Hello Cointribe! 🚀

Today is Saturday, 29 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

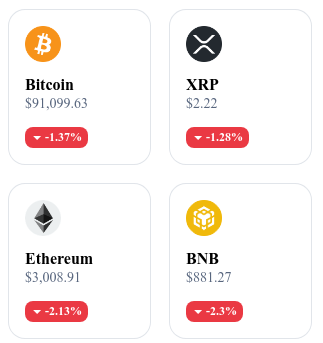

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

⚖️ Do Kwon pleads guilty and requests a reduced sentence after the Terra collapse

Do Kwon, former founder of Terraform Labs, has pleaded guilty in the United States to fraud charges linked to the collapse of the Terra-Luna ecosystem, responsible for around $40B in losses. He is asking that his sentence be limited to 5 years in prison, while prosecutors were seeking up to 12 years.

👉 Read the full article

🤝 FC Barcelona’s partnership with a little-known crypto company triggers criticism

The agreement signed between Spanish club FC Barcelona and a controversial crypto firm raises doubts about the rigor behind the selection of the partner and the image risk for the club. Several observers question the credibility and transparency of this company ahead of the official engagement.

👉 Read the full article

⚠️ Market tokenization: the International Monetary Fund (IMF) warns of five major risks not to ignore

The IMF warns about structural dangers linked to market tokenization, including reinforced systemic risks, increased volatility, financial contagion, asset opacity and collateral fragility. The organization calls for robust regulatory frameworks before any large-scale expansion of tokenized markets.

👉 Read the full article

🌍 Crypto industry mobilizes $32M to help Hong Kong disaster victims

A $32 million fund has been set up by players in the crypto sector to support victims of recent disasters in Hong Kong, combining stablecoin donations and logistical assistance.

👉 Read the full article

Crypto of the day: Conflux (CFX)

🧠 Innovation and added value

Conflux is a Layer-1 blockchain designed to offer high scalability without compromising security. It relies on a unique mechanism called Tree-Graph, a hybrid structure that combines the security of Proof-of-Work with the efficiency of parallel block processing.

This approach allows the network to handle a higher transaction throughput than traditional blockchains while maintaining fast and stable finality.

Conflux also stands out for its international approach, particularly in Asia, where it benefits from a strategic positioning among companies and institutions seeking a reliable and regulated Web3 infrastructure.

The network supports smart contracts, cross-chain interoperability and decentralized applications across various sectors: finance, NFTs, gaming and enterprise solutions.

💰 The token

CFX is the native token of the Conflux network. It is used to:

• pay transaction fees;

• participate in staking and secure the network;

• interact with smart contracts;

• incentivize validators through rewards.

Thanks to its Tree-Graph architecture and EVM compatibility, the CFX token powers an ecosystem where developers can deploy high-performance dApps quickly with low execution costs.

The economic model of CFX is based on usage growth (transactions, staking, dApps) and on network expansion in regions where Conflux positions itself as a Web3 solution compliant with regulatory frameworks.

📊 Real-time performance (CMC)

💵 Current price: $0.08141

📉 24h change: –3.67 %

💰 Market cap: $420.02M

🏅 CoinMarketCap rank: #106

🪙 Circulating supply: 5.15B CFX

📊 Trading volume (24h): $16.91M

XRP rises as traders flee: a crypto reserved for pros?

The price of XRP is climbing, but traders are disappearing — a puzzling paradox is emerging around this emblematic cryptocurrency. Behind this quiet rise may lie a deep transformation of the crypto market, where volatility gives way to a more stable institutional logic.

A misleading price increase?

In recent days, XRP has shown a notable increase, with a price of $2.22, up 0.85% over 24 hours. This bullish movement is accompanied by a 13.76% gain over the week, pushing its market cap to around $133.6 billion. At first glance, these figures point to renewed interest in the asset. Yet, in the background, one technical indicator is moving in the opposite direction: trading volume has contracted by nearly 32%.

This contrast between price and volume can be confusing. Traditionally, a price increase paired with falling volume is interpreted as weakness in the upward trend. In other words, the market seems to be rising with few participants. Is this a sign that investors are losing interest in XRP despite its rebound?

Some analysts believe the opposite. They see a shift in the type of participants active on the market. The drop in volume would not signal declining interest, but a change in market profile: fewer active day-to-day traders, more long-term investors.

Details of a shift toward an institutional market

The XRP ecosystem is now benefiting from a dynamic different from that seen in previous cycles. The rise of ETFs tied to digital assets, combined with a more mature regulatory environment, is encouraging new types of investors. These players — often institutional — operate with less visible trading patterns. They move large amounts, but far less frequently than retail traders.

This evolution partly explains declining activity on exchanges. Volume no longer reflects overall interest alone, but also the mode of market engagement. While a trader might execute multiple transactions a day, a fund exposed through an ETF holds its positions for extended periods. This change in behavior may give the market a false sense of inertia, while masking structural bullish pressure.

However, this shift is not without risks. A market dominated by strong hands can lack liquidity in the event of a sudden reversal. If institutional investors retreat, the absence of traders to absorb selling could amplify declines. In this sense, the current balance around $2.20 may represent a fragile stabilization zone, whose resilience will depend on the staying power of these new entrants.

The case of XRP highlights a broader phenomenon: the crypto industry is entering a new era. The time of rapid surges driven by collective euphoria seems to be giving way to a more thoughtful, strategic cycle. The behavior of XRP — supported by significant capital flows yet avoided by traders — illustrates this transition.