock services, and ensure secure usage of the network.

Its economic model is based on a fixed supply, which reinforces the token’s scarcity. The functional demand for QNT is directly linked to how widely Overledger is adopted across professional environments. As institutional integration grows, so does the need for QNT.

📊 Real-Time Performance (CMC)

💵 Current price: €64.99

📈 24h variation: +1.52%

💰 Market cap: €784.64M

🏅 CoinMarketCap rank: #62

🪙 Circulating supply: 12.07M QNT

📊 24h trading volume: €15.33M

XRP Wavers After Bitcoin’s Pump and Dump Shake-Up

The crypto market was rocked by a dramatic event: Bitcoin’s price briefly surged past $90,000 before crashing back down just as fast — dragging several altcoins with it, including XRP, which dropped 5% in a matter of hours. This sharp volatility highlights both the inherent instability of crypto assets and the lingering risks of market manipulation.

Why did XRP fall after Bitcoin’s brutal swing?

On December 17, 2025, Bitcoin briefly broke above the $90,000 threshold before plummeting below $87,000, sending shockwaves through the entire market. This rapid rise and sudden drop resemble a classic “pump and dump” — a well-known phenomenon in speculative markets where an asset’s price is artificially inflated before being rapidly sold off, causing a steep decline.

In the wake of this move, XRP lost around 5%, breaking a key technical support level at $1.92. This triggered a cascade of liquidations in derivatives markets, accelerating the drop. The use of leverage by many traders amplified the correction, turning what could have been a minor pullback into a significant crash for some investors.

While Bitcoin and XRP differ in their use cases and fundamentals, crypto markets remain highly correlated. When the leading asset makes a sharp move, altcoins tend to follow — often with greater intensity.

What this episode reveals about crypto market dynamics

Events like these are not new. They serve as a reminder that despite growing adoption, crypto markets are still vulnerable to extreme speculative behavior. Pump and dump activity is made easier by several factors: thin liquidity on some platforms, concentrated order books, and investors who are highly reactive to technical signals.

Still, not all signals are flashing red. Grayscale, a major player in crypto investment, continues to maintain a bullish outlook heading into 2026, betting on institutional adoption and structurally strong market narratives. This gap between short-term chaos and long-term optimism is a hallmark of emerging markets.

Analysts are also closely watching the broader macroeconomic context — particularly the Chinese yuan’s valuation, which could impact capital flows into Bitcoin. Regulation is another key factor: the U.S. Department of Justice recently seized large amounts of crypto assets, signaling growing regulatory scrutiny of the space.