💥 Tsunami in the crypto market: One billion dollars vanished in 24 hours!

Welcome to the Daily Tribune Thursday, March 7, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, March 7, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

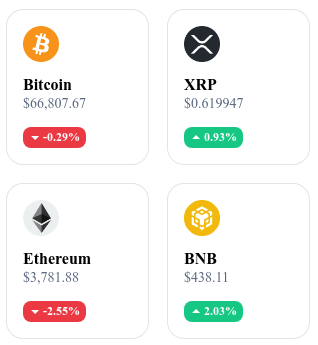

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️:

24-hour crypto summary ! ⏱️

🌀 Binance in turmoil: A wave of layoffs is sweeping through!

In the midst of a fierce battle against regulatory authorities, Binance US is forced to make drastic cuts, laying off 200 employees. This radical decision marks a dark turning point for the company, once a symbol of success in the blockchain universe. Director of Operations, Christopher Blodgett, describes this action as almost fatal, highlighting the colossal challenges and uncertainties that hover over the platform's future. Every eliminated job resonates as an echo of the intense pressure faced by Binance US and illustrates the severity of the relentless regulatory assault led by the US Securities and Exchange Commission (SEC).

In the face of this relentless institution, Binance is not planning to sit idle. The company has launched a major legal counterattack, enlisting the services of top lawyers to challenge the accusations against it. This legal battle, far from being a mere exchange of blows, is shaping up to be a trench warfare that could determine the future of the cryptocurrency sector. The 200 cut positions are thus just collateral damage in a conflict of epic proportions, the outcome of which could redefine the landscape of the crypto industry as a whole.

Rather than seeing this as a mere confrontation, it is essential to recognize the opportunity for the industry to collaborate with regulators to define standards that support innovation while protecting investors. This challenge could accelerate the adoption of more transparent and responsible blockchain technologies, laying the foundation for a more mature and institutionally viable crypto ecosystem.

💥 Financial tsunami: One billion dollars swallowed in 24 hours!

The crypto scene has just experienced one of its most tumultuous days, with over one billion dollars liquidated in just 24 hours. This financial wave swept away the hopes of 318,221 traders, illustrating the extreme volatility and relentless nature of the market. Bitcoin and Ethereum, the two giants of the crypto space, were on the front lines, losing over 340 million and 202.44 million dollars respectively. A particularly remarkable event was the record liquidation of 11.35 million dollars on Bitmex in a single LINKUSD order.

This brutal correction can be perceived by more seasoned investors not as a setback, but as an opportunity for strategic repositioning. In this world where fortunes and disillusionment coexist, this recent financial shake-up reminds us of the importance of caution and strategy in the quest for prosperity in the crypto universe.

This massive liquidation reflects the inherent volatility of the cryptocurrency market, but also highlights the fragility of investor sentiment and the excessive leverage effect in crypto trading.

🚀 Bitcoin Spot ETF: A new horizon of 9.5 billion dollars!

The Bitcoin Spot ETF market has exploded, reaching unprecedented levels with over 9.5 billion dollars in transactions in a single day. This phenomenal performance aligns with the bullish momentum of Bitcoin, which recently reached its highest level since its 2021 record. Three ETFs, in particular, have captured market attention: BlackRock's IBIT, Grayscale's GBTC, and Fidelity's FBTC, each surpassing 2 billion dollars in daily trading volume.

This enthusiasm for Bitcoin Spot ETFs seems to have a notable impact on the valuation of Bitcoin, although analysts remain cautious about directly attributing the recent price surge to this single dynamic. The price of Bitcoin has fluctuated significantly, and these price movements have further encouraged investors to turn to traditional stock markets to trade ETFs.

The explosion in trading volumes of Bitcoin Spot ETFs, with figures surpassing 9.5 billion dollars in a day, indicates an increasing interest from institutional investors in Bitcoin and reflects the legitimization of Bitcoin as a fully-fledged asset class among more traditional investors. In the long term, this could facilitate greater integration of cryptocurrencies into diversified investment portfolios and increase market stability through the entry of institutional capital.

🔝 Bitcoin surpasses the Swiss Franc: A new monetary era?

Bitcoin surpasses a new milestone by overtaking the Swiss Franc to establish itself as the 13th global currency, according to FiatMarketCap data. With a market capitalization exceeding 1 trillion dollars, Bitcoin now positions itself just ahead of the Swiss Franc and the Russian Ruble, even surpassing silver in terms of market value. This remarkable ascent gives it a weight of about one-tenth of all the gold in the world, highlighting the immense potential of this cryptocurrency limited to 21 million units in a world where fiat currencies see their monetary mass expand endlessly.

FiatMarketCap, based on monetary aggregates to rank different currencies, reveals the significant impact of Bitcoin on the global economy. While traditional currencies suffer from rampant inflation, Bitcoin offers an anti-inflationary alternative, generating increasing interest from investors concerned about protecting their savings. This notable rise of Bitcoin, limited by nature unlike fiat currencies with their deemed "unlimited" money supply, highlights the limitations of the current monetary system and raises questions about the future of currencies in a rapidly changing world.

The debate over Bitcoin's ability to replace fiat currencies continues to rage, but one thing is clear: the era of cryptocurrency as a serious and viable store of value is already here.

Crypto of the day: Render Network (RNDR)

Render Network (RNDR) positions itself as a global decentralized rendering platform, harnessing the unused power of Graphics Processing Units (GPUs) to meet the growing demand for GPU computing power in the production of next-generation media. Initiated by OTOY in 2009 and officially launched in 2017, RNDR facilitates the connection between content creators in need of computing power and GPU providers with surplus capacity, using RNDR tokens as the exchange currency.

The token plays a central role in this ecosystem, serving both as a means of payment for rendering services and as a reward for GPU providers. The network utilizes a proof of render system to verify the successful execution of work before payment, thereby ensuring security and trust between parties. RNDR token holders not only gain access to computing power at competitive rates but also have the opportunity to participate in the network's governance through decentralized autonomous organization (DAO) mechanisms.

Recent performance

Current price: Approximately 9.83 USD

Percentage increase/decrease: 36.64% (increase over 1 day)

Market capitalization: approximately 3,720,721,705 USD

Rank on CoinMarketCap: 36th

Leveraged trading in cryptos: A double-edged sword

Leveraged trading allows crypto investors to maximize their profits by using borrowed funds to increase their trading position. Although attractive for amplifying gains, it carries significant risks, including an increased liquidation risk.

Operation and benefits

Leveraged trading in the cryptocurrency field involves the use of borrowed capital to increase a trading position. This allows traders to open larger positions than they could with their own capital alone. Leverage ratios, such as 1:10, indicate how much a trader can borrow relative to their initial investment.

One of the main advantages is the ability to amplify profits with a relatively small initial investment. It also increases liquidity and flexibility in portfolio management, offering the possibility of achieving substantial profits even with small market movements.

Risks

The use of leverage increases the risk of liquidation, especially if the market moves unfavorably against the trader's position. Potential losses are also amplified, which can quickly erode invested capital.

It is important to adopt a prudent risk management strategy, including the use of stop-loss orders, limiting exposure per trade, and investing capital that can be affordably lost. Practicing with a demo account and gradually increasing position sizes can also help traders become familiar with leveraged trading.

Leveraged trading offers attractive opportunities to maximize profits in the volatile cryptocurrency market. However, the associated risks require a deep understanding and rigorous risk management. Traders must carefully assess their risk tolerance and never invest more than they can afford to lose.