📉 Bitcoin, XRP and Dogecoin plunge again: Trump’s policy raises concerns!

Welcome to the Daily Tribune on Tuesday, March 04, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Tuesday, March 04, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

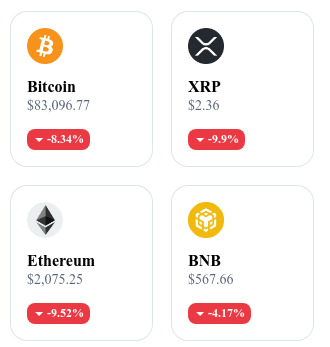

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

🏛️ Binance withdraws several stablecoins starting March 31 to comply with MiCA!

In light of the new European MiCA regulations, Binance must withdraw nine non-compliant stablecoins, including USDT, DAI, and FDUSD. Starting March 31, the affected trading pairs will be removed, and some stablecoins will be automatically converted to USDC. This decision challenges the stability of the stablecoin market in Europe and strengthens players like Circle and its USDC, which complies with the new standards. The diversity of stablecoins is likely to decrease, which could drive up fees and limit user choices. 🔗 Read the full article

⚖️ Coinbase CEO criticizes Trump’s crypto reserve!

Brian Armstrong, CEO of Coinbase, opposes Trump’s diversified approach to the Strategic Cryptocurrency Reserve. According to him, Bitcoin alone should be selected for this reserve, as it is the only digital asset that can compete with gold. He offers as an alternative a market-cap weighted index, but believes that the BTC maximalist approach is the most effective. This disagreement reflects a divide within the crypto community, between those who advocate diversification and those who see Bitcoin as the only legitimate store of value. 🔗 Read the full article

🔄 David Sacks liquidated his cryptos before joining the Trump administration!

Before his appointment as "crypto and AI tsar" by Trump, David Sacks sold all his crypto holdings, including BTC, ETH, and SOL, to avoid any conflict of interest. An active investor through Craft Ventures, he had invested funds in Bitwise and BitGo, but liquidated his positions just after Trump took office. This choice aims to ensure an impartial crypto policy, at a time when the Trump administration is shaping a potentially favorable regulatory framework for cryptos. 🔗 Read the full article

📉 Bitcoin, XRP, and Dogecoin collapse after a Trump announcement!

As Trump confirmed the creation of a Strategic Cryptocurrency Reserve, the crypto market plunged, with BTC dropping to $83,933 (-6%). The cause: increased economic fears, notably an imminent trade war with Canada, Mexico, and China. Over $661 million in positions were liquidated, and U.S. stock markets also retreated, exacerbating the pressure on cryptos. 🔗 Read the full article

Today's crypto: Cardano (ADA)

Cardano is a third-generation blockchain platform that aims to solve the scalability, interoperability, and sustainability issues faced by earlier generations of blockchains like Bitcoin and Ethereum. It stands out for its rigorous scientific approach, based on peer-reviewed academic research and evidence-based methodology. Cardano employs a Proof-of-Stake (PoS) consensus mechanism called Ouroboros, which enhances energy efficiency and network security. This modular architecture allows for better scalability and facilitates the development of smart contracts and decentralized applications (dApps).

The native token of Cardano, ADA, is used to pay transaction fees on the network and participate in the consensus mechanism by delegating or staking it, thereby contributing to network security while earning rewards. ADA holders can also participate in network governance by voting on protocol improvement proposals. The initial distribution of ADA took place between October 2015 and January 2017, with a public sale of 25.9 billion ADA, followed by the allocation of 5.2 billion ADA to the three entities supporting the development of Cardano.

Recent performances:

Current Price: $0.8086 (approximately €0.76)

24-hour change: -20.1%

Market capitalization: $29.08 billion

Rank on CoinMarketCap: #8

Pi Network: How high could its price rise in March?

The Pi Network, after six years of development, has finally launched its native token, generating massive interest among investors. Its market debut was explosive: starting at $0.6152, its price soared to nearly $3 in less than a week, recording an increase of nearly 200%. However, this euphoria was followed by a brutal correction, bringing its price down to $1.99, a decrease of 25% in just 24 hours.

This volatility is partly explained by the wait for exchange platforms. A poll on Binance Square shows that 86% of participants want a PI listing on Binance, but the exchange clarified that no immediate decision has been made.

Optimistic forecasts, but an uncertain future

According to CoinCodex analysts, Pi Network could experience a significant rise in March, with a target price of $8.23, representing an increase of 290%. The forecasts also suggest an average of $4.89 and a potential floor of $2.41, indicating a strong volatility.

However, several challenges remain to be addressed:

Absence of listings on major platforms: without integration into major exchanges, the liquidity and adoption of PI remain limited.

Uncertain regulation: emerging cryptos are under high scrutiny, and strict regulations could hinder adoption.

Investor confidence: Pi Network must demonstrate its real utility and economic viability to attract long-term investors.

March, a decisive month for Pi Network

The month of March could mark a decisive turning point for Pi Network. If the project can entice exchange platforms and prove its worth, a price surge could materialize. Conversely, a stagnation or rejection by major exchanges would keep PI in a zone of uncertainty, hindering its expansion.

The market remains divided: can Pi Network deliver on its promises and establish itself as a significant player in the sector, or will its meteoric rise be followed by a disillusionment? The coming weeks will be crucial.