🚀 XRP: Why October 2025 Could Trigger a Historic Rally 📈

Welcome to the Daily for Friday, October 3, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, October 3, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

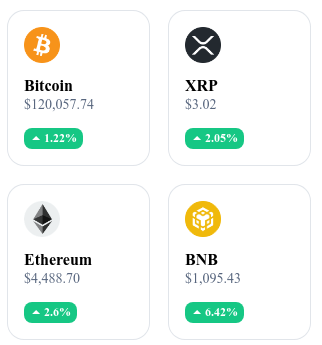

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🤖 OpenAI reaches $500B valuation without IPO

OpenAI has been valued at $500 billion after a secondary sale to private investors. The company thus becomes one of the world’s most valuable tech firms without going through an IPO.

👉 Read the full article

🤖 Bots drive $15.6T in stablecoin volumes in Q3 2025

According to a report, trading bots generated an increase of $15.6 trillion in stablecoin volumes in the third quarter of 2025. At the same time, retail payments in stablecoins hit a record $2.3 trillion.

👉 Read the full article

⚡ Plasma: CEO denies rumors after XPL token crash

Plasma’s CEO publicly denied rumors of bankruptcy that spread after the XPL token dropped more than 45% in 24 hours. He confirmed that the company’s operations continue as normal.

👉 Read the full article

🇸🇪 Bitcoin Reserve: New proposal in Swedish Parliament

Swedish lawmakers have introduced a bill to establish a strategic Bitcoin reserve. The measure is being discussed as a tool for diversification and protection of national finances.

📌 Crypto of the Day: Optimism (OP)

Innovation and Added Value 🧠

Optimism is a Layer-2 solution on Ethereum, based on optimistic rollups. It allows transactions to be executed off the main chain while regularly publishing their data on Ethereum to benefit from its security. This mechanism significantly reduces fees and improves scalability, making dApps more accessible.

Optimism is also at the heart of the Superchain project, a federation of blockchains built on the OP Stack (such as Coinbase’s Base or Unichain), all interoperable and collectively contributing to ecosystem revenues.

The Token 💰

The OP token is primarily a governance tool. Holders participate in decision-making through two chambers: the Token House, which rules on technical developments and incentives, and the Citizens’ House, which manages retroactive public funding for useful projects.

The total supply is capped at 4.29 billion tokens, with about 1.78 billion currently in circulation. OP also helps fuel the ecosystem through Retroactive Public Goods Funding, strengthening community innovation.

Real-Time Performance 📊

💵 Current Price: 0.7169 USD

📈 24h Change: +2.59%

💰 Market Cap: 1,277,790,574 USD

🏅 Rank on CoinMarketCap: #99

🪙 Circulating Supply: 1,778,633,541 OP

📊 Trading Volume (24h): 289,470,000 USD

Regulation, ETFs, and Technical Analysis: The Keys to a Decisive Month for XRP

Fall 2025 may mark a decisive turning point for XRP. Between promising chart structures and major regulatory decisions expected, October crystallizes investors’ hopes. Several technical and fundamental factors converge to make this month a key moment in the evolution of Ripple’s token. Here’s an analysis of the reasons supporting this hypothesis.

A strong support and favorable technical signals

XRP is currently trading within a descending triangle pattern, often interpreted as a potential bullish breakout when breached to the upside. At the base of this structure, a solid support has formed around $2.80, a level that so far has resisted several attempts at breakdown by sellers.

This threshold acts as both a technical and psychological polarity zone, and its resilience fuels optimistic projections. In the event of a confirmed breakout from the triangle with significant trading volume, targets between $3.40 and $3.66 are expected, with a possible extension to $4.20 if momentum remains strong.

These levels are not random: they correspond to intermediate resistances identified on higher timeframes, often monitored by institutional trading algorithms. In short, XRP’s technical mapping suggests a strategic window of opportunity—provided fundamentals reinforce this scenario.

The regulatory catalyst: XRP ETFs under SEC scrutiny

The chart dynamics could be amplified by a very different factor: the U.S. SEC’s decisions regarding the approval (or not) of spot XRP ETFs, expected in October. Several critical deadlines are scheduled between October 18 and 25, 2025—a period during which regulation could cement major progress for the XRP ecosystem.

Even a partial approval fuels expectations of incoming institutional capital flows. The precedent of the XRPR/Osprey ETF launch, which recorded nearly $38 million in volume on its first day, shows the market’s latent interest in XRP-related products. This level of engagement is a strong signal in favor of future large-scale adoption, at a time when asset tokenization and crypto diversification are gaining traction in institutional portfolios.

The impact of an ETF goes far beyond accessibility: it brings regulated exposure, improved liquidity, and institutional legitimacy. For XRP, SEC validation would mark a transition to a new status within financial markets.

October 2025 brings together a rare alignment of technical and fundamental factors for XRP. Between bullish patterns, critical thresholds, and institutional expectations fueled by SEC decisions, everything suggests that this month will play a structural role in the token’s trajectory. If signals are confirmed, XRP could not only break through key resistances but also establish itself as a long-term institutionalized asset in crypto markets.