🪙 The SEC Ends Legal Uncertainty Around PoW Mining

Welcome to the Daily Tribune of Saturday, March 22, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, March 22, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

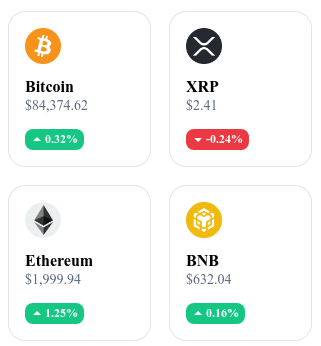

A quick look at the market…

🌡️ Temperature:

Partially Sunny 🌤️

24h crypto recap! ⏱

The SEC Clears Legal Uncertainty Surrounding PoW Mining

The SEC clarifies that Proof-of-Work (PoW) mining is not considered a securities offering, relieving miners from legal risks. The crypto industry welcomes this decision as a victory.

BlackRock Warns of Major Weakness in Its Ethereum ETF

The lack of staking in BlackRock's Ethereum ETF reduces its attractiveness, despite an impressive start with $7 billion in assets under management. Institutional investors are cautious due to yield limitations.

Russia Wants to Create a Crypto Fund with Seized Assets: A Shocking Project!

Russia is considering converting seized cryptos into public funds to finance social and educational projects. The central bank remains skeptical, fearing volatility and instability of digital assets.

Nearly Half of Crypto Experts Bet on a Surge in AI Tokens

44% of experts believe that AI-related tokens could skyrocket in 2025, despite recent market turbulence. Growing adoption and more concrete use cases support this optimism.

Today's Crypto: Immutable (IMX)

Immutable is a layer 2 solution for non-fungible tokens (NFTs) on the Ethereum blockchain. It aims to eliminate Ethereum's limitations, such as low scalability, poor user experience, lack of liquidity, and slow developer experience. Users benefit from instant exchanges and massive scalability while enjoying zero gas fees for NFT creation and trading, without compromising user or asset security.

Immutable’s native token, IMX, is used for various functions within the ecosystem. IMX holders can participate in protocol governance, pay transaction fees, and receive rewards for their contribution to the network's security and growth. The initial distribution of IMX was conducted at its launch, with a total supply of 2 billion tokens.

Recent Performances

Current Price: $0.5753 (about €0.54)

24-hour Change: +5.2%

Market Capitalization: $1.02 billion

Rank on CoinMarketCap: #64

Ripple Wins Its Case Against the SEC, But the Market Remains Unmoved

After more than four years of legal battle, Ripple has finally gained the upper hand against the Securities and Exchange Commission (SEC), which decided to drop its lawsuit on March 19, 2025. Ripple’s CEO, Brad Garlinghouse, hailed this decision as a "resounding victory." Yet, despite the significance of this outcome, the crypto market has hardly reacted.

Why Didn’t This Victory Trigger a Bull Rally?

1. A Widely Anticipated Victory

The crypto community had already priced in this outcome for several months. Indeed, in July 2023, a federal judge ruled that XRP sales on secondary platforms did not constitute a securities offering. This decision had considerably weakened the SEC's position, making the dismissal of the lawsuit almost predictable. Investors had already adjusted their positions based on this outcome, so the official confirmation did not have the expected impact.

2. An Unfavorable Macroeconomic Context

Despite this good news, the market conditions remain unfavorable for bull rallies. Global economic uncertainty and geopolitical tensions dampen investor enthusiasm. Additionally, the lack of bullish momentum for other major cryptocurrencies, notably Bitcoin (+2.2%) and Ethereum (+6.6%), limits the spread of a positive overall sentiment.

3. Ongoing Cautious Expectations on XRP

Although the legal victory is a relief, it does not automatically guarantee increased adoption of XRP. Ripple’s reputation has been tarnished by this long legal saga, and some institutional investors remain cautious about a massive return to this token. Furthermore, technical analyses indicate that XRP could still face a correction towards $1.28 if buying volumes do not follow.

What Long-term Impacts?

This legal victory could, however, restore confidence among institutional investors in the medium term. Ripple, now free from this regulatory sword of Damocles, could regain strategic partners and re-integrate into U.S. exchanges. Moreover, this decision prevents the SEC from setting a negative regulatory precedent for other cryptocurrencies, which is a positive point for the entire sector.